Introduction

Embark on an illuminating odyssey into the enigmatic realm of futures options trading, where risk and reward dance in perfect harmony. This comprehensive guide will equip you with the knowledge and tools to navigate the complexities of this sophisticated market, empowering you to make informed decisions that can potentially yield substantial returns.

Image: www.eudownloads.com

Delving into Futures Options Trading: A Foundation of Understanding

Futures options, essentially financial contracts, provide a unique avenue for investors to manage risk and capitalize on market fluctuations. By delving into their inner workings, you’ll comprehend the intricacies of these instruments and their pivotal role in the financial landscape.

Futures Contracts: A Promise for Future Delivery

Futures contracts obligate the buyer to acquire a specific quantity of an underlying asset, such as a stock, commodity, or currency, at a predetermined price on a predetermined date. They function as hedges against price volatility, enabling investors to secure future prices and mitigate potential losses.

Options Contracts: The Right, but Not the Obligation

Options contracts bestow upon the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a particular date. They provide versatility in managing risk, allowing investors to capitalize on market movements without assuming ownership of the underlying asset.

Image: www.etnasoft.com

Exploring the Nuances of Futures Options Trading

Venturing deeper into the intricacies of futures options trading, you’ll uncover the strategies and techniques employed by seasoned veterans to maximize profit potential while managing risk.

Striking a Balance: The Role of Strike Price

Strike price, a crucial element in futures options trading, represents the predetermined price at which the underlying asset can be bought or sold. Understanding the impact of strike price on option premiums and profit potential is paramount in crafting effective trading strategies.

Time Horizons: Understanding Expiration Dates

Futures options contracts possess finite lifespans, expiring on predefined dates. Comprehending the interplay between time decay and option premiums is essential in determining optimal entry and exit points, minimizing losses, and maximizing gains.

Leveraging Market Dynamics: Analyzing Market Volatility

Market volatility, a measure of price fluctuations, plays a pivotal role in futures options trading. Recognizing the impact of volatility on option premiums and strategizing accordingly enables investors to harness market movements to their advantage.

Harnessing the Power of Futures Options Trading

Equipped with a comprehensive understanding of futures options trading, you’re now poised to unlock its vast potential for risk management and profit generation. By embracing proven strategies and implementing sound tactics, you can navigate the complexities of this dynamic market with confidence.

Hedging Strategies: Shielding against Market Turbulence

Futures options excel as defensive tools, enabling investors to safeguard their portfolios against adverse market conditions. Hedging strategies, such as protective puts and collar strategies, provide valuable protection against potential losses.

Income-Generating Strategies: Harvesting Market Premiums

Futures options trading offers lucrative opportunities to generate income through premium selling strategies. By writing (selling) options, investors collect premiums while assuming a defined level of risk, providing a steady stream of potential earnings.

