Do you dream of financial independence, breaking free from the shackles of a monotonous 9-to-5 grind? Option trading may be your gateway to financial liberation, empowering you to not only supplement your income but potentially build a thriving career from the comfort of your home.

Image: club.ino.com

In this comprehensive guide, we unveil the secrets of option trading strategies that can yield staggering returns in as little as 9 minutes per week. Whether you’re a novice investor seeking to dip your toes into the market or an experienced trader eager to optimize your performance, this article will provide valuable insights and actionable tips to help you navigate the world of options like a seasoned professional.

A Journey into Option Trading: Unveiling the Basics

Options, the versatile financial instruments, present traders with an array of opportunities and risks. Understanding their fundamental concepts is paramount to successful navigation of the options market.

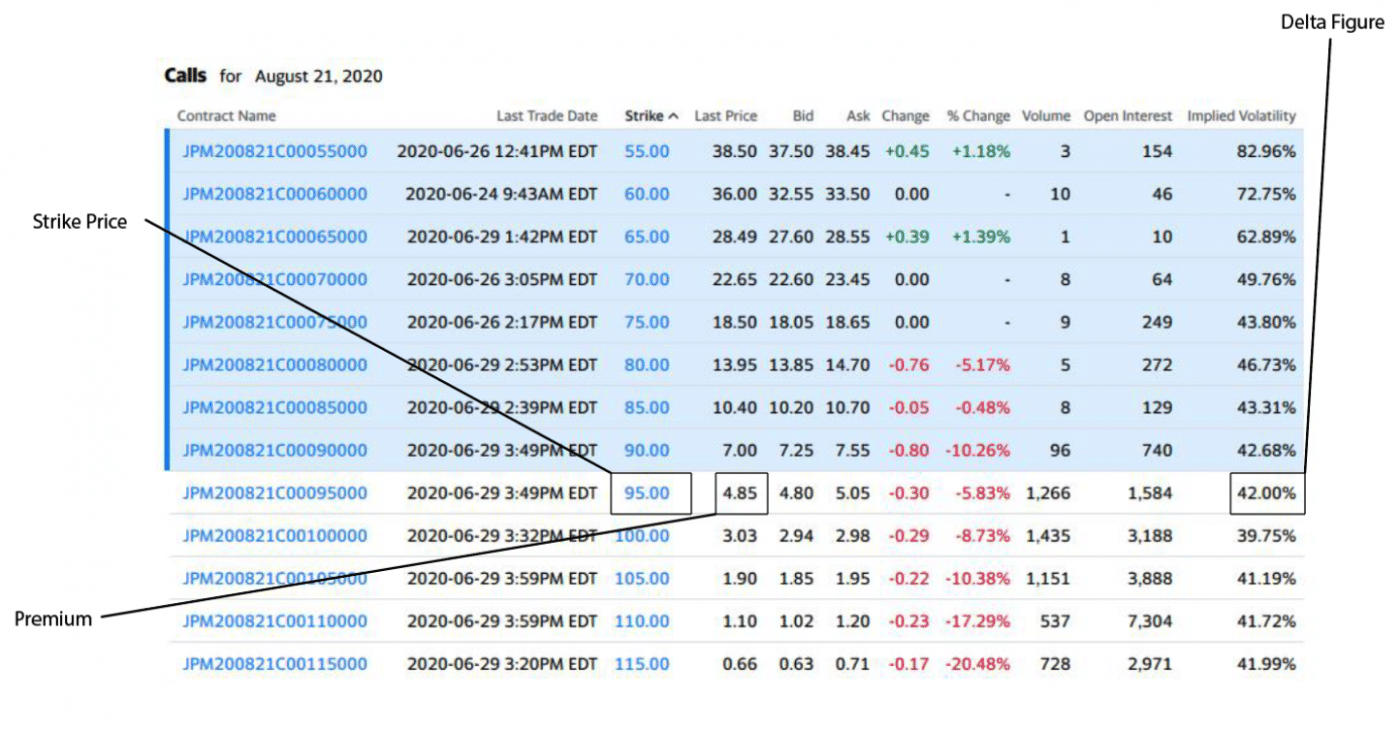

At its core, an option is a contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or currency, at a predetermined price (strike price) on or before a specific date (expiration date). Option traders speculate on the future price movements of an asset to potentially profit from price fluctuations.

When armed with this foundational knowledge, let’s dive into the heart of option trading and unravel the remarkable strategies that can transform your financial destiny.

Strategy 1: Covered Call Writing for Consistent Income

Earn a steady stream of passive income with covered call writing, an effective strategy for generating cash flow. By selling covered calls, you grant another trader the right to buy your shares at a predefined price in exchange for a premium (payment).

The beauty of covered call writing lies in its relative simplicity. Here’s how it works:

- Own 100 shares of a stock, such as Apple (AAPL).

