Introduction

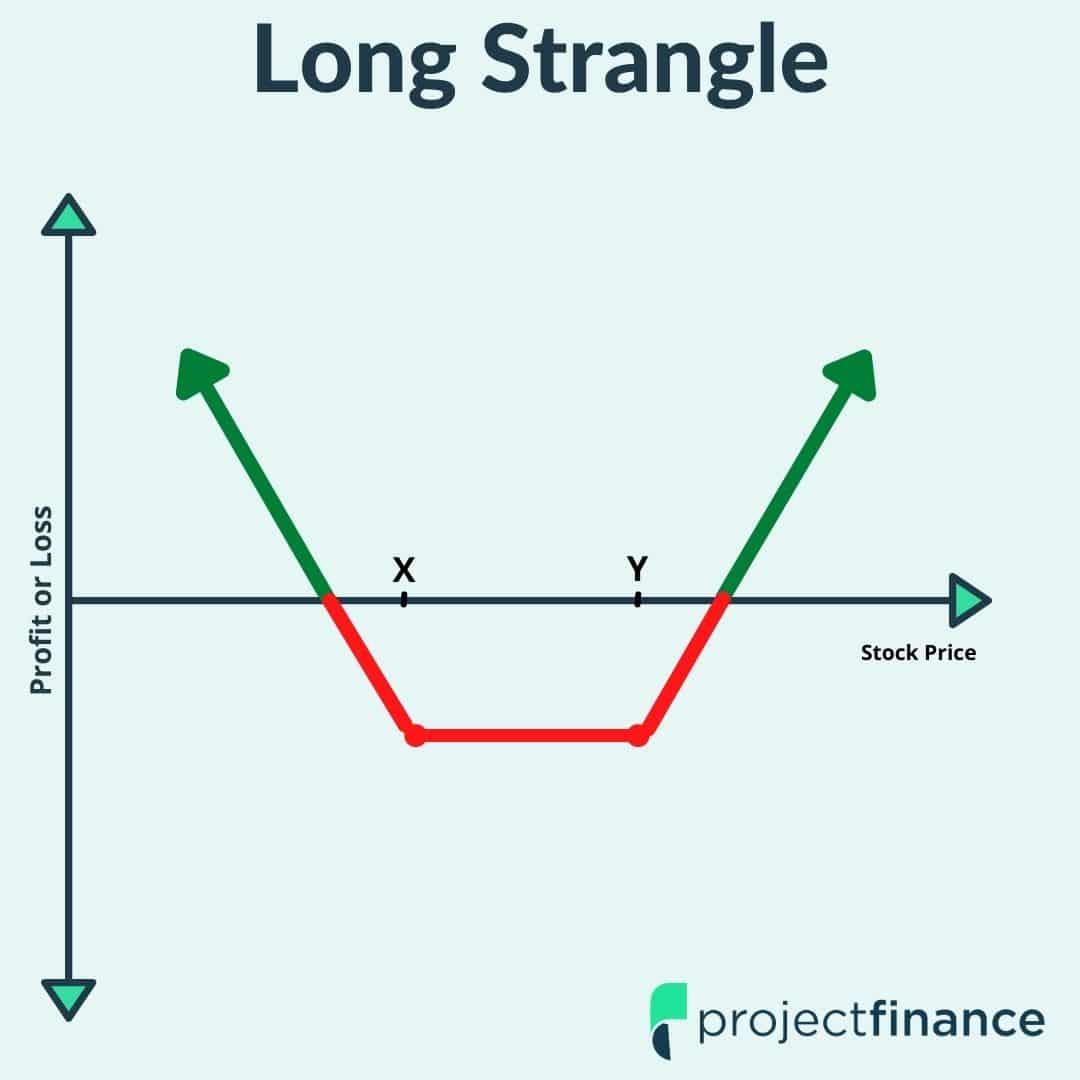

In the realm of financial markets, options trading strategies provide investors with a versatile array of tools to navigate market volatilities and pursue potential profits. Among these strategies, the long strangle stands out as a compelling option for both seasoned traders and those seeking to expand their trading repertoire. This intricate strategy involves the simultaneous purchase of a call option and a put option with the same underlying asset, albeit at different strike prices.

