Introduction

Options trading has emerged as an increasingly popular investment strategy among experienced investors. Robinhood, a leading online trading platform, has made options trading accessible to a broader audience by offering a user-friendly interface and low transaction fees. However, understanding the complexities of options trading is essential before embarking on this endeavor. This comprehensive guide will delve into the intricacies of options trading on Robinhood, empowering you with the knowledge to navigate this dynamic market effectively.

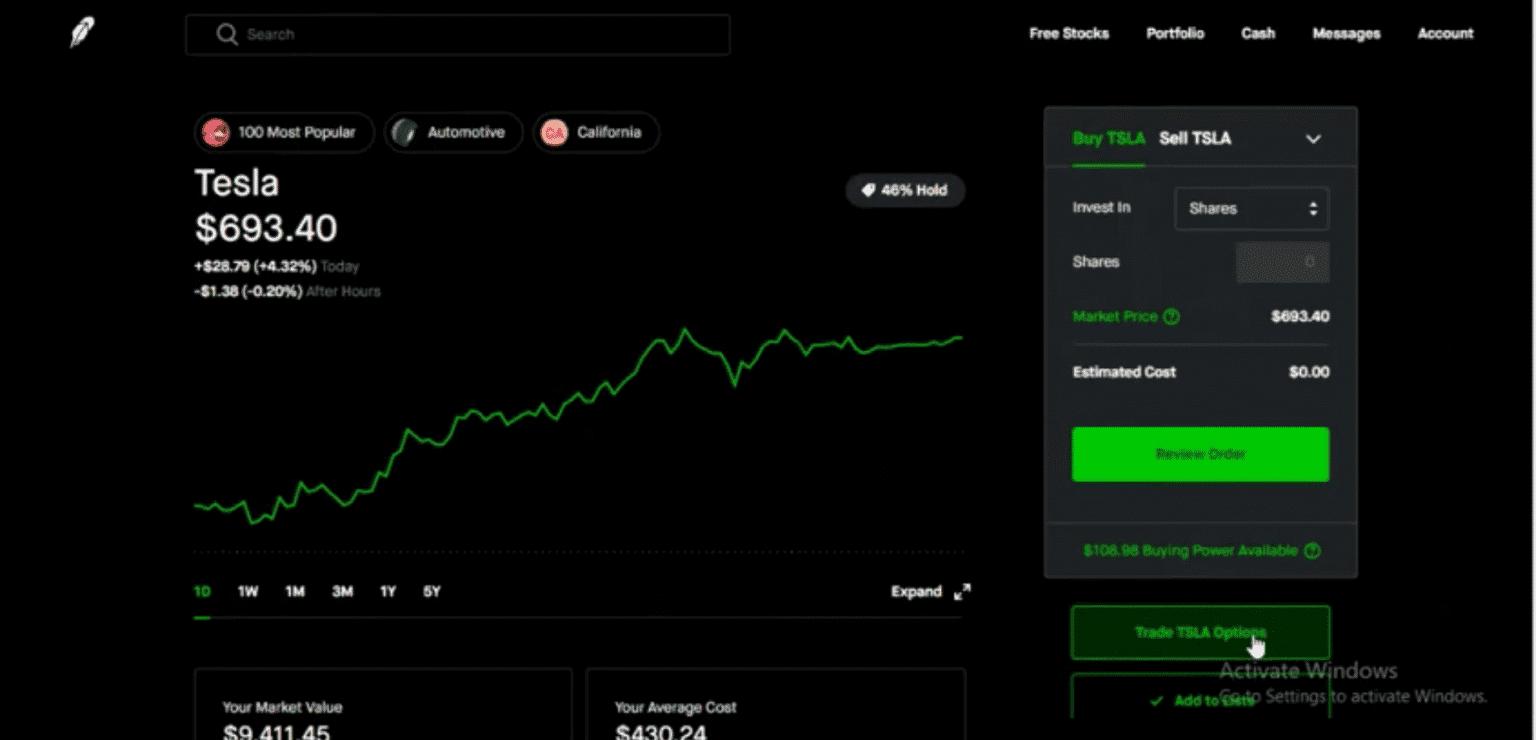

Image: www.warriortrading.com

Understanding Options

An option contract gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). There are two main types of options: calls and puts. A call option grants the buyer the right to purchase the asset, while a put option grants the right to sell. Options are typically used as speculative instruments to either capitalize on potential price movements or hedge existing positions.

Exploring Robinhood’s Options Platform

Robinhood’s options platform offers a wide range of features designed to facilitate options trading. Users can access real-time market data, create watchlists, and place orders with ease. Robinhood also provides educational resources and webinars to help beginners understand the basics of options trading. Additionally, the platform’s intuitive design makes it suitable for both experienced traders and those just starting out.

Types of Options Strategies

There are numerous options trading strategies available, each with its own risk and reward profile. Some common strategies include:

-

Bull Call Spread: This involves buying a call option with a lower strike price and selling a call option with a higher strike price, creating a profit potential from a modest upward movement in the asset price.

-

Bear Put Spread: This involves selling a put option with a higher strike price and buying a put option with a lower strike price, profiting from a moderate decline in the asset price.

-

Covered Call: This involves selling a call option against an existing position in the underlying asset, generating additional income but limiting potential upside gains.

Image: www.youtube.com

Risk Management in Options Trading

Options trading involves significant risks. It’s crucial to employ proper risk management techniques to mitigate potential losses. Some key measures include:

-

Understanding the Greeks: The Greeks are a set of parameters that measure the sensitivity of an option’s price to changes in underlying price, volatility, and time. These parameters provide valuable insights into the potential risks and rewards of an option position.

-

Leverage: Options are leveraged instruments, meaning they can magnify both profits and losses. Use leverage cautiously and ensure you have a clear understanding of the downside potential.

-

Trade Planning: Before executing any trade, develop a clear trading plan outlining your entry and exit strategies, as well as risk management parameters. This plan should align with your overall investment goals and risk tolerance.

How To Know The Options Trading On Robinhood Detail

Image: marketxls.com

Conclusion

Options trading on Robinhood can be a powerful tool for experienced investors looking to enhance their returns or manage risk. However, understanding the complexities of options trading is paramount. By leveraging the features and resources offered on Robinhood, implementing sound risk management practices, and continuously seeking knowledge, you can navigate the options market with confidence. Remember that options trading carries significant risks and is not suitable for all investors. Always conduct thorough research, consult with a financial advisor if needed, and proceed with caution to maximize your potential for success.