As a seasoned trader, I’ve seen countless individuals struggle to grasp the intricacies of option spread trading. It’s a complex but rewarding strategy that can empower you in the financial markets. To bridge this knowledge gap, I’ve compiled this definitive guide, providing a comprehensive exploration into option spread trading. Whether you’re a seasoned professional or a novice yearning for enlightenment, this article will serve as your guiding star.

Image: instapdf.in

Understanding the Concept of Option Spread Trading

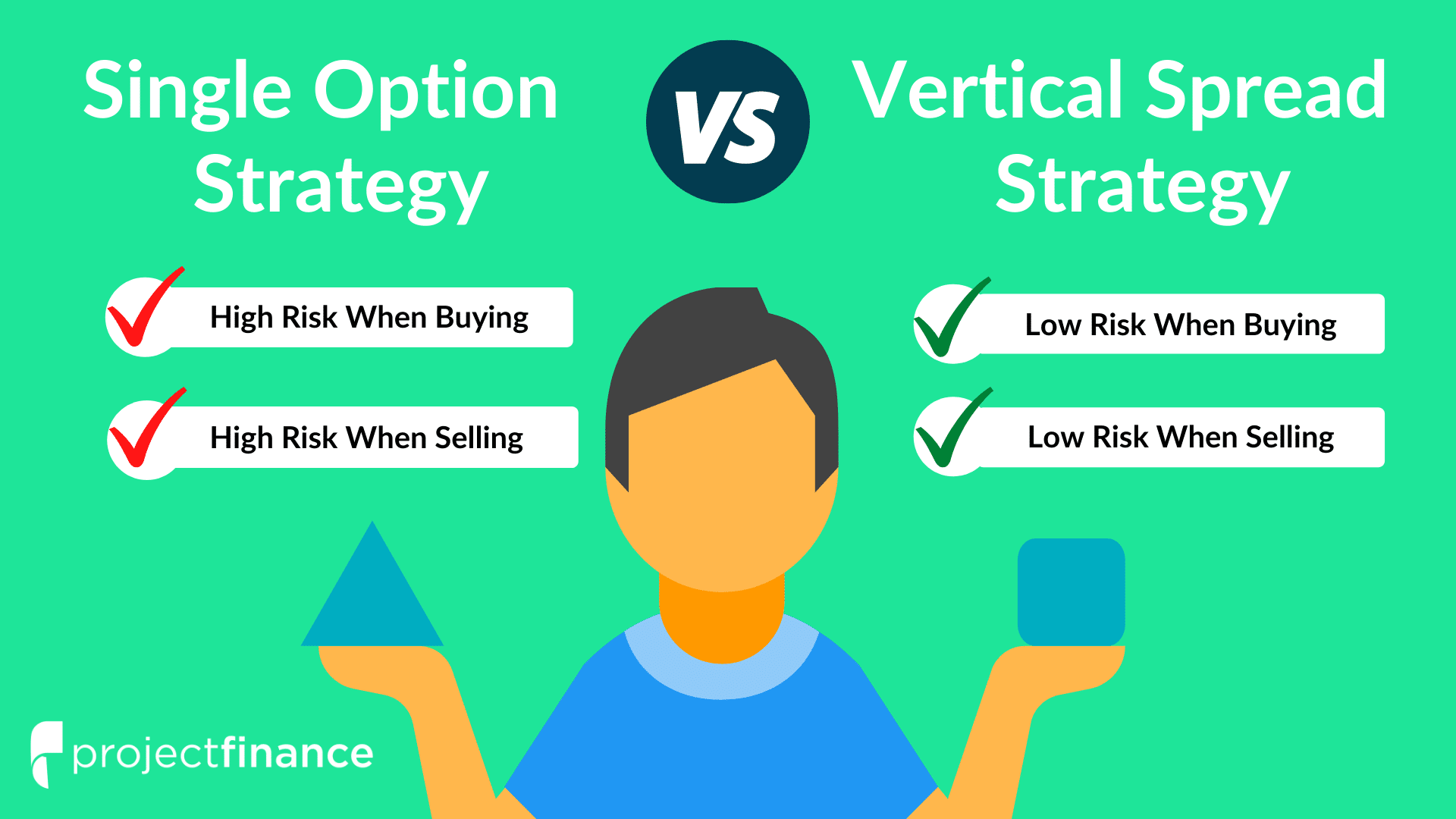

In the realm of options trading, an option spread is a sophisticated strategy that involves buying and selling multiple options simultaneously to achieve a specific financial outcome. By combining multiple options contracts, traders aim to create a balanced position with defined risks and rewards, as opposed to the speculative nature of single-option trading.

Types of Option Spreads: A Comprehensive Overview

The world of option spreads offers a diverse array of strategies, each tailored to unique trading objectives. Call spreads, for instance, seek to profit from a rising asset price, while put spreads capitalize on falling prices. Further, traders can engage in vertical spreads, which involve buying and selling options with different strike prices but the same expiration date. Diagonal spreads, on the other hand, involve options with different expiration dates. The choice of spread type depends upon market conditions, trader expectations, and risk tolerance.

Factors to Consider: Unraveling the Strategy

To successfully navigate the complexities of option spread trading, meticulous consideration of key factors is paramount. Strike price is a crucial variable, influencing the premium paid and the potential profit. Expiration date impacts the length of time available for the trade to play out, affecting the decay of time value. Volatility, an essential measure of market uncertainty, significantly influences option premiums and the potential profitability of spreads.

Image: www.barnesandnoble.com

Expert Tips: Empowering Traders with Market Insights

Drawing upon years of experience in the trading arena, I offer these invaluable tips for maximizing your option spread trading strategies:

- Define Your Objectives: Clearly outline your trading goals before entering a position.

- Risk Management: Implement robust risk management protocols to protect your capital.

- Market Analysis: Diligently analyze market trends and forecast potential price movements.

- Strategy Selection: Choose the option spread strategy that optimally aligns with your objectives and risk tolerance.

- Monitoring and Adjustment: Continuously monitor your positions and adjust them as market conditions evolve.

FAQ: Answering Pressing Questions on Option Spread Trading

- Q: What are the different types of option spread strategies?

- Q: How can I minimize risk in option spread trading?

- Q: What factors should I consider when selecting an option spread strategy?

A: Option spread strategies include call spreads, put spreads, vertical spreads, and diagonal spreads.

A: Employing proper risk management techniques, such as defining stop-loss levels and limiting position size, is crucial.

A: Market conditions, trader objectives, and risk tolerance should be carefully evaluated.

Option Spread Trading Book

Image: fabalabse.com

Conclusion: Embarking on Your Option Spread Trading Journey

The world of option spread trading holds both challenges and rewards. By embracing the knowledge presented in this comprehensive guide, you are well-equipped to navigate the intricate landscape of this trading strategy. Remember the importance of ongoing research, practice, and continuous refinement. Embrace the learning process, and may your trading endeavors be crowned with success.

If you found this article illuminating and are eager to delve further into the complexities of option spread trading, I encourage you to explore additional resources. Consult industry experts, delve into educational materials, and engage with the vibrant online trading community. The pursuit of knowledge and the refining of your skills will empower you to make informed trading decisions and maximize your potential in the financial markets.