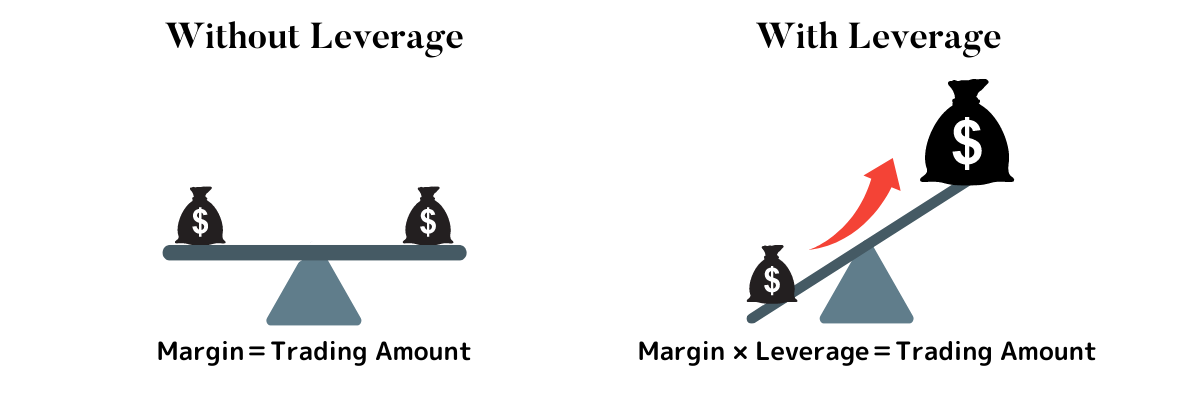

In the fast-paced world of financial trading, option trading stands out as a versatile and potentially lucrative strategy. By leveraging the power of option contracts, traders can amplify their returns and gain greater exposure to the underlying asset. However, it’s crucial to understand the intricacies of option trading leverage and its implications before venturing into this dynamic market.

Image: www.binance.com

Imagine yourself as a savvy trader eager to maximize your potential gains. You’ve been studying the market trends and identified an opportunity in the tech sector. With a limited capital of $5,000, you’re torn between buying 100 shares of a tech stock or purchasing call options on the same stock.

Option Trading Leverage: A Magnifying Glass for Returns

Option trading leverage allows you to control a larger position with a smaller amount of capital compared to buying the underlying asset outright. Call options, in particular, grant the buyer the right, but not the obligation, to purchase a stock at a predetermined strike price within a specified time frame. This leverage can be a double-edged sword, amplifying both potential profits and losses.

Let’s explore the aforementioned scenario with an example. You purchase 100 shares of the tech stock at $50 per share, requiring a total investment of $5,000. Alternatively, you could purchase call options with a strike price of $50 and a premium of $5. Each option contract controls 100 shares, giving you the potential to control 100 shares of the stock with an investment of only $500 (100 contracts x $5 premium).

Key Points:

- Magnified Exposure: Leverage allows traders to gain greater exposure to the underlying asset with less capital.

- Double-Edged Sword: While leverage enhances potential profits, it also amplifies losses.

- Careful Calculation: It’s essential to carefully assess the potential risks and rewards before using leverage.

Leverage in Practice: Understanding the Dynamics

To fully comprehend the impact of leverage on option trading, it’s crucial to delve into the practical aspects:

Image: www.bigboss-financial.com

1. Leverage Ratio:

The leverage ratio quantifies the amount of leverage employed. In our example, the leverage ratio is 10 (100 shares controlled / 10 shares directly owned). The higher the leverage ratio, the greater the exposure and potential for gains or losses.

2. Risk-Reward Spectrum:

Leverage significantly amplifies both potential profits and losses. If the stock price rises above the strike price, the option’s value increases, generating substantial gains. However, if the stock price falls below the strike price, the option becomes worthless, resulting in potential losses.

3. Time-Sensitive Nature:

The time-sensitive nature of options adds another layer of complexity. Options have an expiration date, and their value decays as it approaches. This decay accelerates as the stock price moves away from the strike price.

Expert Tips for Leveraging Option Trading Effectively:

- Assess Risk Tolerance: Understand your risk appetite and only leverage what you can afford to lose.

- Choose Liquid Options: Opt for options with high trading volume to ensure liquidity, enabling you to enter and exit positions with ease.

- Monitor Market Trends: Stay abreast of market conditions and economic events that can impact underlying asset prices.

- Manage Leverage Cautiously: Don’t overextend yourself with excessive leverage. Use it strategically to enhance returns.

- Seek Expert Advice: If you’re new to option trading, consider consulting with a financial advisor to guide you.

FAQs on Option Trading Leverage: Clarifying the Complexities

Q: How can leverage benefit me in option trading?

A: Leverage allows you to amplify potential profits and gain greater exposure to the underlying asset with a smaller capital outlay.

Q: What are the potential risks of using leverage in option trading?

A: Leverage amplifies both potential profits and losses. If the underlying asset’s price moves against you, you may incur significant losses.

Q: What factors should I consider when using leverage?

A: Assess your risk tolerance, choose liquid options, monitor market trends, manage leverage cautiously, and seek expert guidance as needed.

Option Trading Leverage

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.investirsorcier.com

Conclusion: Embracing Option Trading Leverage with Prudence

Option trading leverage can be a powerful tool for skilled traders, allowing them to magnify potential returns. However, it’s imperative to approach leverage with caution, fully understanding its implications and managing it responsibly. By leveraging option trading effectively, you can enhance your returns and gain greater exposure to the market.

So, is option trading leverage the right strategy for you? The answer depends on your risk appetite, trading experience, and financial goals. If you’re comfortable with the risks and have a thorough understanding of option trading dynamics, embracing leverage can empower you to amplify your returns and maximize your potential. However, if you’re new to option trading or have a low risk tolerance, proceeding with caution and seeking professional guidance is advisable.