Introduction

The financial world is vast and complex, encompassing numerous opportunities for investment and trading. Two of the most popular options in this arena are forex trading and binary options, each with its unique characteristics, advantages, and risks. Understanding the differences between these two trading instruments is crucial for making informed decisions about your financial journey.

Image: blog.mt2trading.com

In this comprehensive guide, we delve into the realm of forex trading and binary options, exploring their key features, mechanisms, and suitability for various investors. By gaining a clear understanding of each instrument, you can navigate the financial markets with greater confidence and make astute decisions that align with your financial goals.

Forex Trading: A Global Marketplace

Forex trading, also known as foreign exchange trading or currency trading, revolves around the exchange of currencies from different countries. It is the largest financial market in the world, with trillions of dollars traded daily. In forex trading, participants strive to profit by speculating on currency price movements, buying one currency while simultaneously selling another.

Mechanism and Benefits

Forex trades are executed through brokers, which act as intermediaries between traders and the interbank market. The forex market operates 24 hours a day, five days a week, providing ample trading opportunities. The high liquidity of the forex market allows for quick execution of trades, making it suitable for both short-term and long-term investors.

Forex trading offers several benefits, including:

- Accessibility: With the advent of online brokers, forex trading has become accessible to a wide range of individuals.

- Leverage: Brokers provide leverage, allowing traders to control larger positions with a smaller amount of capital.

- Volatility: Currency prices are constantly fluctuating, providing ample opportunities for profit.

- Flexibility: Forex traders can adopt various strategies, from scalping to position trading, adapting to different market conditions.

Binary Options: A High-Risk, High-Reward Instrument

Binary options, in contrast to forex trading, offer a simpler but potentially more lucrative approach. In binary options trading, investors predict the price movement of an underlying asset within a specified time frame. They speculate on whether the asset price will rise above or fall below a strike price at the time of expiration.

Image: binary365.com

Mechanism and Risks

Binary options transactions involve a specific underlying asset, which can be stocks, indices, commodities, or currencies. Traders make a prediction about the future price movement of the underlying asset and place a buy or sell order accordingly. If the prediction matches the actual price movement at the expiration time, the trader receives a fixed payout, typically ranging from 70% to 95%. Conversely, if the prediction is incorrect, the trader loses their entire investment.

Binary options trading carries inherent high risks due to their all-or-nothing nature. Traders placing a trade are essentially betting on the direction of an asset’s price movement, making it a more speculative investment compared to forex trading.

Which Instrument Is Right for You?

Choosing between forex trading and binary options depends on your financial goals, risk tolerance, and investment style.

- Risk Tolerance: Forex trading offers greater flexibility in terms of risk management. Traders can adjust their leverage and position sizes to align with their risk appetite. Binary options, on the other hand, carry inherently high risk due to their fixed payout structure.

- Time Horizon: Forex trading can be suitable for both short-term and long-term investors. Binary options, with their specified expiration times, are geared towards short-term traders aiming for quick profits.

- Investment Strategy: Forex trading allows for various strategies, ranging from technical analysis to fundamental analysis. Binary options provide a more straightforward approach, where traders simply predict price direction within a set time frame.

Forex Trading Vs Binary Options

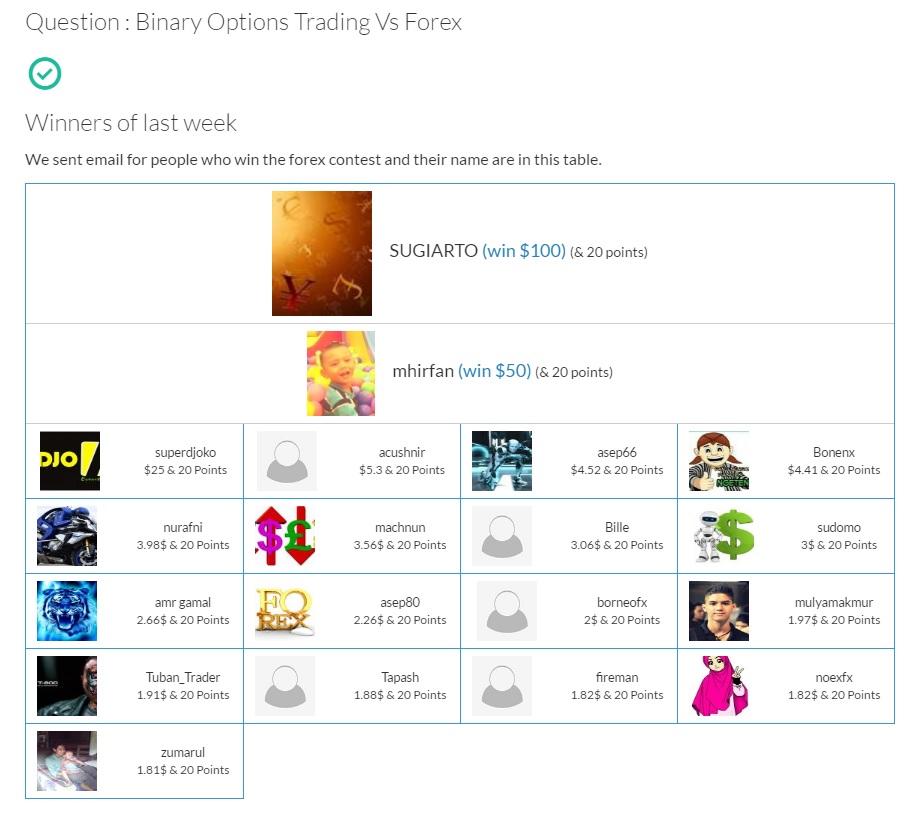

Image: www.pipsafe.com

Education and Risk Management

Regardless of the trading instrument you choose, extensive education and robust risk management strategies are crucial for success. Both forex and binary options can be complex and unpredictable, requiring a deep understanding of market dynamics.

- Education: Educate yourself thoroughly about the trading instrument you intend to engage with. Familiarize yourself with technical and fundamental analysis techniques, risk management tools, and market terminology.