Unlocking the Enigma of Options Trading on Public

Image: finance.yahoo.com

The realm of trading has captivated investors for eons, promising lucrative rewards but often shrouded in a veil of complexity. Enter options trading, a sophisticated tool that empowers traders to navigate market fluctuations with finesse and precision. Options on public companies offer tantalizing opportunities to multiply gains, mitigate risks, and reshape your financial destiny.

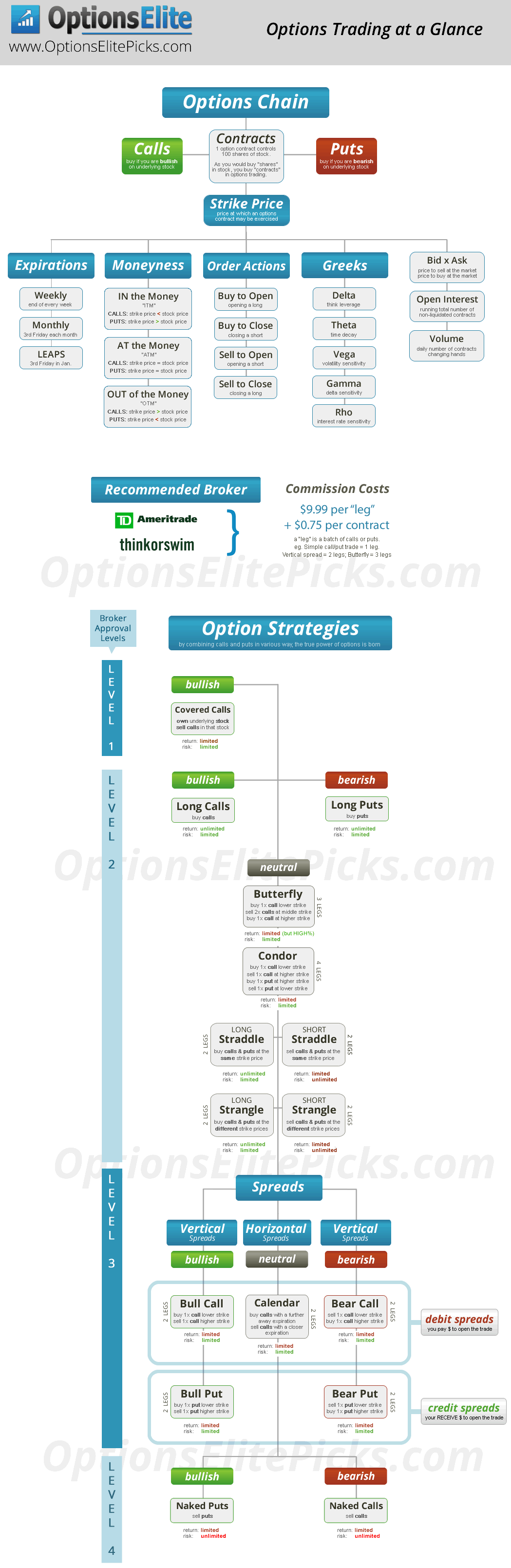

Deciphering the Option Prism

An option, in its essence, grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date). By wielding this dual power, traders can maneuver through market turbulence with both offense and defense.

Unmasking the Options Vocabulary

- Call: Confers the right to buy the underlying asset at the strike price.

- Put: Confers the right to sell the underlying asset at the strike price.

- Premium: The price paid for the option, representing the provider’s expected profit.

Harnessing the Power of Options

Options empower traders with a myriad of strategies tailored to their risk tolerance and financial goals:

- Bullish strategies: For those anticipating a rise in an asset’s price, call options offer ample profit potential.

- Bearish strategies: Put options provide a hedge against market downturns, allowing traders to profit from falling asset prices.

- Neutral strategies: Non-directional approaches aim to capitalize on market volatility without speculating on the direction of the underlying asset.

Expert Insights: The Path to Options Success

Renowned options guru Josh Waitzkin reminds us, “Successful traders understand that every trade is a blend of knowledge, strategy, and execution.” Here are his profound insights to guide your options journey:

- Master the Craft: Diligently educate yourself, practice relentlessly, and stay abreast of market dynamics.

- Manage Risk Prudently: Employ proper risk management techniques, such as position sizing and stop-loss orders, to safeguard your investments.

- Be Patient and Disciplined: Options trading is a marathon, not a sprint. Approach decisions with patience and adhere to your trading plan rigorously.

Empowering Your Financial Future

Options trading on public companies unlocks a universe of financial possibilities, but ventures should be guided by prudence and a keen understanding of the risks involved. By embracing expert insights and adopting responsible trading practices, you can harness the transformative power of options to create a more secure future for yourself.

Embrace the challenge of options trading as a testament to your financial sophistication and unwavering pursuit of success. May this journey enhance your financial prowess and empower you with the confidence to navigate market complexities with finesse.

Image: www.visualcapitalist.com

Options Trading On Public

Image: thestockmarketwatch.com