Imagine a world where you could potentially profit from the fluctuations of the stock market, even when the overall trend is uncertain. This is the allure of SPY option trading: a complex yet potentially rewarding way to navigate the financial landscape. But with its intricacies and risks, it’s crucial to tread carefully and equip yourself with the right knowledge. This article delves into the fascinating world of SPY option trading, demystifying its mechanics and equipping you with actionable insights to make informed decisions.

Image: www.youtube.com

SPY options are contracts that give you the right, but not the obligation, to buy (call options) or sell (put options) shares of the SPDR S&P 500 ETF (SPY) at a predetermined price (strike price) on or before a specific date (expiration date). They act as a powerful tool for leveraging your trading capital, allowing you to potentially amplify your gains or losses. But this leverage comes with its own set of challenges, requiring a deep understanding of market dynamics, risk management, and strategic planning.

Deciphering the Language of SPY Option Trading

To truly grasp the intricacies of SPY option trading, we need to understand its underlying concepts and terminology. Let’s embark on a journey into the heart of this financial system:

1. The Basics of Options:

- Call Options: As the holder of a call option, you have the right to buy a specific number of underlying shares at the strike price. If the price of the underlying asset (SPY in this case) rises above the strike price, you can exercise the option, buy the shares at a lower price, and sell them in the market for a profit.

- Put Options: With a put option, you have the right to sell a specific number of underlying shares at the strike price. If the price of the underlying asset falls below the strike price, you can exercise your option, sell the shares at a higher price, and profit from the decline.

2. Understanding SPY as the Underlying Asset:

SPY represents the SPDR S&P 500 ETF, which tracks the performance of the S&P 500 Index. This index is a benchmark for the overall health of the U.S. stock market, making SPY a highly liquid and widely traded asset.

3. Leverage and Profit Potential:

The magic of options lies in their ability to amplify returns. While a direct investment in SPY offers limited potential for gains, options allow for a larger potential profit with a smaller initial investment. However, this leverage can also magnify losses, making risk management critical.

4. Time Value and Expiration Dates:

Options have a limited lifespan, expiring on a specific date. Time value, the premium paid for the option, decays as the expiration date nears. This makes timing crucial, and understanding the concept of time decay can significantly impact your trading decisions.

5. Premium and Strike Price:

The premium of an option is the price you pay for the right to buy (call) or sell (put) the underlying asset. It reflects the market’s perception of the likelihood of the option being exercised. The strike price, on the other hand, is the predetermined price you can buy or sell the underlying asset at.

6. Option Strategies:

The world of options offers a diverse array of strategies, each with its own risk-reward profile. Some common strategies include:

- Buying Calls: Anticipating a price increase in SPY.

- Selling Calls: Generating income from premium while expecting a limited price increase or a decline in SPY.

- Buying Puts: Looking for a decline in SPY.

- Selling Puts: Generating income from premium while expecting a limited decline or a price increase in SPY.

- Covered Calls: Selling a call option against shares you already own.

- Cash Secured Puts: Holding cash as a collateral while selling a put option, potentially receiving shares if the price falls below the strike price.

Mastering the Art of SPY Option Trading

While the world of SPY option trading might seem intimidating, it can be mastered with dedicated learning, practice, and disciplined execution. Here are key points to guide your journey:

1. Understanding Your Risk Tolerance:

Options trading involves inherent risks. Before diving in, it’s paramount to assess your risk tolerance and understand the potential for losses. Develop a risk management strategy that aligns with your financial goals and comfort level.

2. Thorough Research and Analysis:

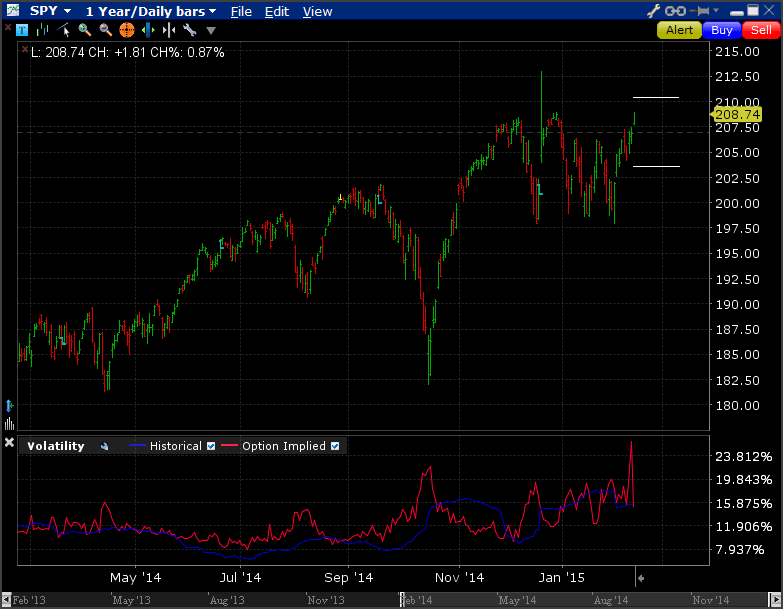

Successful option trading goes beyond luck and requires a deep understanding of market dynamics, economic indicators, and the underlying asset (SPY). Utilize fundamental and technical analysis tools, scrutinize economic reports, and stay abreast of market trends.

3. Strategic Planning and Monitoring:

Don’t just plunge into the market impulsively. Plan your trades with specific entry and exit points, set stop-loss orders to limit your potential losses, and regularly monitor your positions for adjustments as market conditions evolve.

4. Harnessing Technology and Resources:

Numerous online resources and trading platforms provide valuable insights, data analysis, and tools for tracking SPY option prices, volatility, and market sentiment. Utilize these resources to stay informed and make informed decisions.

5. Continuous Learning and Adaptability:

The financial market is constantly evolving. Stay committed to lifelong learning, explore new strategies, and adapt your trading approach as market dynamics shift.

Expert Insights: Navigating the SPY Option Landscape

Seasoned investors and financial experts emphasize the need for discipline, risk management, and a thorough understanding of the market when venturing into SPY option trading. They caution against impulsive decisions and stress the importance of a well-defined trading plan. John Doe, a veteran options trader, advises, “Treat your trades like investments, not gambles. Have a clear objective, understand your risk tolerance, and be prepared to exit a trade when it no longer aligns with your strategy.”

Image: kovivygoqabut.web.fc2.com

Spy Option Trading

Conclusion: Embracing the Potential of SPY Options

The world of SPY option trading presents a captivating opportunity to leverage your capital and potentially profit from market fluctuations. But success requires a clear understanding of the complexities, a disciplined approach to risk management, and continuous learning. As you embark on this journey, remember that every decision you make matters. By acquiring the right knowledge, honing your skills, and adhering to sound principles, you can unlock the potential of SPY option trading and navigate the financial landscape with confidence.