Imagine the thrill of navigating the dynamic world of options trading with confidence and precision. With the help of a meticulously crafted Excel model, you can unlock the power to analyze complex market trends, evaluate potential gains, and make informed decisions that maximize your trading success.

Image: www.warsoption.com

Embark on a journey into the realm of options trading and discover the transformative role an Excel model can play in exponentially enhancing your investment strategies.

Excel Model: Your Blueprint for Options Trading Mastery

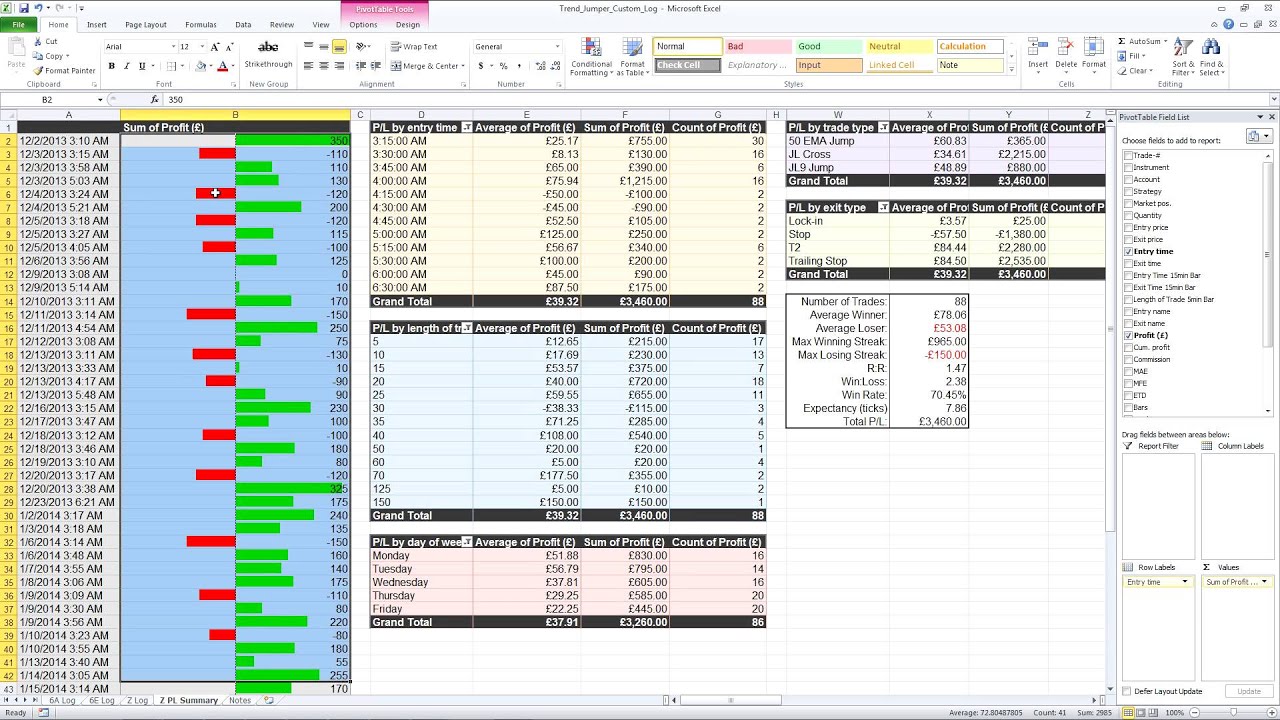

An Excel model for options trading serves as a powerful financial instrument, meticulously designed to simulate real-world market conditions and provide actionable insights into the intricacies of options trading. Armed with this customizable tool, you can delve into historical data, assess volatility and uncertainty, and calculate parameters like premium decay and implied volatility with remarkable accuracy.

Whether you’re a seasoned trader or just starting to explore the world of options, an Excel model can empower you by reducing complexity, streamlining analysis, and unlocking new avenues for profit maximization.

Benefits of Options Trading Excel Model

- Analyze market trends and forecast future price movements

- Calculate Greeks (delta, gamma, theta, vega, rho) to assess risk

- Simulate different trading scenarios and evaluate potential gains and losses

- Optimize portfolio allocation and manage risk exposure

- Automate calculations and streamline the trading process

Expert Tips for Harnessing the Excel Model’s Power

- Customize your model to suit your unique trading style and risk tolerance

- Regularly update the model with the latest market data

- Interpret the results of your analysis with a critical eye

- Seek guidance from experienced traders or financial advisors

- Start with paper trading to gain confidence before implementing real-money trades

Image: www.youtube.com

FAQ: Unraveling the Enigma of Options Trading

-

Q: What is options trading?

A: Options trading involves using contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a set price on or before a specific date. -

Q: What is implied volatility?

A: Implied volatility measures the market’s perception of future asset price volatility, which is a critical factor in determining option prices. -

Q: How do I calculate option premia using an Excel model?

A: You can use the Black-Scholes model or other pricing formulas built into the Excel model to calculate option prices based on factors like underlying price, strike price, time to expiration, and risk-free rate. -

Q: What is delta hedging?

A: Delta hedging is a strategy to reduce portfolio risk by adjusting positions in the underlying asset or related options to offset potential losses.

Options Trading Excel Model

Image: www.tradingoptionscashflow.com

Conclusion: Empowering Decision-Making

In the ever-evolving landscape of financial markets, staying ahead of the curve requires innovative tools and strategies. An Excel model for options trading empowers you with the insights and precision necessary to make informed decisions, seize opportunities, and navigate the market with confidence.

Whether you’re a seasoned trader or an aspiring investor, embrace the game-changing potential of options trading with the invaluable aid of an Excel model. Enhance your financial acumen, optimize your portfolio, and elevate your trading journey to unprecedented heights.

Are you ready to unlock the world of options trading with precision and confidence? Get started today and discover the transformative power of Excel for yourself!