Introduction

In the ever-evolving landscape of investment, options trading stands out as a versatile and potentially lucrative strategy. Options, financial instruments that confer the right but not the obligation to buy or sell an underlying asset at a specific price, have gained immense popularity among investors seeking to enhance portfolio performance and mitigate risk. This comprehensive guide delves into the intricacies of options trading, empowering investors with the knowledge and insights necessary to navigate this dynamic market and maximize their returns.

Image: www.projectfinance.com

Demystifying Options: Basic Concepts

An option contract represents the right to buy (call option) or sell (put option) an underlying asset, such as a stock, at a predetermined price, known as the strike price, on or before a set expiration date. The holder of an option has the flexibility to exercise this right at any time before expiration, or let the option expire worthless if it is out of the money. Call options grant the holder the potential to benefit from an increase in the underlying asset’s price, while put options provide protection against a potential decline.

Types of Options Strategies

Options trading offers investors a wide array of strategies to adapt to various market conditions and risk tolerance levels. Common strategies include:

- Covered Calls: Selling call options against a stock position already owned.

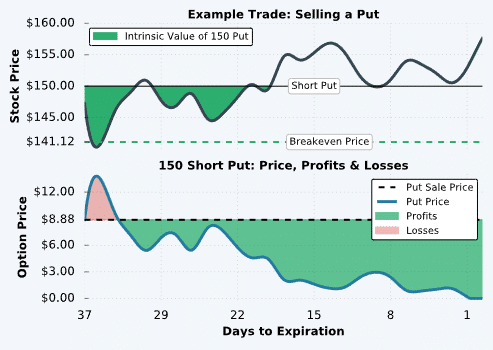

- Cash-Secured Puts: Selling put options while holding cash to potentially acquire the underlying asset at a preferred price.

- Spreads: Combinations of multiple options with different strike prices or expiration dates, allowing for customization of risk and reward.

- Iron Condors: Complex spread strategies that combine call and put options with varying strike prices to hedge against large price movements.

Leverage and Risk Management

Options involve the concept of leverage, amplifying potential returns but also magnifying potential losses. It is crucial for investors to understand their risk tolerance and manage risk effectively. Techniques like position sizing, diversification, and stop-loss orders help mitigate risk while allowing for strategic option plays.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

Image: economiaenegocios.com

Trading Options in Practice

Trading options involves several key steps:

- Choosing the Underlying Asset: Selecting the asset to be traded, considering factors like volatility and liquidity.

- Determining the Option Type: Deciding whether to buy or sell a call or put option based on market outlook and strategy.

- Selecting the Strike Price: Choosing a strike price that aligns with the anticipated price movement of the underlying asset.

- Setting the Expiration Date: Considering the time frame of the projected price change and volatility expectations.

- Execution: Placing the trade on a reputable trading platform, monitoring the market, and adjusting positions as needed.

Options As A Strategic Investment Trading

Image: rmoneyindia.com

Conclusion

Options trading can be a powerful tool for enhancing portfolio returns and mitigating risk. By understanding the basic principles, types of strategies, and risk management techniques, investors can effectively navigate the complexities of the options markets. With careful research and a disciplined approach, options trading offers the potential for strategic investment gains amidst the ever-changing landscape of global finance. It is essential, however, to always proceed with appropriate due diligence and seek professional advice if necessary, as options trading involves inherent risks and should be undertaken with a comprehensive understanding of the subject matter.