Unlock the Power of Options Trading: Master the Call Put Spread

Image: www.optionsbro.com

Imagine controlling an entire stock without owning a single share. This is the alluring promise of options trading, a sophisticated investment strategy that can magnify your profits or mitigate your risks. In this comprehensive guide, we’ll delve into the intricacies of the call put spread, a pivotal technique for savvy traders.

What is a Call Put Spread?

In essence, an options spread is a strategy that involves buying and selling options of the same underlying asset with different strike prices. A call put spread specifically involves the simultaneous purchase of a call option and the sale of a put option. The call option gives you the right but not the obligation to buy the underlying asset at a specific price (strike price) on a predetermined date (expiration date). The put option, on the other hand, gives you the right to sell the underlying asset at the strike price.

Why Use a Call Put Spread?

Call put spreads offer several unique advantages for investors:

- Limited Risk: Options spreads limit your potential losses because the maximum risk is the net premium you pay.

- Potential for Profits in Both Directions: This strategy can profit from either an increase or decrease in the underlying asset’s price, providing flexibility in market conditions.

- Neutral to Bullish Outlook: A call put spread is ideal for investors who believe that the price of the underlying asset will remain stable or increase slightly but are not confident enough to buy the stock outright.

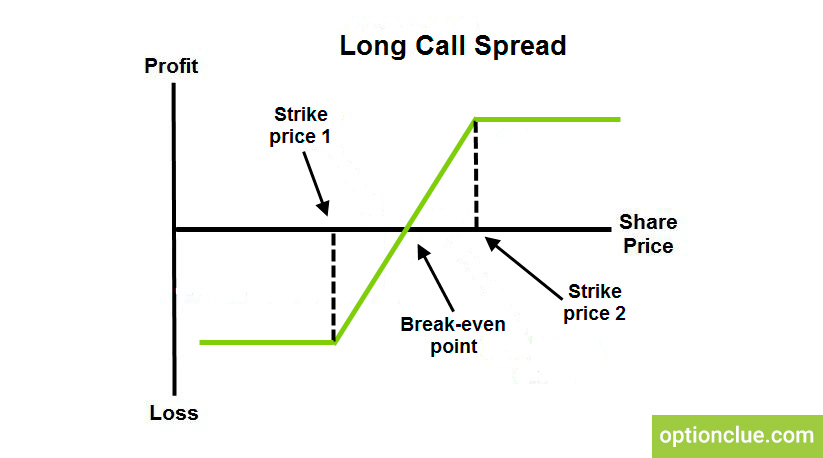

Understanding the Mechanics

To execute a call put spread, you first need to identify an underlying asset that you believe has the potential for price fluctuations. Then, you purchase a call option with a higher strike price than the current market price and sell a put option with a lower strike price. The difference between the two strike prices is known as the spread width.

Expert Insights for Success

Seasoned options traders offer valuable insights for maximizing your call put spread strategies:

- Choose liquid options: Select options with high trading volume to ensure market liquidity and minimize execution risks.

- Set realistic profit targets: Determine attainable profit goals based on historical market trends and your risk tolerance.

- Manage your risk: Control your potential losses by closely monitoring the spread’s value and adjusting your position as necessary.

Conclusion

The call put spread is an indispensable options trading strategy that allows investors to speculate on the direction of an underlying asset with limited risk. By understanding the mechanics of the spread and leveraging the insights of experts, you can harness its power to enhance your investment portfolio and achieve greater trading success. Remember to always consult with a financial advisor before making any trading decisions. Take control of your financial future and embark on the exciting world of options trading with confidence.

![Call Ratio Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019d319f6270a2ec994f4b1_uyoD64sgSjj61tWsuE9l7orba78WXPi2XmLCykx0O8z9iyEKbR3FgfrwVcOXuQg8xX45uam2zEPMAK9rFPrn6aRULpjeqOJKiukZIHwe5Tuo891ESb8xY9uRYeHppr8Wg4UhBeW0.png)

Image: optionalpha.com

Options Trading Call Put Spread

Image: optionclue.com