In the vibrant and ever-evolving world of finance, Mexican options trading stands out as a lucrative and multifaceted investment strategy. It offers a unique blend of risk and reward, enabling savvy investors to capitalize on the dynamic fluctuations of the Mexican financial market. Whether you are a seasoned trader or a novice seeking to venture into the realm of options, understanding the intricacies of Mexican options trading is paramount to achieving financial success.

Image: studylib.net

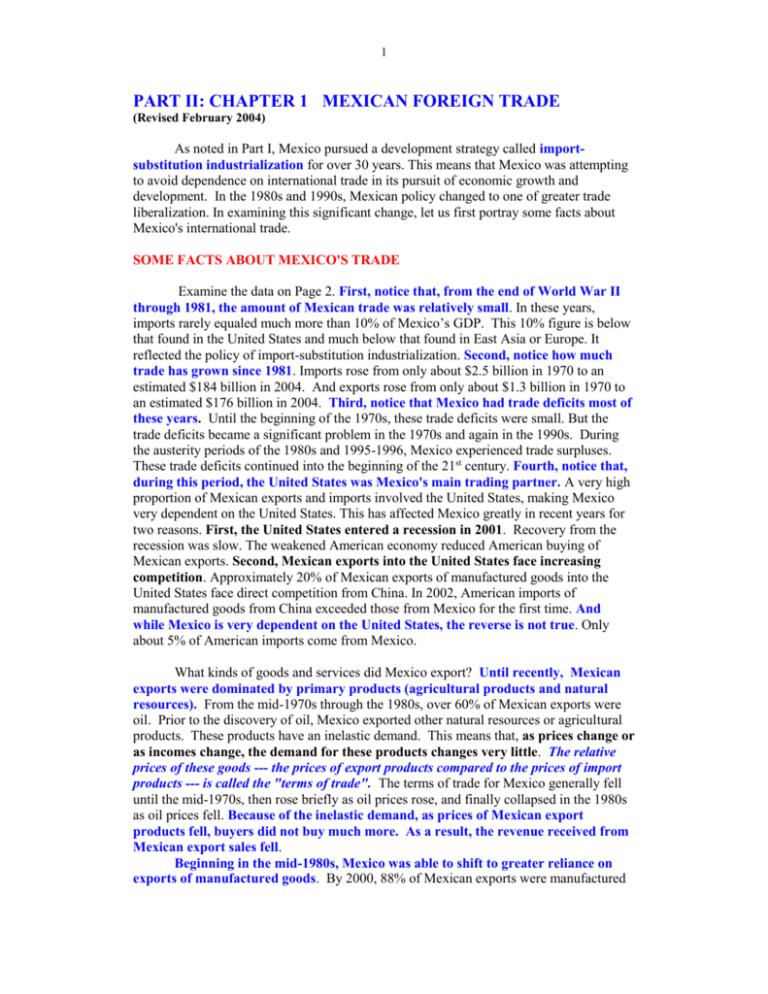

Navigating the Mexican Options Market: Basics and Beyond

Before delving into the complexities of Mexican options trading, it is essential to establish a solid foundation in the basics. Options, in essence, are financial contracts that confer upon the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). By strategically combining call and put options, investors can tailor their positions to exploit market trends and mitigate risks.

Mexican options trading, specifically, involves the trading of options on securities listed on the Mexican Stock Exchange (BMV). These options provide investors with exposure to the performance of Mexican companies and broader market indices. The BMV, with its diverse range of listed companies and robust trading infrastructure, offers a vibrant platform for options trading. Whether you seek to speculate on the trajectory of the Mexican economy, hedge against potential losses, or supplement your income, Mexican options trading presents an array of opportunities for financial gain.

Unlocking the Power of Options Trading: Strategies and Applications

The versatility of Mexican options trading empowers investors with a diverse toolkit of strategies to navigate market volatility and achieve their financial goals. Simple strategies, such as buying a call option to capitalize on anticipated stock price increases or selling a put option to protect against potential declines, form the bedrock of options trading. However, the true power of options lies in the ability to craft complex combinations, known as option spreads, that fine-tune risk and reward profiles to meet specific objectives.

Understanding Greek letters, a set of parameters that measure the sensitivity of an option’s price to changes in underlying factors, is pivotal for mastering options trading. These parameters, including Delta, Gamma, Theta, and Vega, provide invaluable insights into how options prices fluctuate in response to changes in stock prices, time, volatility, and interest rates. By skillfully manipulating Greek letters, traders can craft sophisticated trading strategies that exploit market inefficiencies and enhance their chances of success.

Embracing the Challenges and Seizing the Opportunities

Despite the immense potential rewards, Mexican options trading is not without its challenges. Market volatility, unpredictable economic conditions, and geopolitical uncertainties can create significant fluctuations in option prices, making it crucial for traders to exercise sound risk management practices. Comprehensive research, coupled with a deep understanding of market dynamics and the underlying assets, is essential for mitigating risks and maximizing returns.

For those willing to embrace the challenges and navigate the complexities of Mexican options trading, the rewards can be substantial. By leveraging the power of options, investors can amplify gains, hedge against risks, and generate income in both rising and falling markets. Moreover, the Mexican market presents unique opportunities for investors seeking exposure to emerging market growth and currency diversification.

Image: www.bloomberg.com

Mexican Options Trading Finance

Image: www.transitionsabroad.com

Conclusion: Empowering Investors through Mexican Options Trading

Mexican options trading offers a multifaceted and rewarding avenue for investors seeking to harness the potential of the Mexican financial market. Whether you are a seasoned trader or an aspiring investor, understanding the intricacies of Mexican options trading is the key to unlocking financial success. By mastering the basics, employing strategic trading techniques, and embracing the challenges, investors can capitalize on the opportunities presented by this dynamic and ever-evolving market. As with all financial endeavors, thorough research, risk management, and a deep understanding of market dynamics are essential for maximizing returns and achieving long-term financial success.