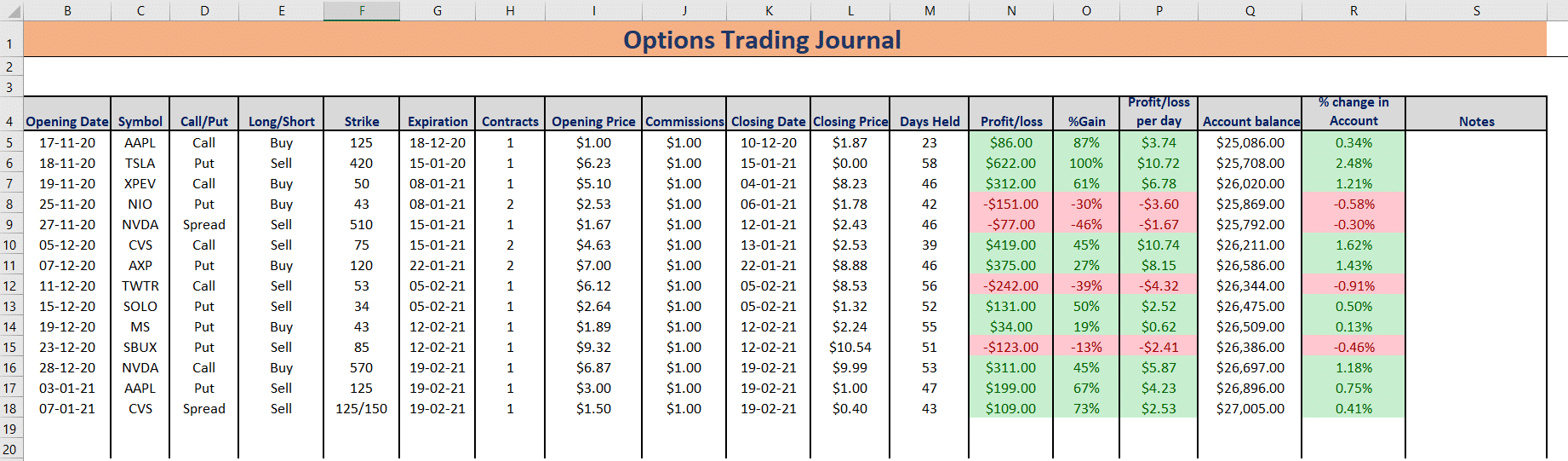

In the realm of options trading, precision and calculated risk-taking are paramount for success. One essential tool that empowers traders with these qualities is an option trading spreadsheet, serving as a vital ally for determining optimal position sizes. This guide delves into the intricacies of using an option trading spreadsheet for position sizing, providing traders with the knowledge to navigate the markets with confidence.

Image: lisannakainat.blogspot.com

Understanding Position Sizing in Options Trading

Position sizing refers to the determination of the number of option contracts to buy or sell. It’s crucial because it dictates the amount of risk and potential reward involved in a trade. Several factors influence position sizing, including account size, risk tolerance, and market volatility. Striking the right balance is essential to both maximize profit potential and protect against excessive losses.

The Role of an Option Trading Spreadsheet

An option trading spreadsheet automates the position sizing process, utilizing predefined formulas and calculations. This eliminates manual errors and enables traders to explore multiple scenarios quickly and efficiently. By factoring in important variables such as option premium, underlying price, and margin requirements, the spreadsheet provides an informed estimation of the appropriate position size for a given trade.

Key Benefits of Using an Option Trading Spreadsheet

Streamlined Position Sizing: The spreadsheet automates position sizing calculations, saving traders time and effort. It eliminates the need for manual calculations, reducing the risk of errors.

Consistency and Accuracy: Predefined formulas ensure consistency and accuracy in position sizing across multiple trades. This standardization reduces the impact of human biases and ensures disciplined risk management.

Scenario Analysis: The spreadsheet allows traders to explore different scenarios by adjusting input parameters. This enables them to assess the impact of changing market conditions, option premiums, and other factors on position size.

Risk Management: The spreadsheet helps traders effectively manage risk by providing insights into the potential profit and loss for a given trade. It assists in determining the maximum loss that can be tolerated, allowing traders to adjust their position size accordingly.

Image: samcheekong.blogspot.com

How to Use an Option Trading Spreadsheet

- Input Option Details: Enter the option premium, strike price, underlying price, and expiration date.

2. Define Account Parameters: Specify the account size, buying power, and risk tolerance.

3. Set Volatility Assumptions: Estimate future volatility of the underlying asset based on historical data or current market conditions.

4.Enter Position Size and Adjust: Determine the initial position size based on the spreadsheet’s calculations. Adjust the position size if needed, considering factors such as risk tolerance and account balance.

5.Monitor and Re-evaluate: Track the position size and underlying price regularly. Re-evaluate the position size as market conditions change, ensuring it remains within the risk parameters defined in the spreadsheet.

Advanced Techniques for Position Sizing

- Greeks Analysis: Incorporate the analysis of Greeks (Delta, Gamma, Theta, etc.) into the spreadsheet to refine position sizing decisions.

2.Monte Carlo Simulations: Utilize Monte Carlo simulations to generate multiple potential outcomes and simulate the impact on profit and loss.

3.Risk-Adjusted Returns: Calculate risk-adjusted returns to assess the expected return per unit of risk taken.

4.Position Optimization: Employ optimization techniques to determine the optimal position size that maximizes risk-adjusted returns.

Option Trading Spreadsheet Position Size

Image: optionstrategiesinsider.com

Conclusion

An option trading spreadsheet is an invaluable tool for traders, empowering them with precise position sizing calculations, risk management capabilities, and scenario analysis. By leveraging this spreadsheet, traders can increase their chances of success by making informed decisions, maximizing profit potential, and minimizing risk exposure. Remember, always conduct thorough research, understand the assumptions behind any calculations, and never invest more than you can afford to lose. Equipped with this comprehensive guide and the power of an option trading spreadsheet, you can navigate the markets with greater confidence and poise.