As a seasoned trader, I’ve experienced the thrill of executing options trades after hours. The extended trading window provides unparalleled opportunities to capitalize on market movements and enhance your trading strategy. In this comprehensive guide, I will delve into the intricacies of TD Ameritrade’s after hours options trading, empowering you to navigate this exciting market landscape.

Image: investgrail.com

TD Ameritrade grants access to after hours trading, a unique realm where options contracts can be bought and sold beyond the traditional market hours. This extended window offers numerous advantages, including the ability to react promptly to breaking news, capitalize on late-breaking market trends, and adjust positions in response to evolving events.

Understanding After Hours Options Trading

After hours options trading extends the trading day, enabling traders to execute options trades from 8:00 PM to 11:59 PM Eastern Time. This market is characterized by lower liquidity and increased volatility, as trading volume is typically less than during regular trading hours.

Despite the potential risks associated with lower liquidity, after hours options trading presents a significant opportunity for discerning traders. By understanding the dynamics of this market, adopting a sound trading strategy, and leveraging the extended trading hours, traders can capitalize on price fluctuations and enhance their overall trading performance.

Tips for Successful After Hours Options Trading

1. Choose Liquid Options Contracts:

In the after hours market, liquidity is paramount. Focus on options contracts with high open interest and volume to ensure efficient execution of trades at desired prices.

2. Exercise Discipline and Patience:

After hours trading requires patience and discipline. Avoid impulsive trades and thoroughly consider the risks and rewards before executing orders. Patience is crucial to identify high-probability trading opportunities.

3. Manage Risk Prudently:

In the low-liquidity environment of after hours trading, prudent risk management is essential. Employ stop-loss orders to mitigate losses, monitor market volatility closely, and adjust positions accordingly.

4. Leverage Trading Tools:

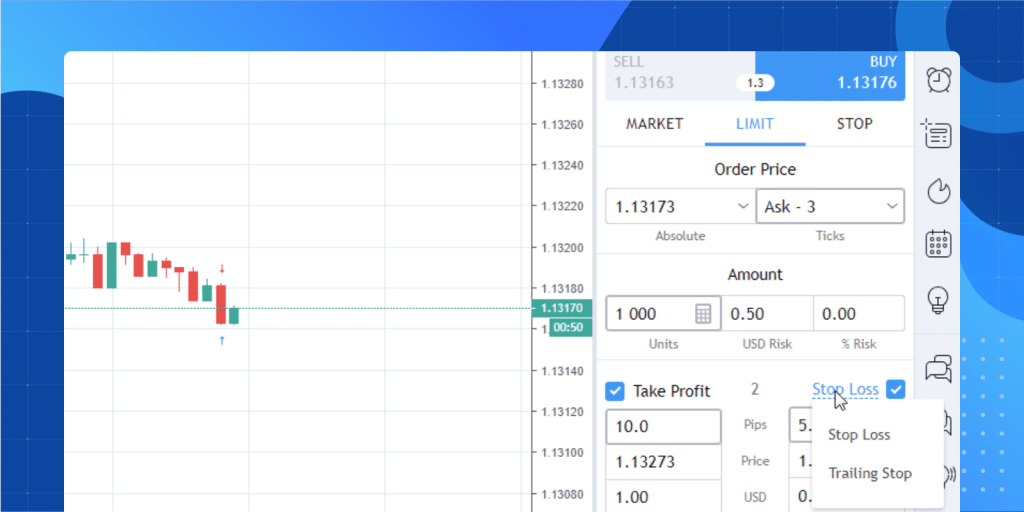

Utilize TD Ameritrade’s trading platform, which offers a comprehensive suite of tools. These tools provide real-time market data, charting capabilities, and sophisticated order entry functionality to enhance your after hours trading experience.

5. Seek Professional Guidance:

Consider consulting with a financial advisor or experienced options trader to gain valuable insights and guidance on navigating the after hours options market. Their expertise can help you avoid costly mistakes and optimize your trading strategy.

Frequently Asked Questions on TD Ameritrade After Hours Options Trading

Q: What are the eligibility requirements for after hours options trading?

A: TD Ameritrade requires specific account approval for after hours options trading. Traders must demonstrate sufficient trading experience, knowledge, and financial resources to participate in this market.

Q: What are the margin requirements for after hours options trading?

A: Margin requirements vary depending on the type of option contract and account type. Contact TD Ameritrade’s customer service for specific margin requirements.

Q: What are the fees associated with after hours options trading?

A: TD Ameritrade may charge additional fees for after hours trading. It is important to consult with your broker to determine the specific fee structure.

Image: tickertape.tdameritrade.com

Tdameritrade After Hours Options Trading

Image: www.gorillatrades.com

Conclusion

TD Ameritrade’s after hours options trading platform offers a unique opportunity for traders to enhance their trading strategies and capitalize on market dynamics beyond regular trading hours. Embracing this extended window, coupled with a sound trading approach and a comprehensive understanding of its intricacies, can empower traders to maximize their profitability.

I encourage you to explore the vast array of resources, educational materials, and trading tools available through TD Ameritrade to navigate this exciting realm of after hours options trading. Remember, knowledge is power, and equipping yourself with the necessary skills will enable you to unlock the full potential of this dynamic market. Are you ready to embark on this journey and embrace the possibilities of after hours options trading with TD Ameritrade?