Options Trading: A Game of Strategy and Fees

Options trading, a sophisticated investment strategy that allows hedging and speculation, involves buying and selling options contracts. Understanding the fees associated with these contracts is crucial to maximize profits and minimize losses. Options trading commission fees vary among brokers and platforms, potentially impacting your overall profitability.

Image: www.shutupandtrade.com

When it comes to options trading, knowledge is power. Whether you’re a seasoned trader or a newbie, navigating the complexities of options requires a deep understanding of the underlying principles and costs involved. This article aims to demystify options trading commission fees, shedding light on their importance and guiding you towards more informed decision-making.

Defining Options Trading Commission Fees

An options trading commission fee is a charge levied by brokers when executing an options trade. This fee typically includes two components: a per-contract fee and a per-share fee. The per-contract fee is a flat charge for each options contract traded, while the per-share fee is a charge based on the number of shares underlying the options contract.

For instance, a broker may charge a per-contract fee of $0.65 and a per-share fee of $0.05. If you trade an options contract for 100 shares, the total commission fee would be $0.65 + (0.05 x 100) = $5.65. Understanding these fees can help you budget effectively and adjust your trading strategy to minimize their impact on your profits.

Strategies for Minimizing Commission Fees

Savvy options traders employ various strategies to reduce their commission fees and maximize their profits. Here are some expert tips:

- Choose a broker with low fees: Comparison shop different brokers to find one that offers competitive commission rates that align with your trading volume and strategy.

- Negotiate with your broker: If you’re a high-volume trader, you may be able to negotiate lower commission rates with your broker.

- Bundle trades: Combining multiple trades into a single order can often result in lower overall commission fees.

- Consider no-fee platforms: Some platforms offer commission-free options trading, which can significantly reduce your trading expenses.

- Utilize online discount brokers: Online brokers typically offer lower commission fees than traditional brick-and-mortar brokerages.

Implementing these strategies can help you significantly reduce your options trading commission fees, thereby increasing your profit potential.

Frequently Asked Questions (FAQs)

- Q: What factors influence options trading commission fees?

A: Fees can vary based on the broker, trading volume, contract type, and exchange. - Q: How can I compare commission fees among brokers?

A: Review the fee schedules provided by different brokers, and consider factors such as your trading frequency and average trade size. - Q: Are there any hidden fees involved in options trading?

A: Some brokers may charge additional fees, such as regulatory fees or exchange fees. Ensure you research and understand all applicable charges. - Q: How do commission fees impact my profitability?

A: High commission fees can eat into your profits. Choosing a broker with competitive fees allows you to keep more of your earnings. - Q: What are the advantages of no-fee options trading platforms?

A: Eliminating commission fees can significantly enhance your profit potential, making these platforms attractive to high-volume traders.

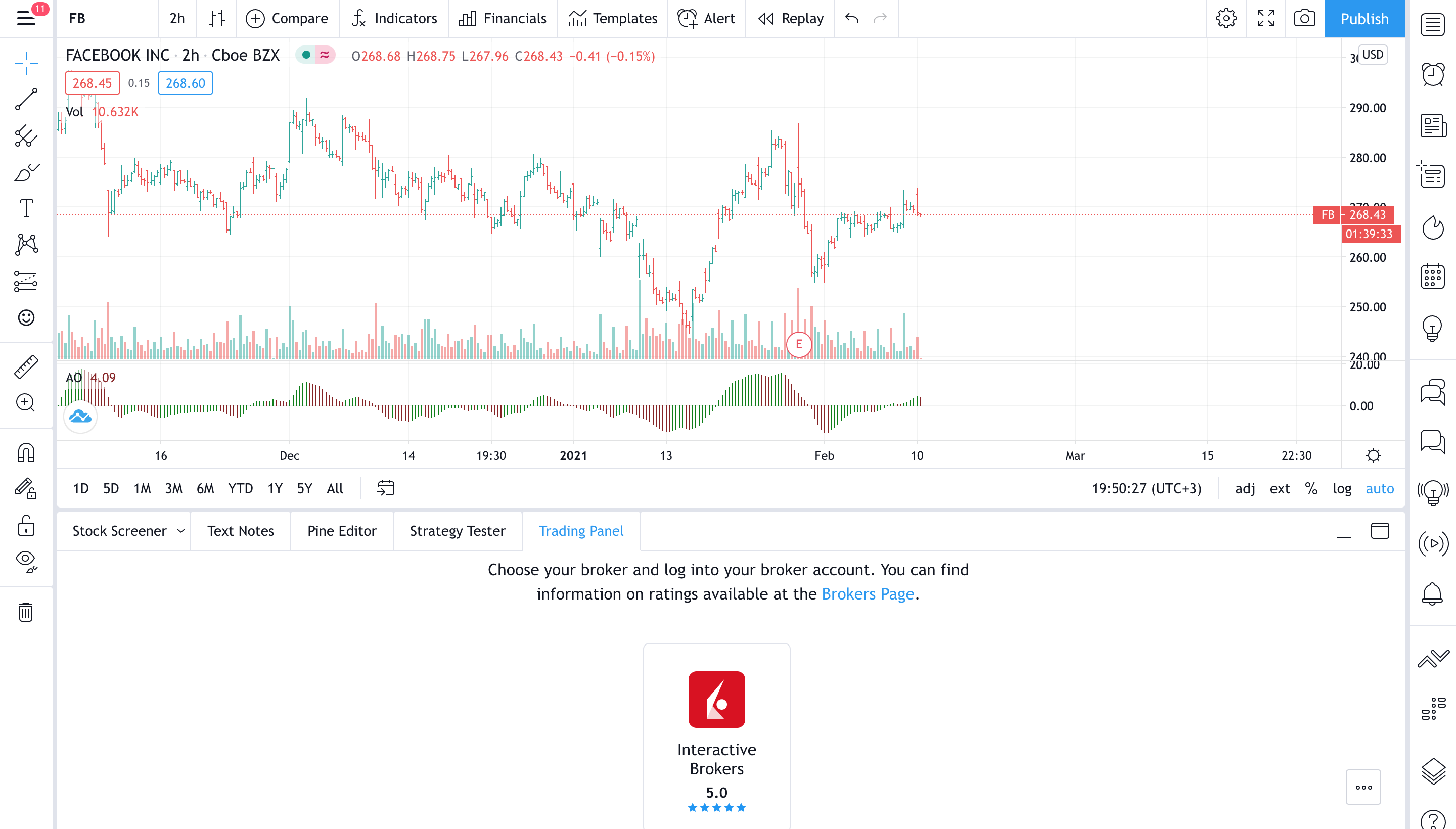

Image: www.interactivebrokers.com

Options Trading Commission Fee

Image: www.wikifx.com

Conclusion

Options trading commission fees are an essential consideration for maximizing profits in this dynamic market. By understanding the fees involved, you can make informed decisions when selecting a broker and developing your trading strategies. Implementing savvy tactics, such as choosing low-fee brokers, negotiating rates, and bundling trades, can significantly reduce your expenses and boost your profitability.

If you’re interested in delving deeper into the world of options trading, I encourage you to continue your research and consult with experienced professionals. By leveraging the power of knowledge and strategic planning, you can master the art of options trading and achieve your financial goals.