- Sell a call option with a strike price higher than the current stock price (e.g., $155 when AAPL is trading at $150).

- Collect the premium (e.g., $2.50 per share) and continue holding the underlying stock.

If AAPL’s price rises above the strike price by the expiration date, the call option will be exercised, and you will be obligated to sell your shares at the agreed-upon price, netting a profit from both the initial premium and the increase in stock value. Conversely, if AAPL’s price falls or remains below the strike price, the call option will expire worthless, and you retain ownership of your shares.

Strategy 2: Cash-Secured Put Selling for Upside Potential

Maximize your upside potential with cash-secured put selling, a strategy that enables you to acquire shares of your desired stock at a discounted price or generate income if the stock remains above a certain level.

Here’s how cash-secured put selling unfolds:

- Have cash in your trading account equal to the underlying stock’s value (e.g., $15,000 if you want to acquire 100 shares of AAPL).

- Sell a put option with a strike price lower than the current stock price (e.g., $145 when AAPL is trading at $150).

- Collect the premium (e.g., $1.50 per share) and lock in the obligation to buy AAPL shares at the strike price if the option is exercised.

If AAPL’s price stays above the strike price by the expiration date, the put option will expire worthless, and you keep the premium as pure profit. However, if AAPL’s price falls below the strike price, the put option will be exercised, and you will be obligated to buy the stock at the predetermined price, potentially at a discount to the prevailing market price.

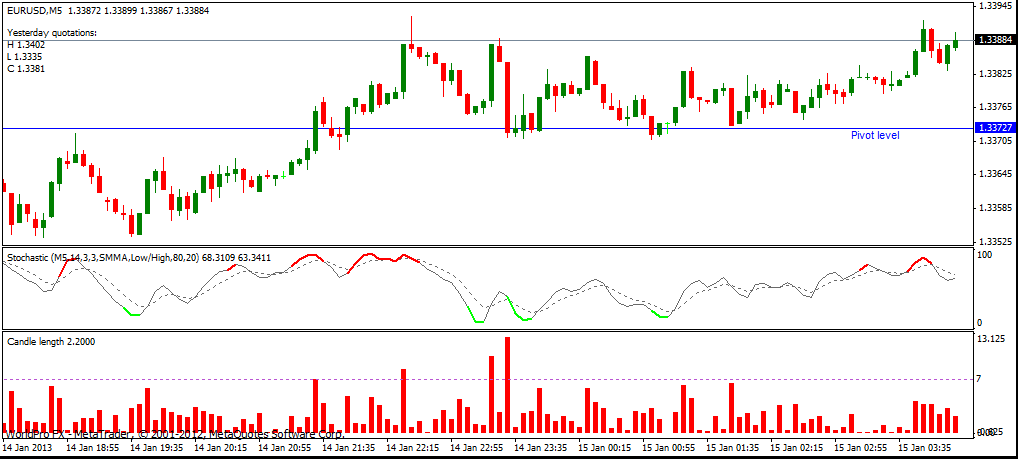

Image: www.pinterest.com

Strategy 3: Collar Strategy for Risk Management

Navigate market volatility with poise using the collar strategy, a sophisticated risk management technique that combines a covered call and a protective put option. This strategy effectively sets both an upper and lower boundary for potential profit and loss.

Here’s how the collar strategy comes together:

- Own 100 shares of a stock (e.g., Tesla (TSLA)).

- Sell a call option with a strike price higher than the current stock price (e.g., $850 when TSLA is trading at $800).

- Buy a put option with a strike price lower than the current stock price (e.g., $750 when TSLA is trading at $800).

The premium received from selling the call option partially or fully offsets the cost of purchasing the put option, creating a protective cushion against significant losses while still allowing for upside potential. If TSLA’s price rises, the call option may be exercised, limiting your potential profit, while the put option protects you from substantial losses if TSLA’s price plummets.

Seek Expert Guidance and Stay Informed

To excel in the world of option trading, it is of paramount importance to seek guidance from experienced professionals and stay up-to-date with market trends. Attend workshops, webinars, and seminars, and immerse yourself in educational resources provided by reputable trading platforms.

Continuously expand your knowledge base by reading books, articles, and financial news outlets dedicated to option trading. This commitment to learning will enable you to make informed decisions and adapt your strategies as market dynamics evolve.

Option Trading Stratigies 9 Minutes Per Week

Image: www.binaryoptionsu.com

Conclusion

The allure of option trading lies in its potential to transform your financial future. The strategies outlined in this guide, paired with unwavering dedication and expert guidance, can empower you to generate consistent income, capitalize on market trends, and mitigate risks.

Remember, investing involves inherent risks, and it’s crucial to embrace a measured approach, carefully considering your financial objectives and risk tolerance before diving into the trading arena. By embracing a diligent and knowledge-driven mindset, you can harness the power of option trading to shape your financial destiny.