The advent of virtual option trading platforms in India has revolutionized the way traders access and execute options trades. Gone are the days of tedious paperwork and physical exchanges. Today, traders can seamlessly navigate the complexities of the options market from the comfort of their own homes.

Image: fintrakk.com

Options trading, in essence, grants traders the flexibility to speculate on the future direction of underlying assets without the obligation to buy or sell them. This flexibility empowers traders to tailor their trading strategies based on market conditions, risk appetite, and trading objectives.

The Virtual Advantage

Virtual option trading platforms offer numerous advantages that set them apart from traditional brick-and-mortar exchanges. These advantages include:

- Convenience and Flexibility: Traders can trade anytime, anywhere with an internet connection, reducing geographical barriers and allowing them to seize market opportunities.

- Real-time Data and Charting Tools: These platforms provide up-to-date market data, charting tools, and analytical capabilities, enabling traders to make informed decisions in real-time.

- Scaled Commissions: Virtual platforms often offer competitive commission structures, reducing trading costs and allowing traders to optimize their profits.

The Indian Landscape

The virtual option trading landscape in India is evolving rapidly. Several exchanges, such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), have introduced electronic platforms for option trading. These platforms have attracted a diverse pool of traders, including retail investors, financial institutions, and proprietary trading firms.

The Indian virtual option trading market has witnessed a steady growth in recent years. This growth is attributed to factors such as the increasing penetration of the internet, the proliferation of mobile trading applications, and the growing awareness of derivative products among traders.

Expert Insights

To help traders navigate the dynamic virtual option trading environment, experts offer valuable tips and advice:

- Start with Paper Trading: Before venturing into live trading, experts recommend practicing on paper trading platforms to gain a thorough understanding of options strategies and risk management.

- Understand Different Strategies: Options trading involves a wide range of strategies, each tailored to specific market conditions. It’s crucial for traders to understand the intricacies and potential risks associated with different strategies.

- Manage Risk Effectively: Options trading is inherently risky, and managing risk is paramount for success. Traders should adopt prudent risk management practices, such as setting stop-loss orders, conducting thorough market analysis, and diversifying their portfolio.

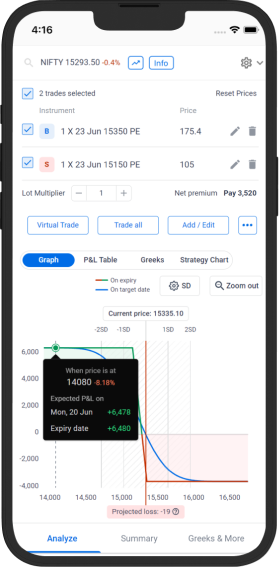

Image: sensibull.com

Frequently Asked Questions

- How do I access virtual option trading platforms?

Traders can access virtual option trading platforms offered by recognized stock exchanges in India, such as the NSE and BSE. - What are the different types of option strategies?

There are numerous option strategies, including bullish strategies (e.g., bull call spread, covered call), bearish strategies (e.g., bear put spread, cash-secured put), and neutral strategies (e.g., strangle, straddle). - How do I manage risk in option trading?

Risk management techniques include setting stop-loss orders, calculating Greeks, conducting thorough market analysis, and maintaining a disciplined trading plan.

Virtual Option Trading Platform India

Image: seorub.com

Conclusion

The emergence of virtual option trading platforms in India has democratized access to the options market for traders of all levels. With its many advantages, including convenience, flexibility, and scaled commissions, the virtual option trading landscape in India is poised for continued growth and innovation. For those seeking to participate in the complexities of the options market, it’s essential to embrace the opportunities presented by these platforms while managing risk effectively and staying abreast of market developments and expert insights.

Are you ready to explore the world of virtual option trading in India? Embrace the possibilities and elevate your trading journey!