In the realm of finance, options trading has long been a lucrative venture, offering investors the potential to amplify their earnings. Ten years ago, the landscape of options trading brokers was vastly different compared to today. Let’s embark on a nostalgic excursion to uncover the remarkable transformation that has reshaped this industry.

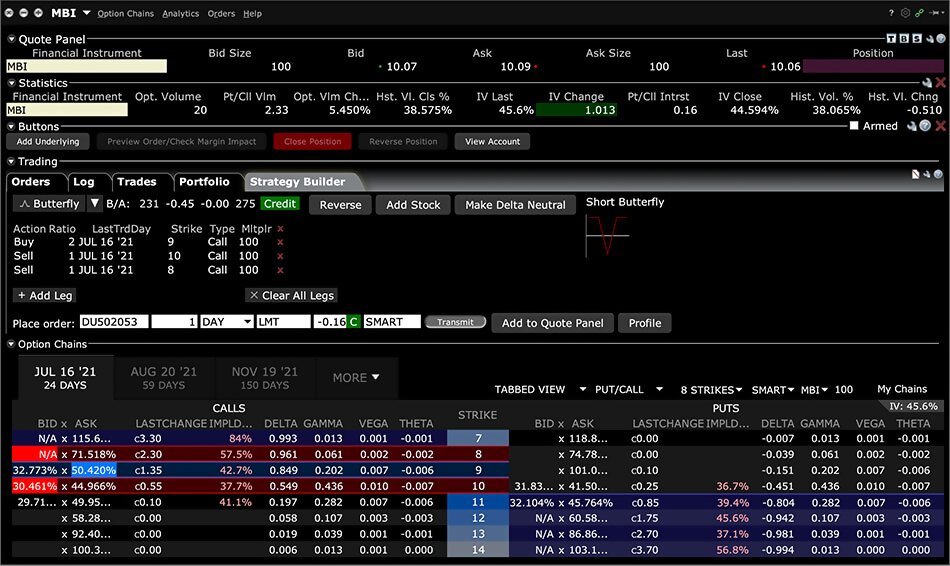

Image: www.interactivebrokers.co.uk

The Dawn of Electronic Trading: A Pivotal Moment

A decade ago, the advent of electronic trading platforms revolutionized the options trading landscape. Prior to this technological breakthrough, trading was predominantly conducted through traditional brokerage firms and over-the-counter (OTC) networks, introducing complexities and inefficiencies into the process.

The emergence of online brokerages simplified trade execution, expedited transaction processing, and provided real-time market data. The ease of access to options markets and the transparency brought forth by electronic platforms empowered traders, fostering a more level playing field.

The Rise of Discount Brokerages: Empowering the Masses

Traditionally, options trading was confined to a small circle of elite investors with access to high-net-worth brokerages. However, the rise of discount brokerages shattered this exclusive barrier.

Discount brokers offered commission-free trades or significantly reduced fees, opening up options trading to a broader audience. This democratization of options trading paved the way for individual investors to participate in a market that was previously out of reach for many.

Emerging Trends and Future Prospects

The options trading industry has witnessed continuous evolution over the past decade. The proliferation of mobile trading apps has allowed traders to access markets on the go, while the introduction of fractional shares has made options trading more accessible to small-scale investors.

Looking ahead, the future of options trading appears bright. With technological advancements, such as artificial intelligence (AI) and machine learning, traders can expect enhanced market analysis, automated trade execution, and personalized trading strategies.

Image: www.nytimes.com

Expert Tips for Options Trading Success

Navigating the world of options trading requires a combination of knowledge, strategy, and risk management. Here are a few invaluable tips to help you maximize your potential:

- Understand the Basics: Before venturing into options trading, it is crucial to grasp the underlying concepts, including option types, pricing, and risk.

- Start Small: Begin with small trade size to manage risk and gain experience. As your confidence and knowledge grow, you can gradually increase your position sizes.

- Choose the Right Strategy: Determine the most suitable options strategy based on your risk tolerance, time horizon, and market expectations.

FAQ: Demystifying Options Trading

Q: What are options, and how do they work?

A: Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date.

Q: What are the risks involved in options trading?

A: Options trading involves inherent risks, including the risk of losing the entire amount invested. It is essential to understand and mitigate these risks through proper position sizing and risk management strategies.

Options Trading Brokers Ten Years Ago

Image: www.danielstrading.com

Conclusion: Embracing the Evolving Landscape of Options Trading

The journey of options trading brokers over the past decade has been marked by revolutionary advancements in technology, accessibility, and trading practices. As we step into the future, the industry promises to continue evolving, empowering countless individuals with the opportunity to harness the transformative power of options trading.

If you have ever considered delving into options trading, the time is now. With the abundance of resources, educational materials, and online communities available, you can embark on this exciting endeavor with confidence. Embrace the ever-changing landscape of options trading and seize the opportunities it presents.