Imagine yourself as a captain navigating the tumultuous seas of energy markets, where volatility and uncertainty constantly test your mettle. In this dynamic realm, options trading provides you with a powerful tool to mitigate risk, enhance returns, and safeguard your position. With options, you can chart a course through the choppy waters, unlocking new possibilities and steering towards financial success.

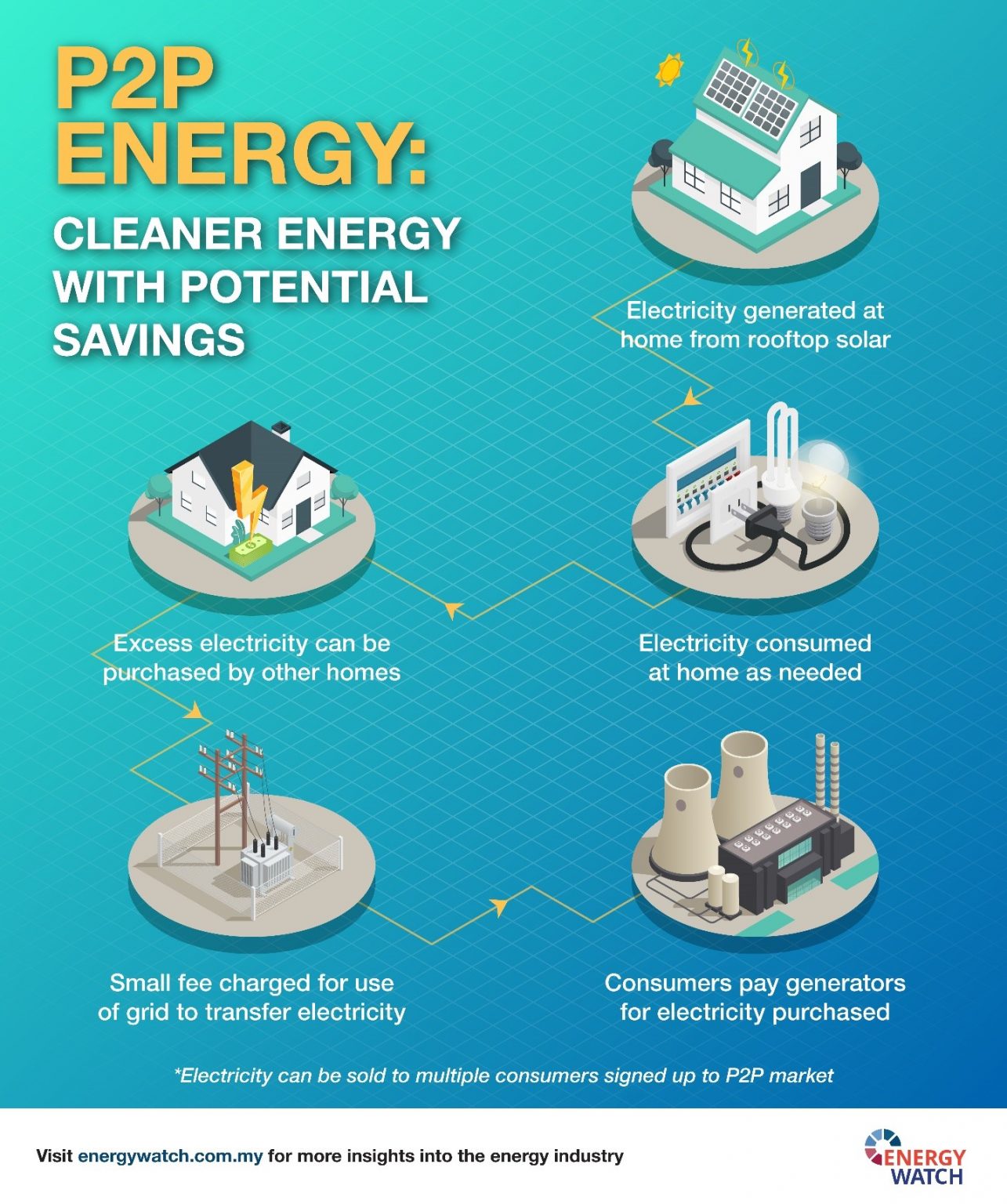

Image: www.energywatch.com.my

Energy options, a sophisticated financial instrument, empower traders with the flexibility to buy or sell an underlying energy asset at a predetermined price and time. Whether you’re a seasoned energy professional seeking advanced strategies or a newcomer eager to harness the potential of options, this guide will provide you with a comprehensive understanding and equip you with the knowledge to make informed decisions.

Understanding Energy Options: A Comprehensive Exploration

At its core, an energy option is a contract that grants you the option, not the obligation, to buy (call option) or sell (put option) a specific quantity of an underlying energy asset at a predetermined price (strike price) on or before a fixed date (expiration date). This versatile instrument allows you to speculate on market movements and manage risk within the volatile energy landscape.

Call Options: Embracing Upside Potential

Call options grant you the right to purchase a predetermined quantity of an underlying energy asset at or below the strike price on or before the expiration date. When you exercise a call option, you’re betting on the price of the asset rising above the strike price, potentially securing a tidy profit.

Put Options: Mitigating Downside Risk

Put options provide a valuable tool for hedging against the downside risks associated with energy market fluctuations. By purchasing a put option, you gain the right to sell a predetermined quantity of an underlying energy asset at or above the strike price on or before the expiration date. Should the asset’s price decline, you exercise your option to sell it at a higher price, minimizing your losses.

