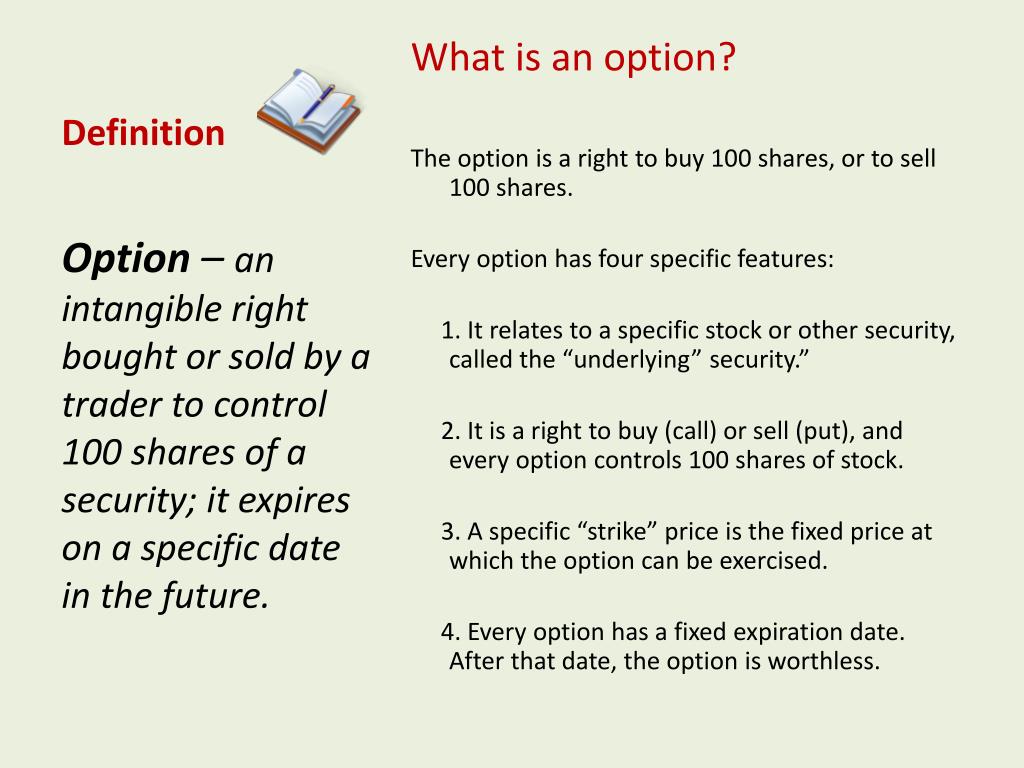

Option trading is a versatile investment strategy that has garnered significant attention in recent years. At its core, an option contract grants you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a particular date (expiration date). Understanding the terminology associated with option trading is crucial for navigating the complexities of this market.

Image: www.pinterest.es

Call and Put Options

Call Option: A call option grants you the right to purchase the underlying asset at the strike price before the expiration date. Upon exercising your right, you can buy the asset at a price typically lower than the current market price, benefiting from any subsequent price appreciation.

Put Option: In contrast, a put option provides you with the right to sell the underlying asset at the strike price before the expiration date. Here, you can sell the asset at a price potentially higher than the current market value, profiting from any price decline.

Expiration Date and Strike Price

Expiration Date: The date on which your option contract expires. You must exercise your right to buy or sell the underlying asset (if profitable) on or before this date. Failure to do so will result in the option contract expiring worthless.

Strike Price: The price at which you can buy (for call options) or sell (for put options) the underlying asset. It is crucial to select a strike price that aligns with your investment goals and market expectations.

Premium and Intrinsic Value

Premium: The purchase price paid to acquire an option contract. It reflects the market’s expectation of the likelihood of the contract being exercised profitably. The higher the expected market movement, the higher the premium.

Intrinsic Value: The difference between the strike price and the spot price (current market price) of the underlying asset at any given time. It represents the immediate profit that you would realize if the option were exercised.

Image: www.slideserve.com

Bullish and Bearish Options

Bullish Options: Options that bet on the underlying asset’s price increasing. Call options are bullish options, as they profit when the asset’s price rises.

Bearish Options: Options that anticipate a decline in the underlying asset’s price. Put options are bearish options, as they benefit from a decrease in the asset’s value.

Variations in Option Trading

Covered Call: A strategy where you own the underlying asset and sell (write) a call option against it. If the option is exercised, you deliver the asset to complete the transaction.

Naked Call: Selling (writing) a call option without owning the underlying asset. This is considered a riskier strategy as you have unlimited loss potential if the option is exercised.

Cash-Secured Put: Selling (writing) a put option while having deposit funds to cover the asset’s purchase if the option is exercised.

Protective Put: Buying (purchasing) a put option to protect an asset you own from potential price declines.

Option Trading Definitions

Image: messots.blogspot.com

Conclusion

Option trading offers myriad opportunities to investors, but it also comes with inherent risks. By understanding the fundamental concepts and terminology of option trading, you can delve into this market with confidence. Remember to conduct thorough research, carefully evaluate market conditions, and seek professional advice when necessary. The world of option trading awaits exploration, armed with this comprehensive guide to its definitions.