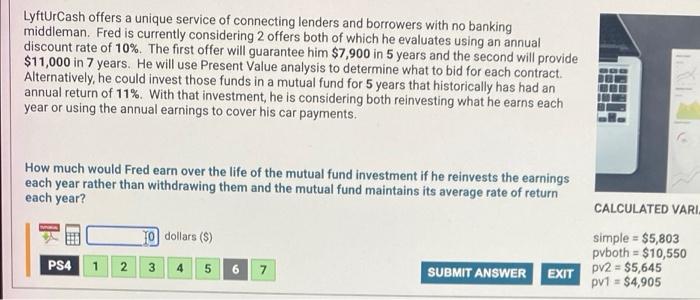

When a limited company faces financial distress, its creditors may pursue various legal options. Understanding these options and their potential consequences is crucial for company owners. This article explores the complexities of creditor options, wrongful trading, and voluntary liquidation, providing practical guidance and empowering readers to make informed decisions.

Image: www.chegg.com

Creditors’ Options

Creditors, such as banks, suppliers, and employees, can take legal action against a company that fails to repay its debts. Their options include:

- Winding-up Petition: A formal application to the court to have the company liquidated, effectively ending its operations.

- Creditor’s Voluntary Liquidation (CVL): A process initiated by the company’s directors to wind up the company voluntarily.

- Statutory Demand: A legal notice demanding payment of a specific debt within 21 days. Failure to comply may trigger a winding-up petition.

- Administration: An insolvency procedure in which an independent administrator is appointed to manage the company’s affairs and explore options for its survival.

Wrongful Trading

Directors can be held personally liable if they knowingly continue to trade the company while it is insolvent, diminishing its assets. This is known as wrongful trading and can result in disqualification and even prosecution. Directors should seek professional advice as early as possible to avoid potential legal repercussions.

Voluntary Liquidation

Voluntary liquidation is a managed process in which the company’s directors appoint a liquidator to oversee the company’s dissolution. The liquidator will:

- Sell the company’s assets and distribute the proceeds to creditors.

- Investigate the company’s affairs and conduct a final audit.

- Dissolve the company and its debts.

Voluntary liquidation can be an advantageous option if:

- The company is genuinely insolvent and unable to repay its debts.

- The directors are concerned about personal liability for wrongful trading.

- It is necessary to protect the company’s reputation and avoid legal proceedings.

Image: www.chegg.com

Expert Insights

“Creditors’ options can vary depending on the specific circumstances of each case,” advises corporate lawyer Sarah Jones. “Seeking legal advice early on can assist in navigating these complex issues and protecting the interests of all parties involved.”

“Directors have a duty to act in the best interests of the company and its creditors,” emphasizes insolvency practitioner John Smith. “If they fail to do so, they may be held liable for wrongful trading.”

Actionable Tips

- Monitor the company’s financial health regularly and seek professional advice when necessary.

- Communicate openly and transparently with creditors to maintain relationships and explore repayment options.

- Consider voluntary liquidation if all other options have been exhausted and the company is genuinely insolvent.

- Before making any decisions, consult with legal and insolvency professionals to fully understand the implications and protect your interests.

Creditors Options Wrongful Trading Voluntary Liquidation Limited Company

Image: www.chegg.com

Conclusion

Creditors’ options, wrongful trading, and voluntary liquidation are complex issues that can have significant consequences for limited company owners. By understanding these options and the legal implications involved, directors can make informed decisions and take steps to protect themselves and the company. Remember, seeking professional advice and acting promptly are crucial to safeguarding your interests and mitigating potential risks.