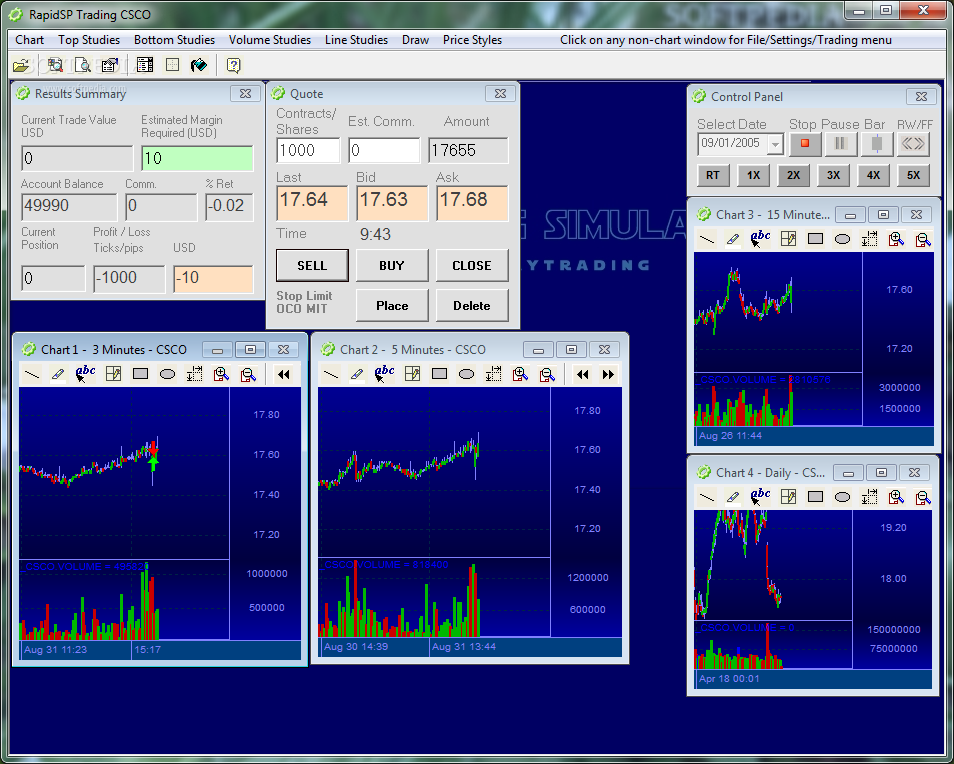

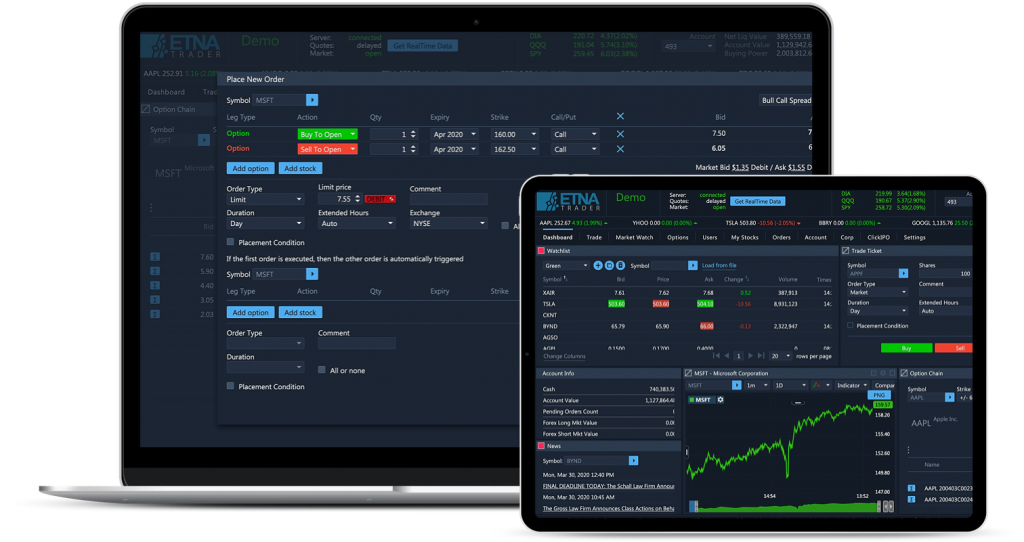

Unveiling the Secrets of Futures Options Trading Simulation

Futures options trading simulators, invaluable tools for aspiring and seasoned traders alike, mirror the real-world trading environment without the financial risks. These simulators empower traders to hone their skills, test strategies, and gain invaluable experience before venturing into live markets.

Futures Options Trading Simulator

Image: www.pinterest.com

Conclusion

Unveiling the intricacies of futures options trading empowers you to navigate the financial markets with precision and confidence. By mastering the concepts outlined in this comprehensive guide, you’ll unlock the potential for risk management and profit generation inherent in this dynamic arena. Remember to approach trading with a disciplined mindset, leveraging futures options trading simulators to refine your strategies and maximize your chances of success. Embrace the challenge, immerse yourself in the complexities of this fascinating market, and witness the transformative power of futures options trading.