Introduction

In the realm of financial trading, options are indispensable instruments that bestow investors with the right, not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. To maximize success in this dynamic market, traders rely on meticulous record-keeping and analysis. An options trading journal, specifically crafted in Excel format, serves as an invaluable tool, enabling traders to track, monitor, and learn from their trades. This comprehensive guide will empower you with the knowledge to harness the full potential of an options trading journal XLS.

Delving into the Options Trading Journal

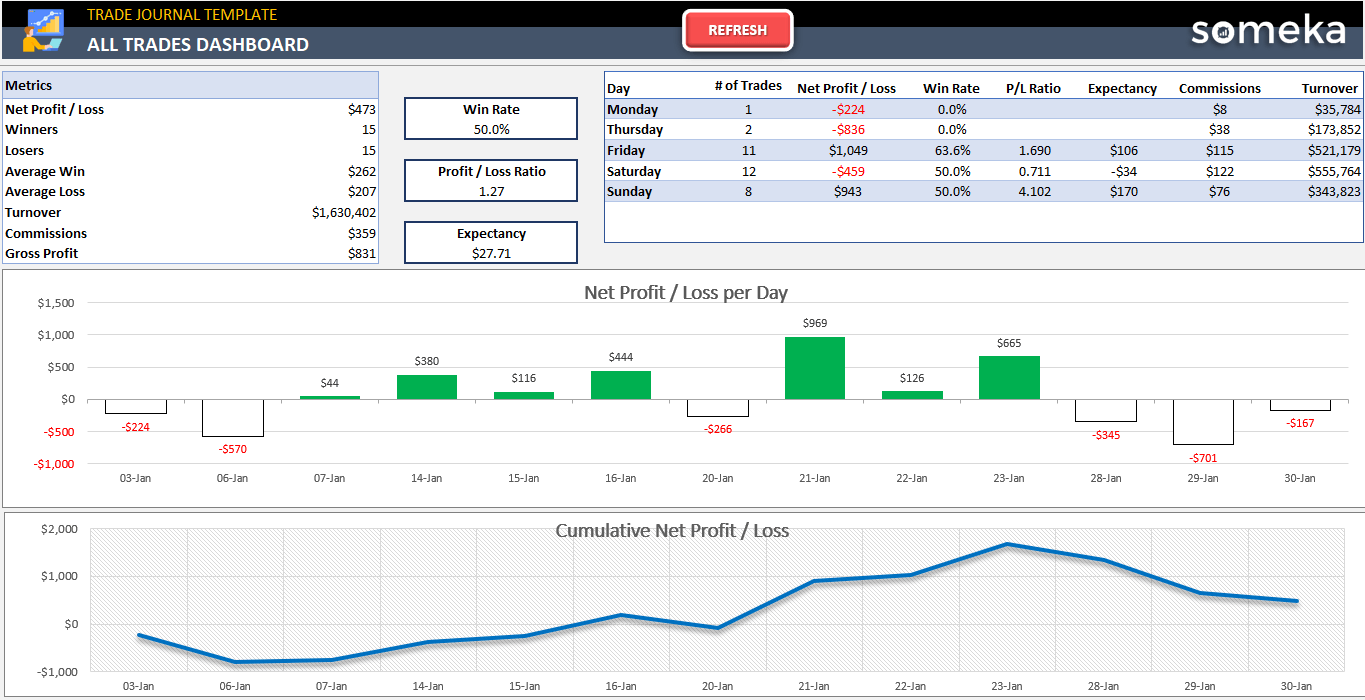

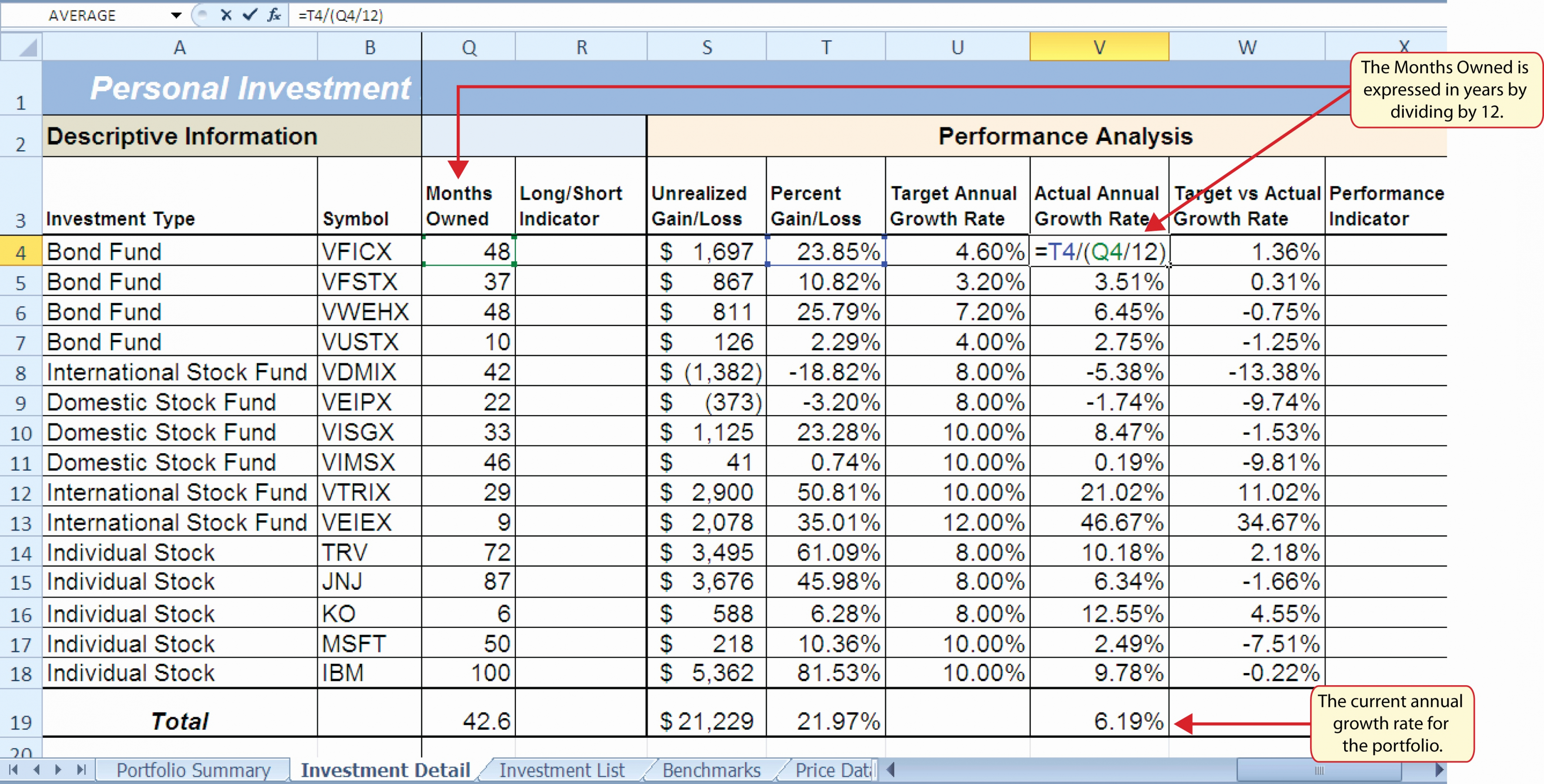

Organized into a tabular format, an options trading journal provides a holistic view of every trade executed. Crucial information recorded includes the trade date, underlying asset, type of option (call or put), strike price, expiration date, number of contracts traded, premium paid or received, and the all-important trade outcome. By diligently updating and maintaining this journal, traders gain a treasure trove of data that empowers them to make informed decisions.

Advantages of an Options Trading Journal

This meticulously compiled journal offers numerous benefits that elevate trading performance. Firstly, it serves as a consistent and centralized repository of trading activities, eliminating the hassle of relying on scattered notes or memory. Secondly, traders can swiftly identify patterns, trends, and mistakes, assisting in refining strategies and enhancing profitability. Thirdly, the journal serves as an indispensable tool for tax record-keeping, ensuring accuracy and compliance.

Creating Your Own Options Trading Journal XLS

Crafting a robust options trading journal XLS is a straightforward endeavor. Open a new Excel workbook and create a separate worksheet for each month. Include the following columns in the worksheet:

- Trade Date: Record the date the trade was executed.

