Introduction: Unleashing the Power of Options with Chuck

In the vibrant world of investing, unlocking the potential of options trading can be an exhilarating journey. Join Chuck, a seasoned financial expert, as we delve into the depths of options, deciphering their intricacies and empowering you to navigate this dynamic market with confidence. Whether you’re a seasoned trader seeking new insights or a curious novice yearning for knowledge, this comprehensive guide will equip you with the essential tools and strategies for successful options trading.

Image: www.youtube.com

Let’s embark on this adventure together, unraveling the mysteries of options and unlocking the gateway to financial growth. Are you ready to conquer the options market with Chuck as your guide?

Chuck’s Guiding Principles for Options Trading

Before we delve into the intricacies of options trading, it’s imperative to establish a solid foundation of principles that will serve as your compass in this ever-evolving landscape:

- Understand the Risks: Recognize that options trading carries inherent risks. It’s crucial to carefully assess your risk tolerance before engaging in any trades.

- Educate Yourself Continuously: Options trading is a dynamic field that demands continuous learning. Stay abreast of market trends, follow industry news, and seek knowledge from reputable sources.

- Manage Your Emotions: Trading can trigger strong emotions, both positive and negative. Cultivate emotional discipline and avoid making impulsive decisions that could jeopardize your financial goals.

Unveiling Options: A Comprehensive Overview

Options are versatile financial instruments that provide traders with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on a specific date (expiration date). These contracts offer a unique opportunity to capitalize on market movements, hedge against risks, or generate income.

Options pricing is a blend of intrinsic and extrinsic value. Intrinsic value represents the difference between the underlying asset’s current market price and the strike price, while extrinsic value encompasses additional factors, such as time to expiration, volatility, and interest rates.

The Art of Options Trading: Strategies and Techniques

Navigating the complex world of options trading requires a repertoire of strategies and techniques to maximize success. Some popular strategies include:

- Buy Call Option: A bullish strategy that seeks to profit from an increase in the underlying asset’s price, offering the potential for unlimited gain.

- Sell Call Option: A neutral strategy that generates income by selling the right to buy an underlying asset, profiting from a stable or declining market.

- Buy Put Option: A bearish strategy that bets on a decline in the underlying asset’s price, offering limited risk and the potential for substantial gain.

- Sell Put Option: A neutral strategy that generates income by selling the right to sell an underlying asset, benefiting from a stable or rising market.

These strategies form the foundation for a diverse array of trading tactics, empowering traders to adapt to varying market conditions and optimize their returns.

