Introduction

Image: tradersbulletin.co.uk

In the ever-evolving world of finance, options and volatility trading have emerged as powerful tools for savvy investors. Whether you’re an experienced trader or just starting your journey, understanding these concepts is crucial to navigating the complex markets. This comprehensive guide will provide you with a deep dive into options and volatility trading, empowering you with the knowledge and strategies to make informed decisions.

What are Options?

Options are derivative financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset (such as a stock or bond) at a specified price on or before a certain date. The two main types of options are calls and puts. A call option grants the holder the right to buy the underlying asset, while a put option grants the holder the right to sell it.

Volatility and Its Impact

Volatility measures the rate at which an asset’s price changes. High volatility indicates rapid fluctuations, while low volatility suggests more stable prices. Volatility has a significant impact on option pricing and trading strategies.

Understanding Option Pricing

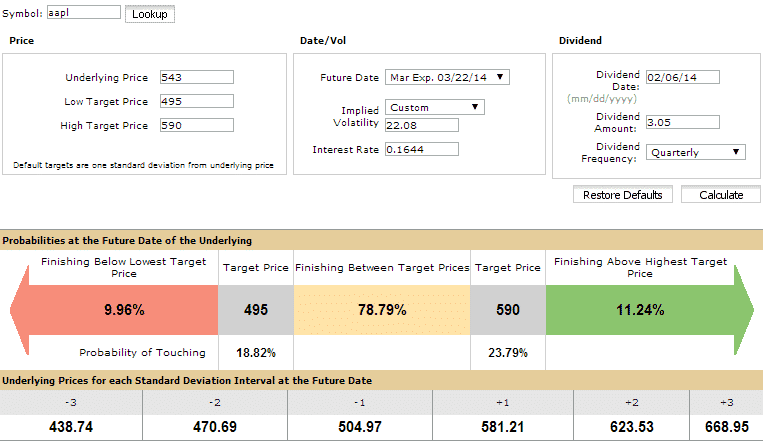

The price of an option is determined by several factors, including the underlying asset’s price, the strike price (the price at which the option can be exercised), the expiration date, and the prevailing market volatility. The Black-Scholes model is commonly used to calculate option premiums.

Trading Options and Volatility

Trading options and volatility can be a complex but potentially rewarding endeavor. There are numerous strategies available, each with its own risk and reward profile. Some common strategies include:

- Covered calls: Selling call options against a stock that you already own.

- Protective puts: Buying put options to hedge against potential losses on a stock that you own.

- Iron condors: Selling options that cover a wide price range and generating income from both bullish and bearish market movements.

- Volatility trading: Betting on the direction of future volatility through instruments like VIX futures or options.

Expert Insights and Actionable Tips

To succeed in options and volatility trading, it’s essential to seek guidance from experts and apply practical tips:

- Consult with a financial advisor: Gain personalized advice based on your individual circumstances and risk tolerance.

- Study technical analysis: Use charts and indicators to identify trading opportunities based on historical price patterns.

- Practice risk management: Determine your acceptable level of risk and implement stop-loss orders to protect your capital.

- Monitor market news: Stay informed about economic events and news that may affect asset prices and volatility.

Conclusion

Unlocking the secrets of options and volatility trading requires a deep understanding of the concepts, a keen eye for market trends, and a disciplined approach to risk management. By embracing the insights and actionable tips provided in this guide, you can enhance your trading acumen and pursue potentially profitable opportunities in the financial markets. Remember, knowledge is power, and the more you grasp about these instruments, the better equipped you’ll be to navigate the complex world of finance.

Image: optionstradingiq.com

Options And Volatility Trading

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Image: www.ainfosolutions.com