Introduction

Options trading is a powerful tool that can be used to enhance portfolio returns. It can also be overwhelming to learn. I was intimidated by it when I was new to the market, but I wanted to find a way to improve my returns. I started researching options trading and found that there are many strategies that even beginners can use. Today I will introduce you to put spread with call trading strategy.

What is a Put Spread with Call?

A put spread with call is a neutral to slightly bullish option strategy in which the trader sells a put option and buys a call option with the same strike price and expiration date, but the call option should have a lower premium than the put option premium. The trader’s maximum profit is limited to the net amount of the option premiums collected at the sale of the options, while the maximum loss is limited to the difference between the strike prices of the options plus the net premium paid.

How a Put Spread with Call Works

When you sell a put option, you are giving someone else the right to sell you a specific number of shares of a stock at a specific price on or before a certain date. When you buy a call option, you are giving yourself the right to buy a specific number of shares of a stock at a specific price on or before a certain date.

In a put spread with call, if the stock price closes above the option premiums, you will make a profit. If it closes below the premiums, you will lose money. The maximum profit is limited to the net amount of the option premiums collected at the sale of the options, while the maximum loss is limited to the difference between the strike prices of the options plus the net premium paid.

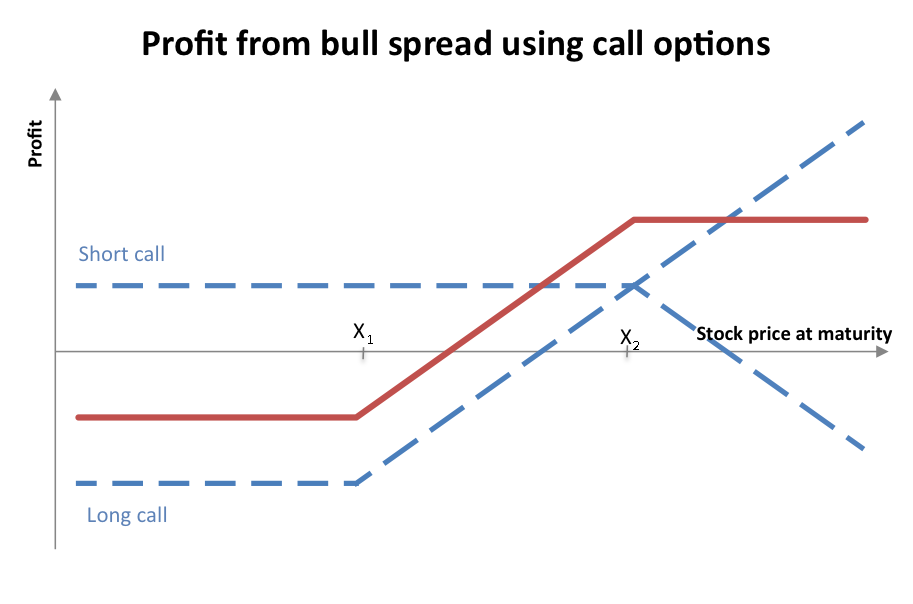

Image: kygimafezes.web.fc2.com

Example of a Put Spread with Call

Let’s say that the stock XYZ is trading at $50. You could sell a one-month out put option with a strike price of $45 for $2.50. You could then buy a one-month out call option with a strike price of $45 for $1.50. The net premium would be $2.50-$1.50 = $1.00 or $1 per share (or $100 per contract of 100 shares).

When to Use a Put Spread with Call

A put spread with call is a good strategy to use when you expect the stock price to stay within a certain range. If you are correct, you will make a profit. If you are wrong, you will lose money.

Tips for Using a Put Spread with Call

Here are a few tips for using a put spread with call:

- Choose a stock that has a high implied volatility. This will give you the opportunity to collect a higher premium.

- Sell the put option as close to the current stock price as possible. This will reduce your risk of assignment.

- Buy the call option with a lower premium than the put option. This will limit your potential loss.

- Monitor your position closely. If the stock price starts to move against you, you should consider exiting the trade.

Image: www.pinterest.com

Options Trading Strategy Put Spread With Call

Image: www.pinterest.com

Conclusion

A put spread with call is a neutral to slightly bullish option strategy that can be used to generate income or hedge against downside risk. It is an ideal strategy for traders who are new to options trading. Are you interested in learning more about options trading??