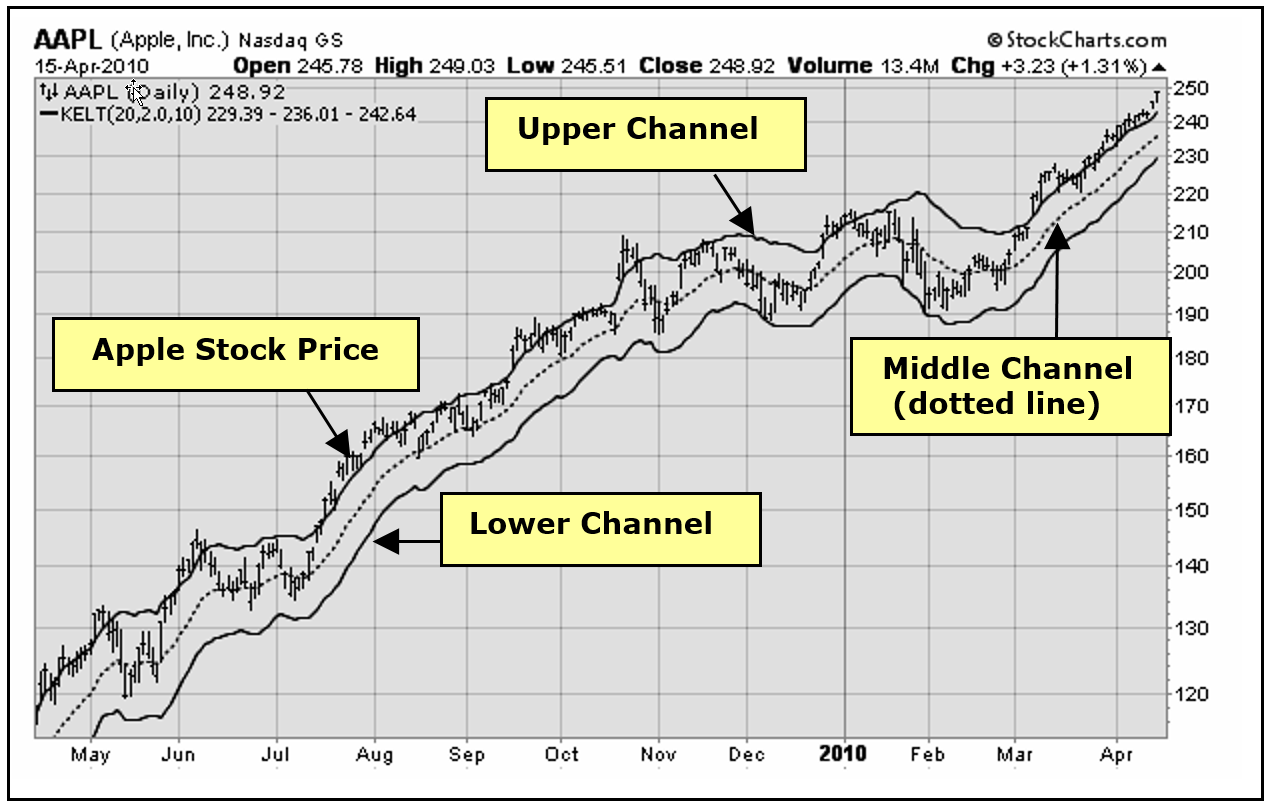

Image: optionpub.com

Embracing the Latest Trends and Developments in Options Trading

The options trading landscape is constantly evolving, driven by technological advancements, market innovations, and regulatory changes. Staying abreast of these trends is essential for staying ahead of the curve.

Social media platforms have emerged as a valuable source of insights, with experienced traders and analysts sharing their perspectives and strategies. Additionally, the proliferation of mobile trading apps has made it easier than ever to execute trades on the go.

Expert Tips and Advice for Successful Options Trading

To enhance your options trading journey, Chuck offers these valuable tips based on his years of experience and market acumen:

- Start Small and Learn Gradually: Avoid overtrading or taking on excessive risk. Start with small positions and gradually increase your investment as you gain experience.

- Don’t Chase the Market: Resist the temptation to jump into trades based on FOMO. Carefully analyze market conditions and develop a trading plan before entering a position.

- Stay Disciplined and Manage Risk: Adhere to your trading plan, manage your risk appetite, and avoid making decisions that deviate from your established strategy

By following these tips, you can cultivate a disciplined approach to options trading, increasing your chances of achieving your financial goals.

Frequently Asked Questions (FAQs) about Options Trading

Q: What is the difference between a call and a put option?

A: A call option provides the right to buy an underlying asset, while a put option provides the right to sell an underlying asset.

Q: What is the role of volatility in options pricing?

A: Volatility is a key determinant of option premiums. Higher volatility leads to higher option prices.

Q: Can I lose more money than I invested in options trading?

A: Yes, it is possible to lose more money than you invested when trading options, especially in certain types of strategies.

Options Trading Chuck

Image: chucktv.net

Conclusion: A Call to Action for Options Trading Mastery

With a solid foundation in options trading principles, strategies, and expert advice, you’re well-equipped to embark on your trading journey. Remember to approach the markets with caution, continuously educate yourself, and manage your risks diligently.

Are you ready to conquer the world of options trading with Chuck as your guide? Take the first step today and unlock the potential for financial growth and empowerment. Your trading adventure awaits!