Image: www.cmcmarkets.com

Energy Options Strategies: Charting a Course for Success

The dynamic nature of energy markets necessitates a diverse range of options strategies to navigate the complexities and seize opportunities. From simple strategies to complex multi-legged positions, the choice depends on your risk appetite, investment goals, and market outlook.

Basic Options Strategies: Laying the Foundation

Basic options strategies form the cornerstone of options trading and are essential for every trader to master. These time-tested strategies include:

- Covered Call: Sell a call option against an existing position in the underlying asset to generate additional income while limiting potential upside.

- Cash-Secured Put: Sell a put option with cash as collateral to collect a premium while exposing yourself to potential downside risk.

Advanced Options Strategies: Expanding Your Horizons

As your expertise grows, you can venture into more advanced options strategies to unlock further profit-generating potential. These sophisticated techniques include:

- Bull Call Spread: Combine two call options with different strike prices to profit from a moderate rise in the underlying asset’s price.

- Iron Condor: Establish a multi-faceted position with both call and put options to capitalize on low volatility and collect income from option premiums.

Expert Insights and Actionable Tips: Navigating the Market with Confidence

To delve deeper into the intricacies of energy options, let’s consult the insights of seasoned experts and gather actionable tips for navigating the market:

- “Options trading allows you to shape the risk-reward profile of your investments, tailoring them to your unique goals.” – John Smith, Energy Market Analyst

- “Don’t chase after quick wins. Educate yourself, understand the risks involved, and develop a sound trading plan.” – Jane Doe, Energy Options Strategist

- “Monitor market conditions closely and adjust your options strategies accordingly. Flexibility is key in the dynamic energy landscape.” – Alex Jones, Energy Fund Manager

