Introduction

![Home [knasharebroker.com]](https://knasharebroker.com/wp-content/uploads/2023/02/mcxlogo.png)

Image: knasharebroker.com

In the realm of financial markets, Multi Commodity Exchange (MCX) stocks and options trading have emerged as a dynamic avenue for traders seeking both potential profits and risk management. Discover the intricacies of this market, encompassing its history, fundamentals, and practical applications, as we delve into the multi-hued tapestry of MCX stocks and options trading.

MCX was established in 2003, aiming to provide a regulated platform for trading various commodities, including gold, silver, crude oil, and agricultural products. The exchange offers diverse financial instruments such as futures and options contracts, allowing traders to speculate on future price movements and hedge against potential risks.

Understanding MCX Stocks and Options

MCX stocks represent shares in companies involved in the production, distribution, or utilization of commodities traded on the exchange. Unlike traditional stocks, which are traded on equity exchanges and derive value from company performance, MCX stocks derive their value from the underlying commodity price movements.

MCX options, on the other hand, grant traders the right but not the obligation to buy or sell a specific quantity of an underlying commodity at a predetermined price on a specified date. Options provide traders with flexibility and leverage, enabling them to express market views and manage risk.

Benefits of MCX Stocks and Options Trading

The benefits of participating in MCX stocks and options trading are multifaceted:

-

Diversification: Commodity markets exhibit unique price movements often distinct from equity and bond markets, providing opportunities for portfolio diversification.

-

Hedging: Options allow traders to hedge against potential losses in their underlying physical commodity positions.

-

Speculation: MCX stocks and options offer opportunities for swift profits by speculating on price movements of commodities influenced by factors such as supply and demand, geopolitical events, and economic conditions.

-

Leverage: Options contracts provide leverage, enabling traders to control a larger position size with limited capital outlay.

Trading Strategies

MCX stocks and options trading offer various trading strategies to cater to diverse risk appetites and market views:

-

Long Positions: In a bullish market, traders may buy MCX stocks or call options to profit from anticipated price increases.

-

Short Positions: In a bearish market, traders may sell MCX stocks or buy put options to profit from anticipated price declines.

-

Hedging Strategies: Traders can employ options to hedge against risk in existing physical commodity positions.

Factors to Consider

Successful MCX stocks and options trading requires careful consideration of several factors:

-

Market Conditions: Analyze current supply and demand dynamics, economic indicators, political events, and weather patterns that may influence commodity prices.

-

Risk Management: Establish clear risk limits, trading stop-loss levels, and hedge positions to manage potential losses.

-

Technical Analysis: Utilize technical indicators to interpret price patterns and identify potential trading opportunities.

-

Broker Selection: Choose a reliable and experienced broker with low commissions and a user-friendly trading platform.

Conclusion

MCX stocks and options trading offer a dynamic and rewarding avenue for traders seeking portfolio diversification, hedging against risk, or speculating on commodity price movements. By understanding the market fundamentals, employing appropriate trading strategies, and considering key factors, traders can navigate the complexities of this market and potentially reap its benefits. Embrace the opportunities and challenges inherent in MCX stocks and options trading, and embark on a journey of financial empowerment.

Image: blog.profitkrishna.com

Multi Commodity Exchange Stocks Options Trading

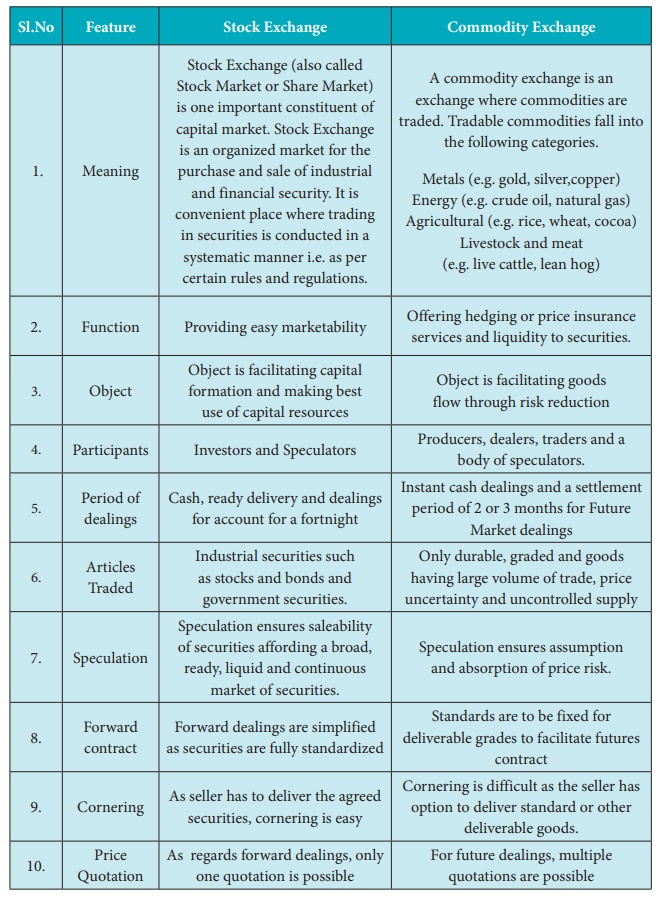

Image: www.brainkart.com