In the fast-paced world of trading, finding strategies that offer quick returns can be tempting. Among these strategies, the concept of three-day options expiration trading has gained traction. It promises the allure of harnessing short-term market movements for rapid gains. But before you jump into this arena, let’s explore the mechanics and unveil the potential risks involved.

Image: marketrebellion.com

Delving into Three-Day Options Expiration

Options contracts provide traders with the right, but not the obligation, to buy or sell underlying assets at a specified price (strike price) on or before a predefined date (expiration date). Three-day options, as the name suggests, have an expiration period of three trading days. This accelerated time frame amplifies the potential for short-term profit or loss, making them both tantalizing and precarious.

The Mechanics of Trading

To participate in three-day options expiration trading, you’ll need a brokerage account that offers options trading. Once you’re set up, the process involves:

-

Identifying an Underlying Asset: Choose an asset, such as a stock, index, or currency, that you believe will experience a significant move within the three-day period.

-

Selecting the Strike Price: This is the price at which you would buy or sell the asset if you exercise the option. Choose a price that aligns with your market expectations.

-

Choosing the Call or Put Option: A call option gives you the right to buy the asset, while a put option grants you the right to sell the asset.

-

Determining the Expiration Date: This is the three-day mark when the option expires and your rights vanish.

Potential Advantages

-

Limited Risk: Unlike traditional stock trading, options limit your maximum loss to the premium you pay for the contract. This defined risk management can be attractive for traders looking to mitigate potential losses.

-

Leverage: Options offer leverage, allowing you to control a significant position with a relatively small investment. This can amplify potential profits, but it also magnifies potential losses.

-

Short-Term Gains: The short expiration period of three-day options allows traders to target quick profits by capturing short-term market fluctuations.

Image: www.daytrading.com

Embarking Cautiously: Addressing Risks

While three-day options expiration trading offers the potential for quick gains, it also carries significant risks that should not be underestimated:

-

Rapid Market Movements: The highly accelerated time frame requires traders to predict market movements with precision, which can be challenging in volatile markets.

-

Time Decay: The value of options contracts erodes over time, even if the underlying asset price remains unchanged. This “time decay” can significantly diminish profits if the market doesn’t move in your favor.

-

Liquidity: Three-day options tend to have lower liquidity compared to longer-term options. This can make it difficult to enter or exit positions at favorable prices.

Expert Insights and Prudent Tips

Before venturing into three-day options expiration trading, seek guidance from experienced traders or financial professionals. Here are some prudent tips to consider:

-

Start Small: Begin with small trades to gain experience and understand the risks involved.

-

Manage Risk: Use stop-loss orders to limit potential losses and protect your capital.

-

Monitor the Market: Stay informed about market news, events, and economic indicators that could impact your positions.

-

Avoid Overconfident Trading: Don’t let the lure of quick profits cloud your judgment. Research, analysis, and a disciplined approach are crucial.

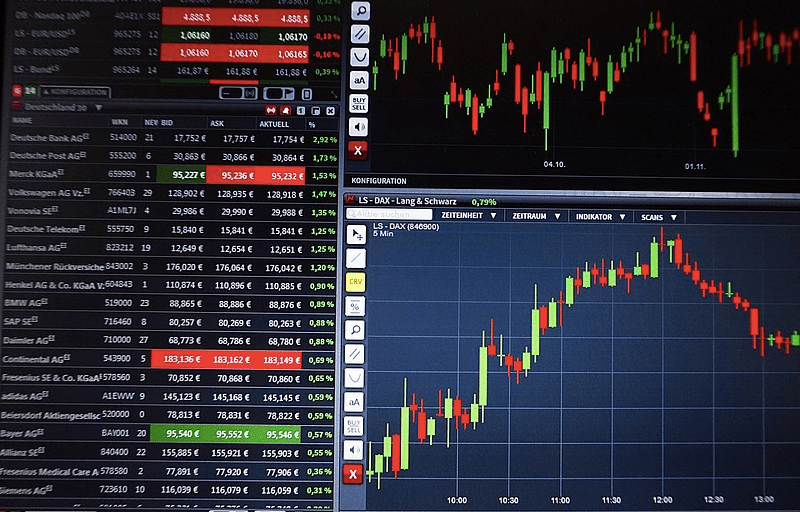

Option Three Day Expiration Trading

Image: stockcharts.com

Conclusion: A Prudent Path for Potential Rewards

Three-day options expiration trading can be a double-edged sword, offering both the potential for quick profits and the risk of substantial losses. It’s a strategy that requires a deep understanding of options trading, a keen ability to predict market movements, and robust risk management practices.

For those willing to embrace the inherent risks and develop the necessary skills, three-day options expiration trading can provide a path to rapid profits. However, it’s essential to proceed with caution, seek expert guidance, and prioritize risk management strategies to navigate this volatile terrain safely.