Navigating the intricate world of financial markets can be a daunting task, especially when encountering complex trading strategies like options trading. However, delving into the realm of CME options trading opens up a gateway to potentially lucrative market opportunities and the ability to manage risk effectively. In this comprehensive guide, we will unravel the intricacies of CME options trading, empowering you with the knowledge and strategies to harness its immense potential.

Image: industrynewsbulletin.com

Understanding CME Options Trading: A Gateway to Market Mastery

CME Group, the world’s leading derivatives marketplace, offers a vast selection of options contracts, providing traders with the ability to speculate on the future direction of underlying assets. Unlike futures contracts, which obligate the holder to buy or sell a specific quantity of an underlying asset at a predetermined price, options contracts confer the right, but not the obligation, to do so. This flexibility empowers traders to tailor their trading strategies to specific market scenarios and risk tolerances.

The value of an options contract is derived from several factors, including the underlying asset’s price, the option’s strike price, the time remaining until expiration, and prevailing market volatility. Traders can choose between two primary types of options: calls and puts. Call options grant the holder the right to buy the underlying asset at a specified strike price on or before the expiration date, while put options provide the right to sell the underlying asset at the same terms.

Delving into the Mechanics of Options Trading: A Building Block Approach

To fully grasp the dynamics of CME options trading, it’s essential to dissect the interplay between key concepts and mechanics.

Option Premium: The price paid to acquire an options contract represents the option premium. This premium encompasses two components: intrinsic value and time value. Intrinsic value is the difference between the underlying asset’s price and the strike price, while time value represents the value attributed to the remaining time until expiration.

Strike Price: This refers to the predetermined price at which the underlying asset can be bought or sold upon exercising the options contract. Call options confer the right to buy at the strike price, while put options provide the right to sell at the strike price.

Expiration Date: Each options contract has a predefined expiration date, marking the final day on which the option can be exercised. The time remaining until expiration significantly influences the option’s premium.

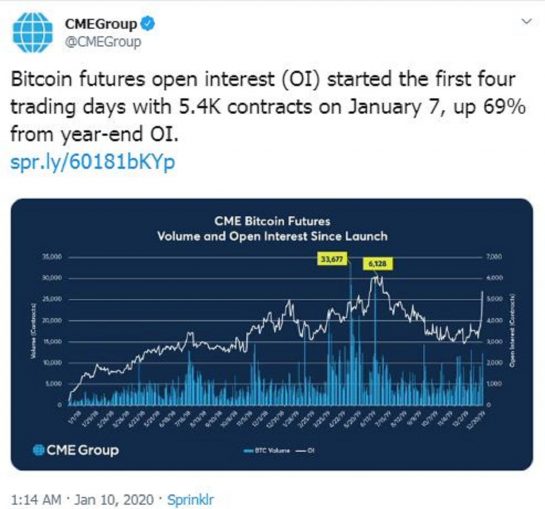

Open Interest: This metric represents the total number of options contracts that have been bought but not yet exercised or closed out. High open interest can serve as an indicator of market sentiment and liquidity.

