Introduction

Options are versatile financial instruments that grant traders the privilege – but not the obligation – to buy or sell an underlying asset at a specific price on or before a predetermined date. This flexibility has fueled their popularity among investors seeking to manage risk, enhance returns, and capitalize on market opportunities. Embark on this comprehensive guide to uncover the intricacies of options trading strategies, empowering you to navigate today’s market landscape with confidence.

Image: seekingalpha.com

Options Trading: A Foundational Primer

An option contract represents a standardized agreement between two parties: the buyer and the seller. The buyer acquires the right, though not the compulsion, to exercise the option’s terms. For this privilege, they pay the seller a premium. Call options confer the right to buy, while put options grant the right to sell the underlying asset.

Options are characterized by two crucial elements: strike price and expiration date. The strike price represents the price at which the buyer can exercise their right, while the expiration date specifies the deadline by which this right must be exercised. Understanding these fundamental concepts is pivotal for comprehending options trading strategies.

Exploring the Options Trading Landscape

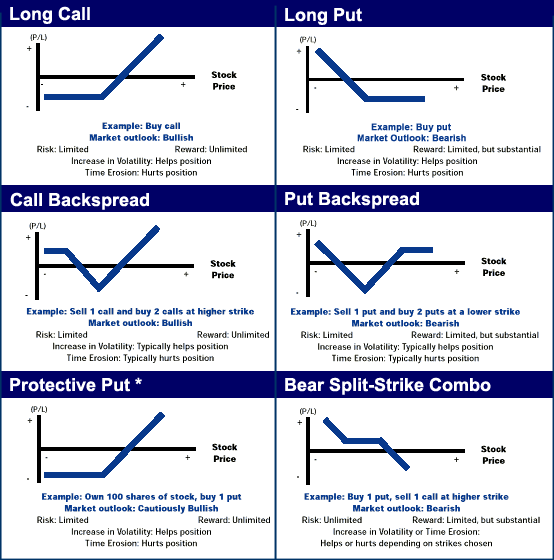

Options strategies encompass a wide spectrum of approaches tailored to diverse market conditions and investor objectives. Among the most popular strategies are:

-

Covered Call: This strategy entails selling (or writing) a call option against an existing holding of the underlying asset. The trader anticipates that the asset’s price will not exceed the strike price, allowing them to collect the premium while potentially limiting their potential gains.

-

Protective Put: A protective put strategy safeguards against potential downside risk. It involves purchasing a put option to protect an existing position in the underlying asset. If the asset’s price falls below the strike price, the put option can be exercised to offset losses.

-

Bull Call Spread: Bullish investors utilize this strategy to capitalize on anticipated price appreciation. By simultaneously buying a lower-strike call option and selling a higher-strike call option, the trader aims to generate profit if the underlying asset’s price rises.

-

Bear Put Spread: This strategy is designed for bearish market sentiments. It involves selling a lower-strike put option and buying a higher-strike put option, seeking to benefit from a decline in the underlying asset’s price.

-

Iron Condor: This multi-leg strategy combines a bull call spread and a bear put spread, providing the potential for limited profit within a defined price range. It is often employed when the trader expects the underlying asset’s price to remain relatively stable.

Navigating Options Trading with Expertise

Seasoned experts recommend a prudent approach to options trading, emphasizing the importance of:

-

Proper Research: Thoroughly analyze the underlying asset, market conditions, and potential risks before venturing into options trading.

-

Risk Management: Implement robust risk management techniques to mitigate potential losses. Start with smaller trades and understand that options trading entails inherent risks.

-

Emotional Discipline: Maintain emotional control and avoid impulsive decisions. Options trading can be exhilarating, but it is essential to stay grounded and make rational choices.

-

Seeking Professional Guidance: Consider consulting with a financial advisor or brokerage professional to gain personalized insights and guidance tailored to your specific circumstances.

Image: stockscreenertips.com

Options Trading Strategies Today

Image: www.analyticssteps.com

Conclusion

Options trading offers myriad strategies for investors seeking to enhance their market acumen. By delving into the intricacies of call and put options, strike prices, and expiration dates, you can unlock the potential of this dynamic financial instrument. Remember, the key to successful options trading lies in thorough research, prudent risk management, unwavering emotional control, and a commitment to continuous learning. Embrace these principles and embark on your options trading journey with confidence, empowering yourself to seize market opportunities and achieve your financial aspirations.