Options trading has emerged as a powerful tool for investors seeking both income and growth. Among the multitude of options available, Microsoft (MSFT) stands out as a blue-chip giant with ample liquidity and a solid track record. In this comprehensive guide, we delve into the intricacies of MSFT options trading, empowering you to seize opportunities and navigate the complexities of the market.

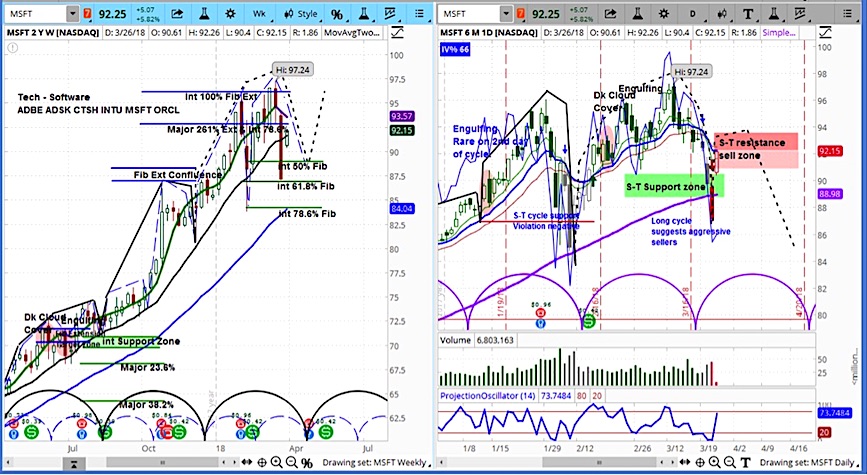

Image: www.seeitmarket.com

Unveiling Options: A Gateway to Risk-Adjusted Returns

Options are financial contracts that convey the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) by a specified date (expiration date). By carefully selecting and executing options strategies, investors can potentially mitigate risk while capturing market upside or downside moves.

Types of MSFT Options: Catering to Diverse Investment Needs

Microsoft offers a range of option types, each tailored to specific investment goals:

- Calls: Grant the right to buy MSFT shares at the strike price. Ideal for bullish investors anticipating stock price appreciation.

- Puts: Provide the right to sell MSFT shares at the strike price. Suitable for bearish investors expecting a stock price decline.

- Covered Calls: Sell calls against existing MSFT stock positions to generate additional income while limiting upside participation.

- Protective Puts: Buy puts to protect against potential stock price declines below a certain level.

Trading MSFT Options: A Strategic Approach

Effective MSFT options trading demands a systematic approach:

- Analyze Market Trends: Identify overall market sentiment, macroeconomic factors, and specific company news that may impact MSFT stock performance.

- Choose the Right Option Strategy: Determine the appropriate option type based on your market outlook and risk tolerance.

- Select the Strike Price: Carefully consider the current stock price, historical volatility, and potential price movements to determine the optimal strike price.

- Manage Expirations: Options have finite lifespans, so it’s crucial to monitor expiration dates and adjust strategies accordingly.

- Monitor Positions: Regularly track open options positions, making necessary adjustments based on changing market conditions.

Image: optiontiger.com

Expert Insights: Navigating MSFT Options with Confidence

To enhance your MSFT options trading journey, heed the wisdom of seasoned experts:

- Understand Risk: Options trading involves inherent risk. Thoroughly evaluate your risk tolerance before engaging.

- Seek Diversification: Spread your investments across multiple MSFT options and other asset classes to mitigate risk.

- Consider Option Greeks: Use Greek measures (Delta, Gamma, Theta, Vega) to assess option sensitivity and optimize strategies.

- Stay Informed: Continuously monitor market news, earnings reports, and analyst recommendations for potential market catalysts.

MSFT Options FAQs: Empowering Your Investment Decisions

Q: What is the minimum investment required to trade MSFT options?

A: The margin requirement varies depending on the brokerage firm and the specific option strategy employed.

Q: What are the advantages of trading MSFT options over stocks?

A: Options offer flexibility, risk management tools, and the potential for significant returns.

Q: How does volatility impact MSFT options trading?

A: Higher volatility increases option premiums but also the potential for profit and loss.

Msft Options Trading

Image: www.youtube.com

Conclusion: Embracing the Power of MSFT Options

MSFT options trading presents a unique opportunity to leverage the strength of a tech giant while mitigating risk. By employing the strategies outlined in this guide, cultivating a prudent mindset, and embracing expert advice, you can unlock the potential of the financial markets and elevate your investment returns. Embrace the world of MSFT options trading and empower yourself to take control of your financial future.

Would you like to delve further into the world of MSFT options trading? Explore our recommended resources below to enhance your knowledge and elevate your trading endeavors.