Introduction

Image: www.tradingview.com

In the ever-evolving financial landscape, option grid trading has emerged as a versatile and rewarding strategy for astute investors seeking to navigate market volatility and capitalize on price movements. This comprehensive guide delves into the intricacies of this powerful technique, unraveling its history, core principles, and practical applications.

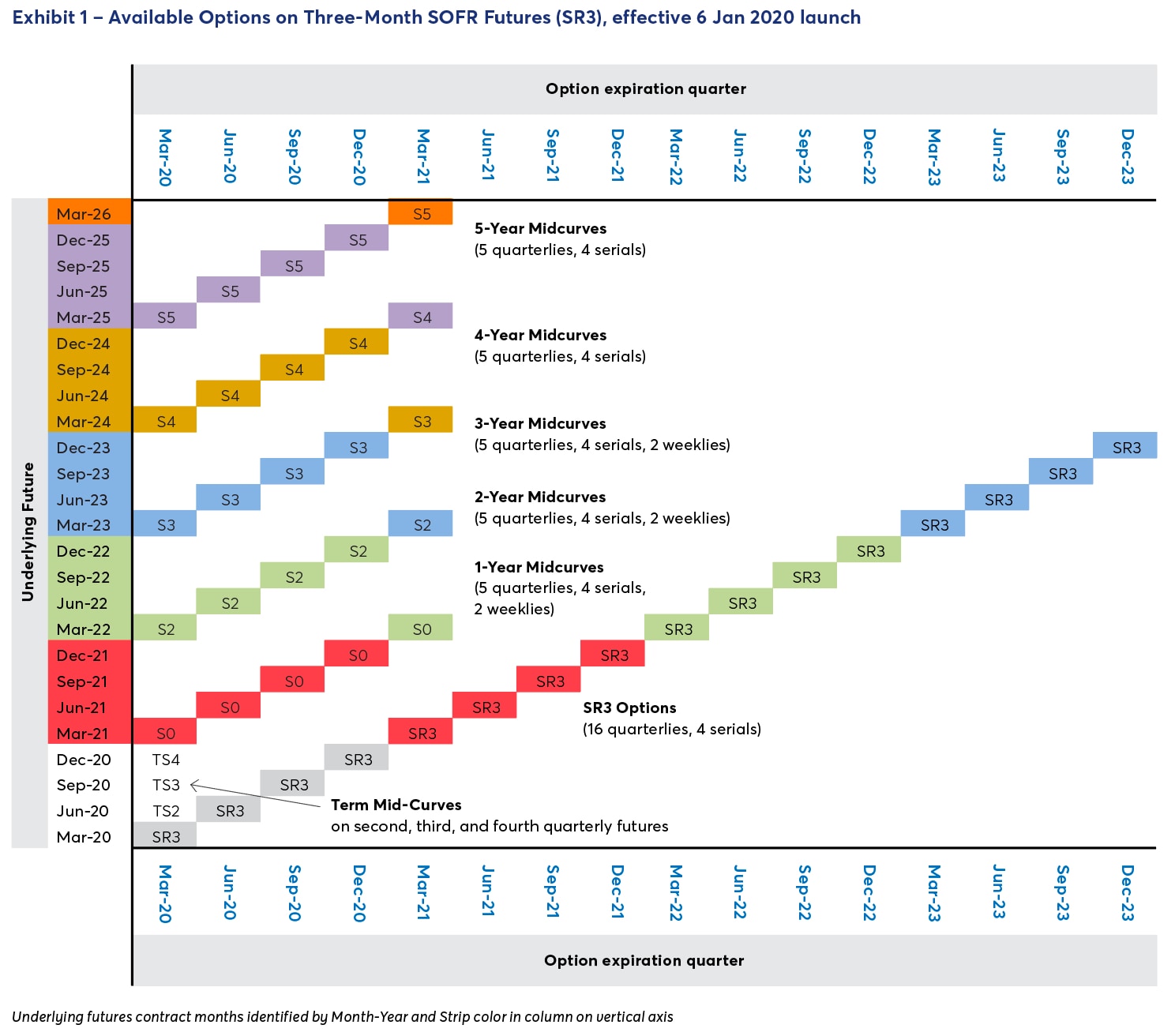

Understanding Option Grid Trading

Option grid trading is a neutral options strategy that involves selling multiple pairs of options, typically in different strike prices and expiration dates, across underlying assets like stocks, indices, or commodities. By establishing a grid-like structure of short options, traders aim to generate income from option premiums while managing risk and limiting potential losses.

Components of an Option Grid Trade

-

Sold Options: Grid trades involve selling multiple short calls and short puts at varying strike prices.

-

Strike Prices: The strike prices of the sold options form the vertical grid structure, determining the potential range of underlying price movements that can trigger option exercise.

-

Expiration Dates: The expiration dates of the options provide the horizontal grid structure, defining the time frame within which the trade execution and profit/loss calculations occur.

-

Premiums Collected: The sale of each option pair generates a premium income, which is the immediate profit for the grid trader.

How Option Grid Trading Works

A grid trade seeks to achieve a neutral market position, benefiting from option premiums while mitigating significant price movements. By selling both calls and puts, the trader expects the underlying asset’s price to remain within the grid’s boundaries, as options outside these boundaries will expire worthless, generating maximum income.

However, if the underlying asset price moves outside the grid, the trader may incur losses on the option outside the range. The optimal grid structure requires careful consideration of market volatility, historical price patterns, and the trader’s risk tolerance.

Image: thewaverlyfl.com

Advantages and Disadvantages

Advantages:

-

Income Generation: Grid trades can provide steady income from option premiums, regardless of the underlying asset’s direction.

-

Risk Management: The neutral position limits potential losses to the premiums collected, mitigating downside risk.

-

Flexibility: Grid trading allows for customization based on volatility, strike prices, and expiration dates to suit individual risk profiles.

Disadvantages:

-

Potential for Losses: Extreme market movements or unexpected volatility can lead to losses if the asset price breaches the grid’s boundaries.

-

Margin Requirements: Selling options can require substantial margin, which can constrain trading capacity for some investors.

-

Ongoing Monitoring: Grid trades require diligent monitoring and timely adjustments as market conditions change.

Applications of Option Grid Trading

Option grid trading is employed in various market scenarios:

-

Income Generation: Generating consistent income from option premiums, regardless of market direction.

-

Volatility Hedging: Neutralizing portfolios against excessive market volatility while maintaining exposure to the underlying asset.

-

Trend Trading: Positioning the grid structure to capture expected price trends within a defined range.

-

Range Trading: Grids are structured to profit from the underlying asset’s movement within a specific price range.

-

Market Neutral: Managing market risk by hedging with opposite options positions, allowing for neutral exposure to market direction.

Option Grid Trading

Image: cryptolisty.com

Conclusion

Option grid trading offers investors a sophisticated tool for managing risk and generating income, but it requires a thorough understanding of its principles and prudent implementation. By carefully selecting strike prices, expiration dates, and underlying assets, traders can harness the potential of this versatile strategy to enhance their investment returns.