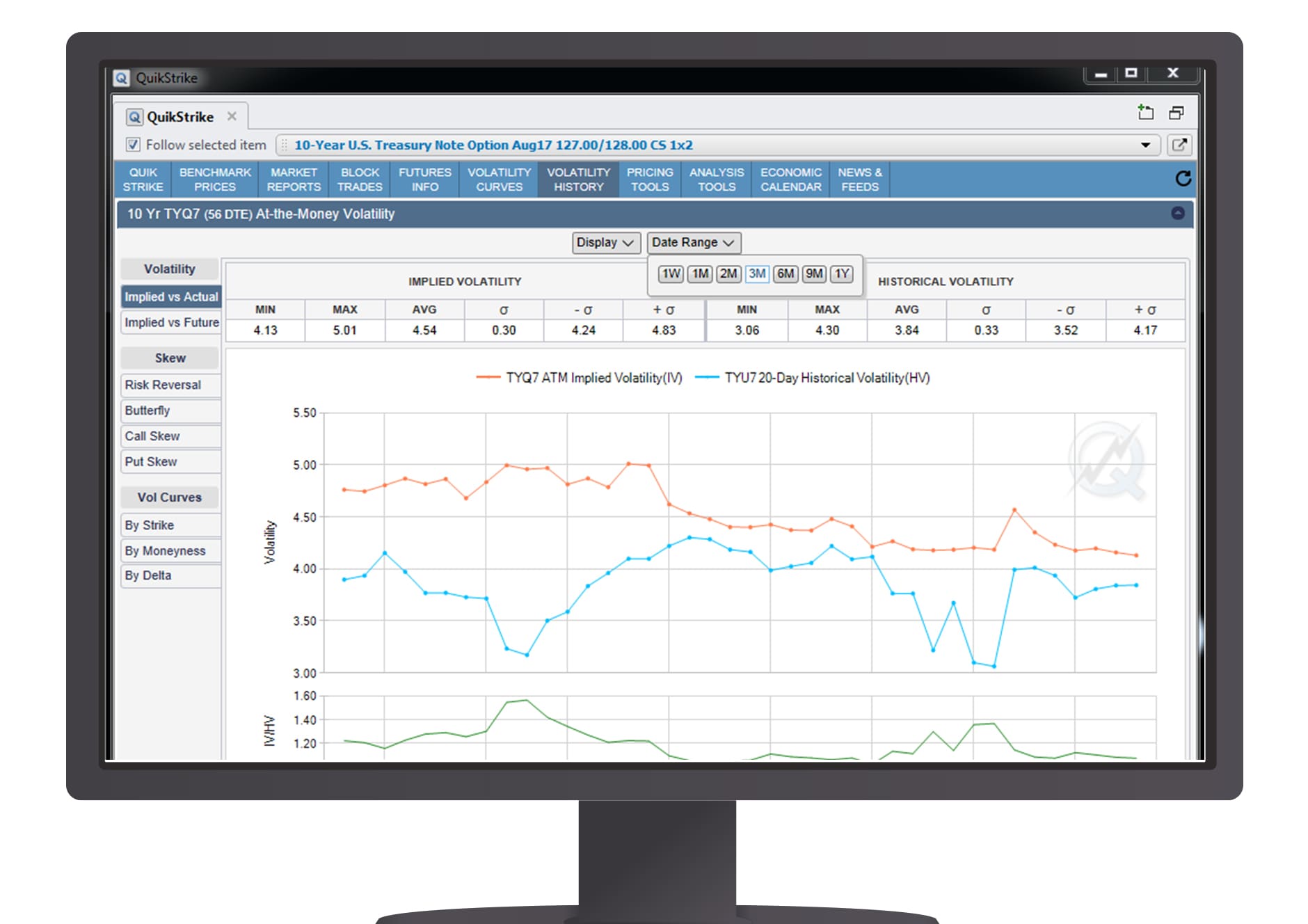

Volatility: The degree of price fluctuations in the underlying asset is known as volatility. Elevated volatility tends to increase option premiums as it enhances the likelihood of profitable trades.

Image: www.tradingview.com

Cme Options Trading

Image: eaforexkiller.blogspot.com

Unveiling Trading Strategies for CME Options: A Path to Informed Decisions

The realm of CME options trading offers a multitude of strategies, each catering to specific market conditions and risk appetites.

Covered Call Strategy: This strategy involves selling (writing) a call option while simultaneously owning the underlying asset. It generates income through premium collection and benefits from a modest rise in the underlying asset’s price.

Protective Put Strategy: This strategy is employed to hedge against potential losses on a long position in the underlying asset. It involves buying (purchasing) a put option that provides the right to sell the asset at a predetermined price, thus limiting downside risk.

Bull Call Spread: This strategy aims to capitalize on a bullish outlook for the underlying asset’s price. It involves buying (purchasing) a call option at a lower strike