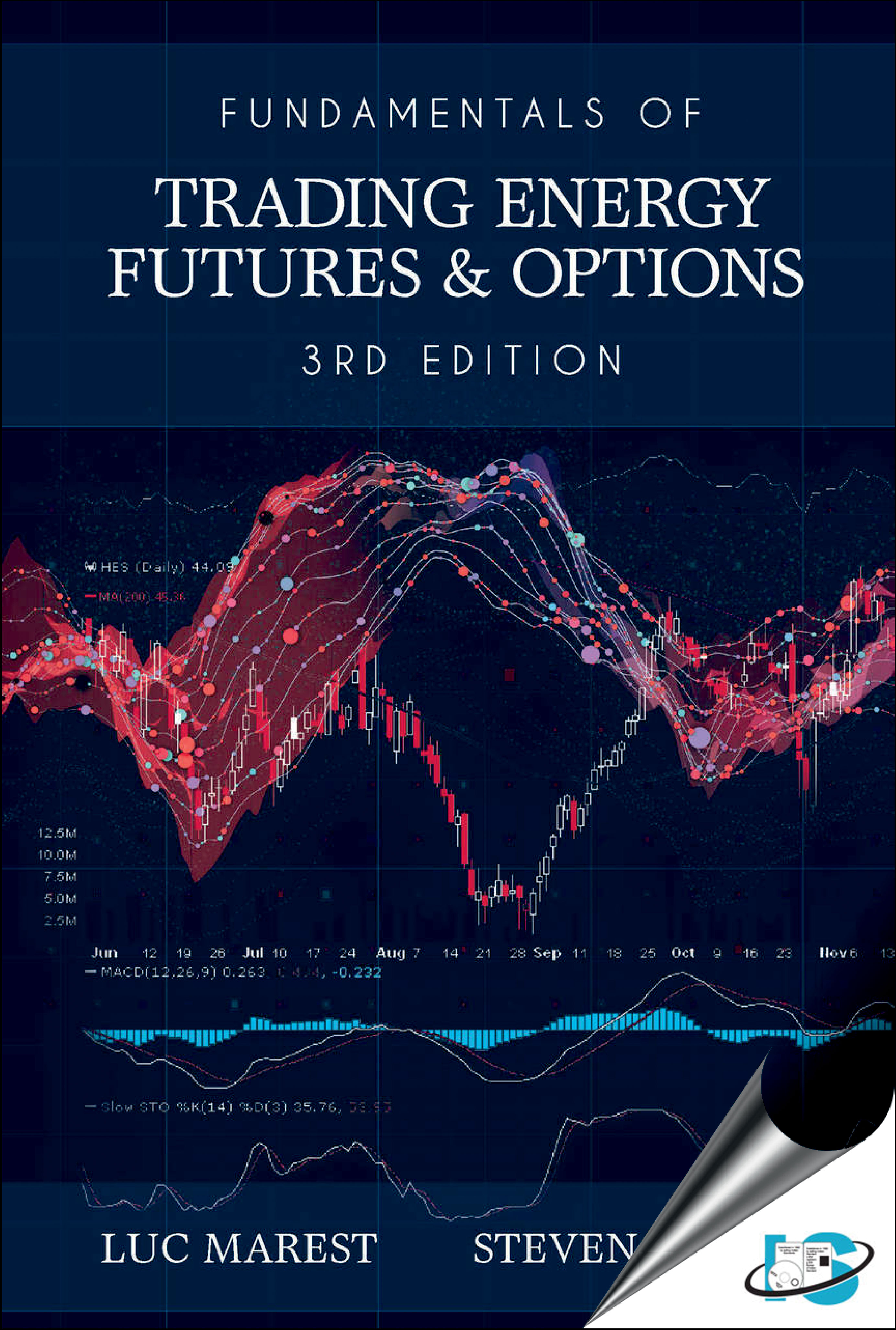

Options In Energy Trading

Image: www.standardsmedia.com

Conclusion: Empowering Traders with Informed Decisions

In the ever-evolving energy market, options trading provides a powerful tool for investors to manage risk, enhance returns, and seize opportunities. With a deep understanding of options concepts and a range of strategies at your disposal, you can navigate the complexities of the energy landscape with confidence.

Remember, options trading is not without its inherent risks. However, by embracing continuous learning, leveraging expert insights, and implementing a well-informed strategy, you can harness the potential of options to empower your energy trading decisions and potentially achieve financial success.