Introduction: Harnessing the Power of Quantitative Analysis for Options

Options trading has emerged as a lucrative arena, offering opportunities for substantial financial gains. However, navigating its intricacies requires a deep understanding of market dynamics, sophisticated trading strategies, and the ability to leverage technology. In this article, we will delve into the realm of options trading quant and guide you through the labyrinth of algorithmic success.

Image: www.financialwatchngr.com

Deciphering Options Trading Quant: A Symbiosis of Finance and Technology

Options trading quant is an advanced financial discipline that combines quantitative analysis with options trading. It employs a fusion of mathematical models, statistical techniques, and computational algorithms to empower traders with predictive insights and automated execution. Through the analysis of historical data, traders generate probabilistic models that estimate the future behavior of options prices, aiding in informed decision-making.

Essential Principles of Options Trading Quant

- Model Construction: Formulating mathematical equations that mimic options pricing behavior, incorporating variables such as volatility, time to expiration, strike price, and risk-free interest rates.

- Calibration: Iteratively adjusting model parameters to minimize errors and enhance accuracy through statistical techniques like Monte Carlo simulations and optimization algorithms.

- Prediction: Employing statistical techniques to forecast options prices based on calibrated models, providing traders with actionable trading signals.

- Execution: Conceptually designing and implementing trading strategies that automatically execute trades based on predicted price movements, optimizing returns and minimizing risks.

Trends and Developments in Options Trading Quant

- Machine Learning Integration: Leveraging advanced machine learning algorithms to derive complex models from vast datasets, enhancing predictive accuracy.

- Algorithmic Trading Platforms: Utilizing specialized trading platforms that integrate quant models, facilitating rapid trade execution and portfolio management.

- Market Microstructure Research: Employing methods from financial econometrics to analyze trading dynamics at a microstructural level, improving execution strategies.

Image: www.cashinginfomation.com

Tips and Expert Advice for Mastering Options Trading Quant

- Acquire a Strong Foundation: Develop a comprehensive understanding of financial mathematics, statistics, and algorithmic trading concepts to effectively interpret quantitative models.

- Leverage Technology: Utilize industry-leading trading platforms and analytical tools to automate trading strategies and conduct in-depth simulations.

- Seek Expert Mentorship: Engage with experienced options trading quant practitioners to accelerate your learning curve and gain valuable insights.

- Control Risk: Employ robust risk management strategies, including backtesting, position sizing, and stop-loss orders, to mitigate potential losses.

- Continuous Learning: Stay abreast of the latest advancements in financial technology and modeling techniques through ongoing education and industry events.

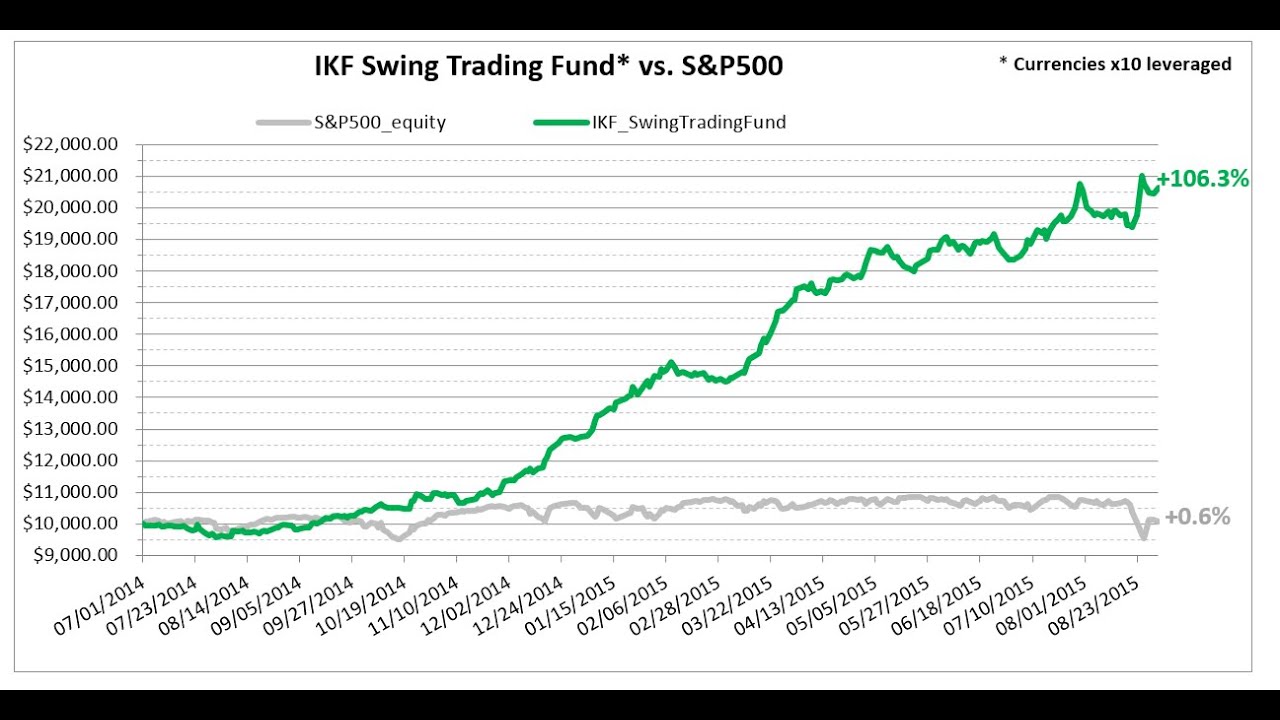

Options Trading Quant

Image: www.youtube.com

Frequently Asked Questions (FAQs)

Q: What are the prerequisites for becoming an options trading quant?

A: A strong foundation in mathematics, statistics, programming, and financial markets is essential.

Q: Can I automate my options trading strategies using quant models?

A: Yes, quant models provide the foundation for conceptually designing and implementing automated trading strategies.

Q: How do I ensure the accuracy of my quant models?

A: Regular model calibration and validation are crucial to maintaining accuracy, ensuring alignment with market realities.

Conclusion: Embracing the Power of Options Trading Quant for Financial Success

Options trading quant harnesses the power of quantitative analysis to empower traders with predictive insights and automated execution, unlocking the potential for substantial financial gains. By mastering its principles, trends, and expert advice, you can navigate the complex landscape of options trading and achieve algorithmic success. Embrace the power of quant and elevate your trading prowess to new heights.

Are you ready to embark on your journey as an options trading quant? Let the insights within this guide inspire your pursuit of knowledge, as you master the art of quantitative trading and unlock the doors to financial success.