- Underlying Asset: Specify the underlying asset associated with the option.

- Option Type: Distinguish between call and put options.

- Strike Price: Enter the strike price of the option.

- Expiration Date: Indicate the date on which the option expires.

- Number of Contracts: Specify the number of contracts traded.

- Premium Paid or Received: Record the premium paid or received for the option.

- Trade Outcome: Conclude each trade by noting its outcome, whether a profit, loss, or break-even.

Customizing Your Journal

While the core elements of an options trading journal remain constant, traders may customize it to align with their specific needs. Adding additional columns or sheets to capture metrics such as risk management parameters, entry and exit strategies, or performance analysis is a common practice. Personalizing your journal empowers you to extract maximum value from the data you collect.

Analyzing Your Trading Journal

The true power of an options trading journal lies in the analysis of the data it contains. By scrutinizing trade outcomes, traders can gauge their strengths and weaknesses. If a particular strategy yields consistent profits, it should be further explored and refined. Conversely, if certain trades repeatedly result in losses, adjustments to the strategy are warranted. The journal provides a robust foundation for making informed decisions that bolster trading success.

Conclusion

In the ever-evolving landscape of options trading, the formidable combination of an options trading journal XLS and meticulous record-keeping practices is an invaluable asset. Whether you are a seasoned trader or a novice embarking on this thrilling endeavor, maintaining an organized and up-to-date journal empowers you to maximize profits, minimize losses, and consistently refine your trading strategies. Embrace the power of an options trading journal and witness your trading prowess soar.

Image: db-excel.com

Image: www.someka.net

Options Trading Journal Xls

Image: db-excel.com