Image: www.projectfinance.com

Unveiling the intricacies of a long strangle strategy empowers traders to capitalize on market fluctuations while mitigating potential losses. By comprehending its nuances, traders can unlock its full potential and harness its benefits effectively.

Delving into the Long Strangle Mechanism

The long strangle strategy is crafted by purchasing a call option and a put option simultaneously. The call option bestows upon its holder the right to acquire an underlying asset at a predefined price (known as the strike price) prior to a specific expiration date. The put option, on the other hand, grants its holder the right to sell an underlying asset at a predetermined strike price before its expiration.

In the context of a long strangle, the call option’s strike price is set at a level above the current market price, while the put option’s strike price is set at a level below the current market price. This positioning endows the trader with the flexibility to profit from substantial price movements, irrespective of their direction.

Understanding the Profit Potential and Risks

The long strangle strategy holds the allure of generating profits in both rising and falling markets. When the underlying security appreciates in value, the call option will increase in value, potentially yielding a substantial return. Conversely, if the underlying security declines in value, the put option will furnish a profit to the trader.

However, it is imperative to acknowledge that the long strangle strategy is not without its inherent risks. A prolonged period of market stagnation or a sharp price movement that breaches the strike prices can lead to losses. Therefore, traders must carefully evaluate market trends and exercise prudent risk management techniques to maximize their chances of success.

Mastering the Long Strangle Strategy

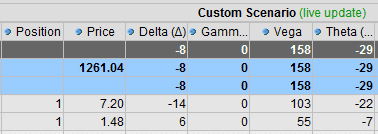

To master the long strangle strategy, traders should possess a thorough understanding of various factors that influence its potential profitability and risks. These factors include:

Image: optionstradingiq.com

1. Volatility:

Volatility, a measure of price fluctuations, serves as a crucial determinant of the long strangle’s profitability. Increased volatility enhances the potential for substantial profits but also amplifies the risks associated with the strategy.

2. Strike Prices:

The selection of appropriate strike prices is paramount to maximizing the long strangle’s profit potential. Traders should consider factors like support and resistance levels, historical price ranges, and anticipated market movements when determining strike prices.

3. Expiration Dates:

The expiration date of the options contracts plays a pivotal role in defining the timeframe of the strategy. Traders must carefully calibrate the expiration dates based on their market outlook and risk tolerance.

Real-World Applications of the Long Strangle

The long strangle strategy has found widespread application in various real-world trading scenarios. It can be employed:

1. Market Direction Speculation:

Investors can utilize the long strangle to capitalize on anticipated price moves, both upward and downward, without committing to a specific directional bet.

2. Hedging Against Volatility:

By purchasing a long strangle, traders can offset potential losses stemming from unexpected market volatility. This strategy provides a hedge against price fluctuations, safeguarding portfolios from adverse market movements.

3. Income Generation:

Under specific market conditions, the long strangle can be employed as an income-generating strategy. By selling the options at a higher price than their purchase price, traders can generate a steady stream of income.

Long Strangle Options Trading

Image: top10stockbroker.com

Conclusion

Embracing the intricacies of long strangle options trading unlocks a powerful tool for strategic profit-seeking. By skillfully navigating market volatilities, traders can exploit the long strangle’s potential to generate returns. Yet, it is imperative to approach this strategy with caution, fully comprehending the inherent risks and implementing prudent risk management measures.

For those seeking further enlightenment on the long strangle strategy, a wealth of resources awaits your exploration. Engage in extensive research, seek mentorship from experienced traders, and test your skills in simulated trading environments. Let the long strangle be your guide to navigating market complexities and unlocking financial opportunities.