Introduction

In the fast-paced and dynamic world of finance, options are a powerful tool for investors seeking to enhance their portfolio returns and mitigate risk. An options trading algorithm code in Python can automate this process, enabling traders to execute complex trading strategies quickly and efficiently. By leveraging the capabilities of high-performance computing and machine learning, algorithmic trading has revolutionized the options market, opening up new possibilities for investors of all levels.

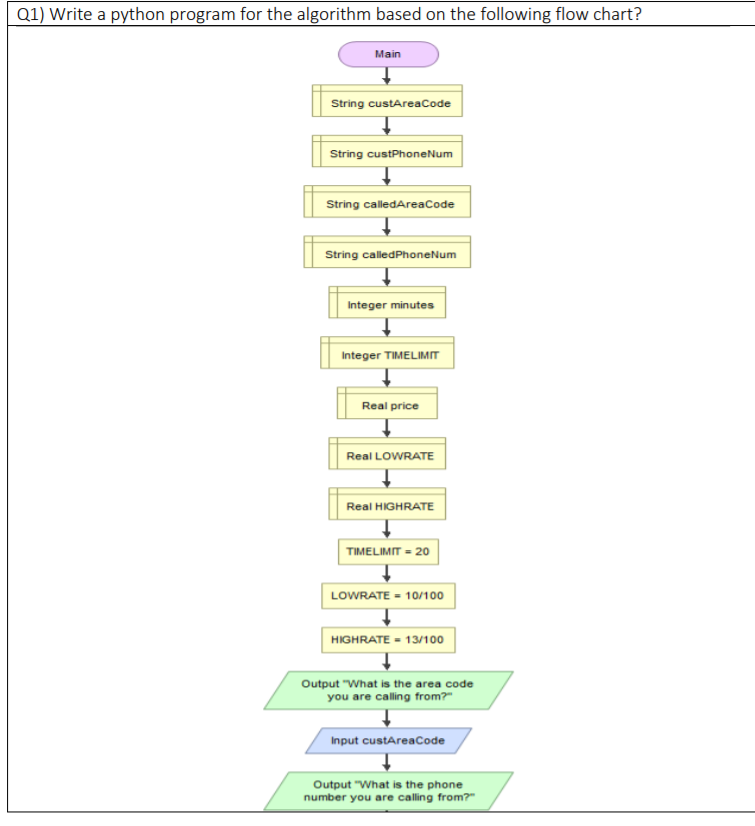

Image: www.chegg.com

This article serves as a comprehensive guide to options trading algorithm code in Python, providing you with the essential knowledge to develop and deploy effective automated trading strategies. We will delve into the basics of algorithmic trading, explore the intricacies of options markets, and equip you with practical Python code examples to navigate the complexities of the financial landscape.

Understanding Algorithmic Trading

Algorithmic trading, also known as automated trading or algo trading, involves using computer programs to execute trading strategies based on pre-defined rules and parameters. These algorithms monitor market data in real-time, analyzing price trends, technical indicators, and other relevant information to make informed trading decisions. Algorithmic trading offers several advantages, including:

- Speed and Efficiency: Algorithms can execute trades in milliseconds, providing traders with an edge in fast-moving markets.

- Objectivity and Discipline: Algorithms adhere strictly to pre-defined rules, eliminating emotional biases and ensuring consistent trade execution.

- Backtesting and Optimization: Algorithms enable traders to backtest their strategies on historical data, optimize parameters, and refine their approach.

Options Trading Concepts

Options are derivative contracts that grant the holder the right (but not the obligation) to buy (call option) or sell (put option) an underlying asset, such as a stock, at a predetermined price (strike price) within a specified time period (expiration date). Understanding key options trading concepts is crucial for developing effective algorithmic trading strategies:

- Premium: The price paid to acquire an option contract.

- Intrinsic Value: The difference between the strike price and the underlying asset’s current market price.

- Time Value: The premium component that reflects the remaining time until expiration.

- Greeks: Metrics that measure the sensitivity of an option’s price to changes in underlying asset price, volatility, time to expiration, and interest rates.

Python Code Examples

Python is a versatile and open-source programming language that provides a rich ecosystem of libraries and tools for developing options trading algorithms. Here are a few Python code snippets to get you started:

import pandas as pd

import numpy as np

from optionstrading import *

# Fetch option chain data

chain = get_option_chain("AAPL")

# Calculate option Greeks

greeks = calc_greeks(chain)

# Create a trading strategy

strategy = SimpleCoveredCallStrategy(chain, 0.1)

# Optimize strategy parameters

params = optimize_strategy(strategy, historical_data)

# Generate trade signals

signals = generate_signals(strategy, params)

Image: samchaaa.medium.com

Options Trading Algorithm Code Python

Image: sites.duke.edu

Conclusion

Options trading algorithm code in Python empowers traders with powerful tools to automate complex trading strategies. By leveraging the advantages of algorithmic trading and the versatility of Python, investors can enhance their returns, mitigate risk, and navigate the complexities of options markets effectively. Whether you are a seasoned trader or just starting your journey in algorithmic trading, this guide provides you with the necessary insights and code examples to embark on your adventure in this exciting field.

Remember that while algorithmic trading offers significant benefits, it also requires a deep understanding of financial markets, trading strategies, and programming skills. Conduct thorough research, backtest your strategies, and seek guidance from experienced professionals as you develop your own options trading algorithm code in Python.