When it comes to options trading, position sizing is paramount to successful risk management and profit optimization. Unlike traditional stock trading where your potential loss is limited to the purchase price of the stock, options trading introduces the concept of leverage, magnifying both potential gains and losses. Understanding and implementing effective position sizing strategies is essential for mitigating risk and maximizing long-term returns.

Image: www.enlightenedstocktrading.com

What is Options Trading Position Sizing?

Options trading position sizing refers to the process of determining the appropriate number of options contracts to trade based on your available capital, risk tolerance, and market conditions. Proper position sizing helps you avoid overexposing your portfolio to excessive risk while optimizing your profit potential.

Factors to Consider When Sizing Your Options Position

Numerous factors influence optimal position sizing, including:

- Available Capital: The amount you are willing to commit to a particular trade is a crucial determinant. Overleveraging can lead to significant financial losses.

- Risk Tolerance: Assessing your tolerance for potential losses is essential. Conservative traders prefer smaller positions, while aggressive traders may opt for larger positions.

- Market Conditions: Market volatility, liquidity, and implied volatility influence position sizing. Higher volatility warrants smaller positions, while lower volatility allows for larger positions.

- Option Type: The type of option you trade (call, put, buy, or sell) affects position sizing. Different options have varying levels of risk and potential returns.

- Time Decay: Position sizing needs to account for time decay in options. Options lose value over time, so holding a large position for an extended period can impact profitability.

Position Sizing Strategies

Various position sizing strategies exist to suit different trading styles and risk tolerances. Common methods include:

- Percentage of Account: Allocating a fixed percentage of your available capital to each trade is a simple but effective strategy. This approach ensures consistency and reduces the likelihood of losing a significant portion of your account.

- Kelly Criterion: A probabilistic model that calculates the optimal position size considering the win rate, risk-reward ratio, and volatility. However, it assumes a constant edge, which can be challenging to maintain in real-world trading.

- Fixed Dollar Amount: Trading a fixed dollar amount per contract is a straightforward strategy suitable for beginner traders. It provides a predictable level of exposure and potential profit or loss.

- Adjusted Risk Approach: This approach adjusts the position size based on the calculated potential loss. The goal is to ensure that the potential loss is a manageable amount given your overall trading strategy.

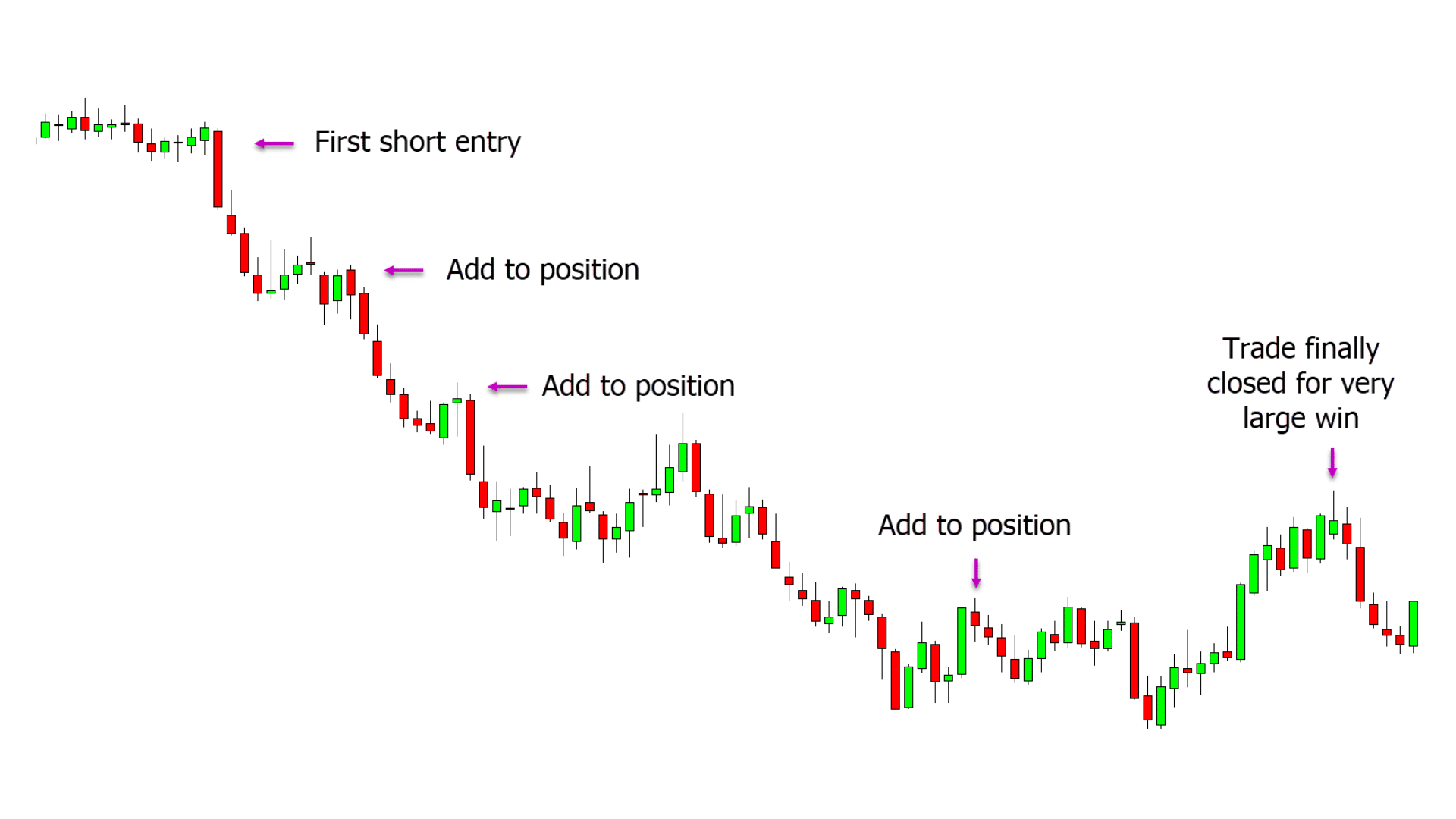

Image: learnpriceaction.com

Options Trading Position Sizing

Image: www.thweis.com

Conclusion

Options trading position sizing is a crucial element that can profoundly impact your trading success. By understanding the factors that influence position sizing and implementing appropriate strategies, you can mitigate risk, maximize returns, and build a sustainable trading career. Remember, position sizing is a balancing act between achieving your financial goals and managing the inherent risks associated with options trading.