Options vs. Forex Trading: Navigating the Labyrinth of Speculative Investment

Image: blog.mt2trading.com

Introduction:

In the ever-expanding realm of financial markets, speculative investment strategies like options and forex trading have emerged as enticing avenues to potentially generate wealth. However, understanding the intricacies, risks, and rewards associated with each is paramount before embarking on this intricate path. This comprehensive guide will delve into the captivating worlds of options and forex trading, providing invaluable insights to help you navigate this speculative labyrinth.

Unraveling the Realm of Options Trading:

Options trading presents an enticing form of speculative investment characterized by flexibility and versatility. It grants traders the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified period (expiration date). A deep understanding of its terminology, types (e.g., long and short calls/puts), and pricing dynamics is crucial for successful navigation.

Decoding the Enigmatic Forex Market:

Foreign exchange (forex) trading stands as the world’s largest and most liquid financial market, facilitating the conversion of currencies. Unlike options, forex encompasses the direct exchange of currencies, such as the classic EUR/USD pair. Armed with technical and fundamental analysis, traders speculate on the fluctuations in exchange rates, aiming to profit from currency movements.

Risking the Stakes in Options and Forex Trading:

Embracing speculative investment strategies involves acknowledging the inherent risks associated with both options and forex trading. Options trading carries the potential for unlimited losses if market conditions turn unfavorable. Forex trading also presents risks associated with leverage, market volatility, and geopolitical events that can influence currency valuations.

Weighing the Scales: Advantages and Disadvantages

To make an informed decision between options and forex trading, it’s imperative to weigh their respective advantages and disadvantages. Options trading offers flexibility, limited risk profiles in certain scenarios, and the potential for substantial gains. Forex trading boasts high liquidity, 24/7 accessibility, and lower transaction costs compared to other markets. However, both strategies demand a high level of skill, discipline, and risk tolerance to navigate effectively.

Seeking Guidance from the Masters:

Successful navigation through the treacherous waters of options and forex trading hinges on seeking guidance from seasoned experts. Seasoned traders with proven track records can provide invaluable insights, strategies, and mentorship to help refine your understanding and improve your trading decisions. Their collective wisdom can serve as a guiding compass, leading you towards potential success.

Delving into the Technical Intricacies:

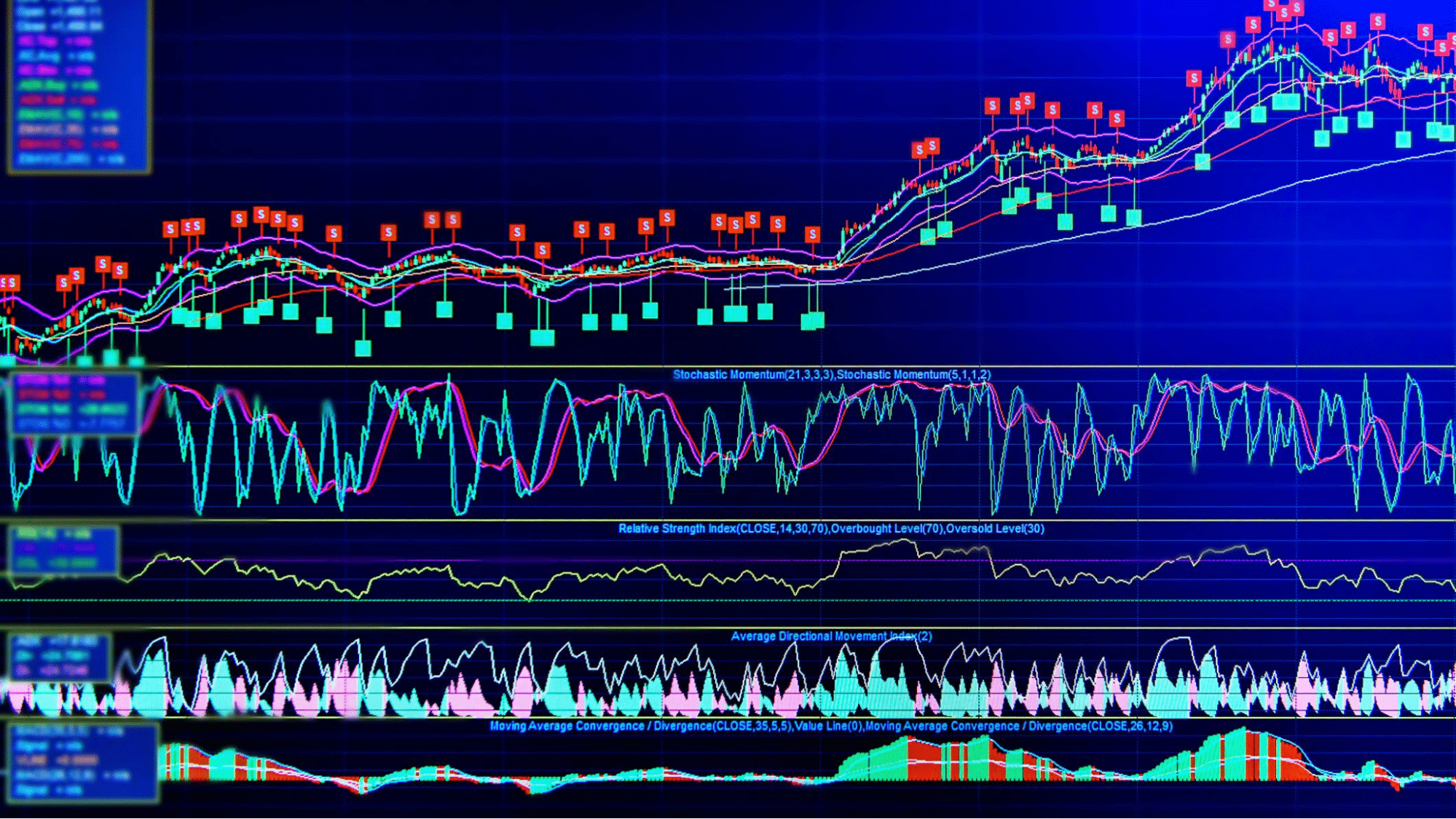

Mastering options and forex trading demands a thorough understanding of technical analysis and fundamental drivers. Technical analysis involves studying price patterns, indicators, and charting techniques to identify potential trading opportunities. Fundamental analysis, on the other hand, examines macroeconomic factors, news events, and economic indicators that can influence market sentiment and asset prices. By combining both approaches, traders can gain a holistic perspective to inform their trading strategies effectively.

Harnessing the Power of Trading Platforms:

Selecting the right trading platform empowers traders with the tools and resources to execute their strategies seamlessly. Modern trading platforms offer advanced charting capabilities, risk management features, real-time market data, and access to educational materials to enhance the trading experience.

Conclusion:

Navigating the exhilarating yet intricate world of options and forex trading requires a blend of knowledge, skill, and risk tolerance. By comprehending their fundamental principles, advantages, and disadvantages, traders can make informed decisions about which strategy aligns best with their financial goals and risk appetite. Embrace continuous learning, seek mentorship from experienced professionals, and relentlessly refine your trading strategies to optimize your chances of success in this dynamic and potentially rewarding arena.

Image: investluck.com

Option Vs Forex Trading

Image: www.pinterest.com