Introduction

In today’s dynamic financial landscape, options trading has emerged as a sophisticated strategy that empowers investors with the ability to manage risk and potentially enhance their portfolios. For those seeking to capitalize on this lucrative market, understanding the intricacies of stocks trading in options is paramount. This comprehensive guide delves into the depths of this financial instrument, guiding you through its history, fundamental concepts, and practical applications.

Image: leonwheeler.z13.web.core.windows.net

Options, by their very nature, grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. Essentially, this empowers investors with the flexibility to control their investment decisions and respond effectively to market fluctuations. With a wide range of stocks available for options trading, investors can tailor their strategies to suit their risk appetite and financial goals.

Historical Antecedents of Options Trading

The origins of options trading can be traced back to ancient Greece, where merchants engaged in informal agreements to secure future purchase or sale prices for goods. These rudimentary practices evolved over time, gaining prominence during the Dutch Golden Age in the 16th century. It was in the bustling markets of Amsterdam that standardized options contracts first emerged, laying the foundation for the modern-day derivatives market.

By the 18th century, options trading had become an integral part of the London Stock Exchange, where it was primarily used to hedge against price risks associated with commodities and agricultural products. The advent of the Chicago Mercantile Exchange (CME) in the 19th century marked a turning point in the history of options trading, as standardized contracts for various commodities were introduced, further expanding the scope and accessibility of this financial instrument.

Fundamental Concepts of Options Trading

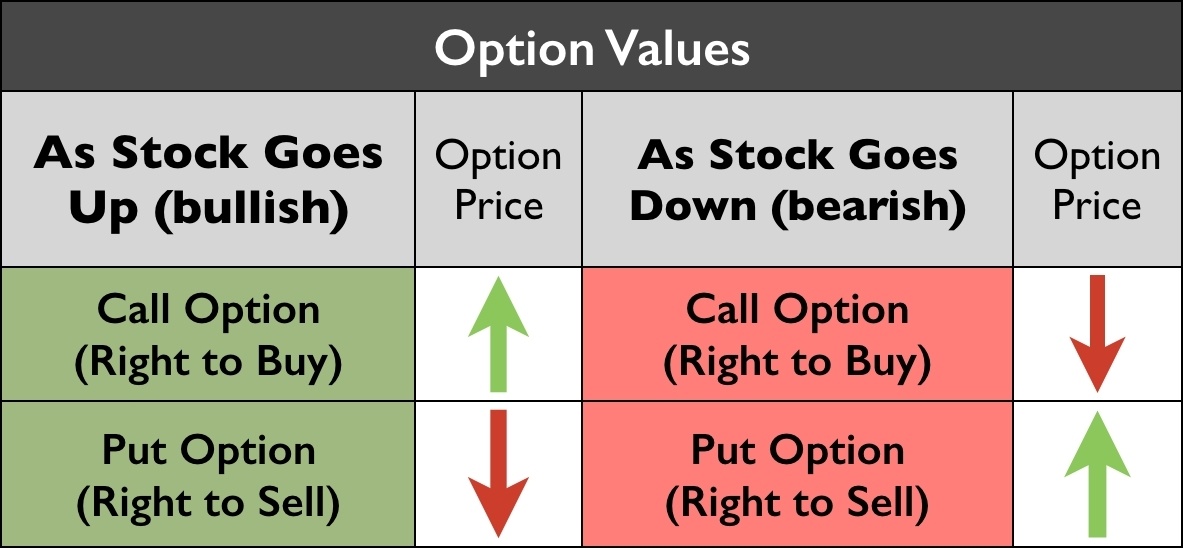

Understanding the fundamental concepts of options trading is essential for successful navigation of this market. At the heart of options trading lies the underlying asset, which can be any financial instrument such as stocks, bonds, commodities, or indices. Options contracts are typically classified into two main categories: calls and puts.

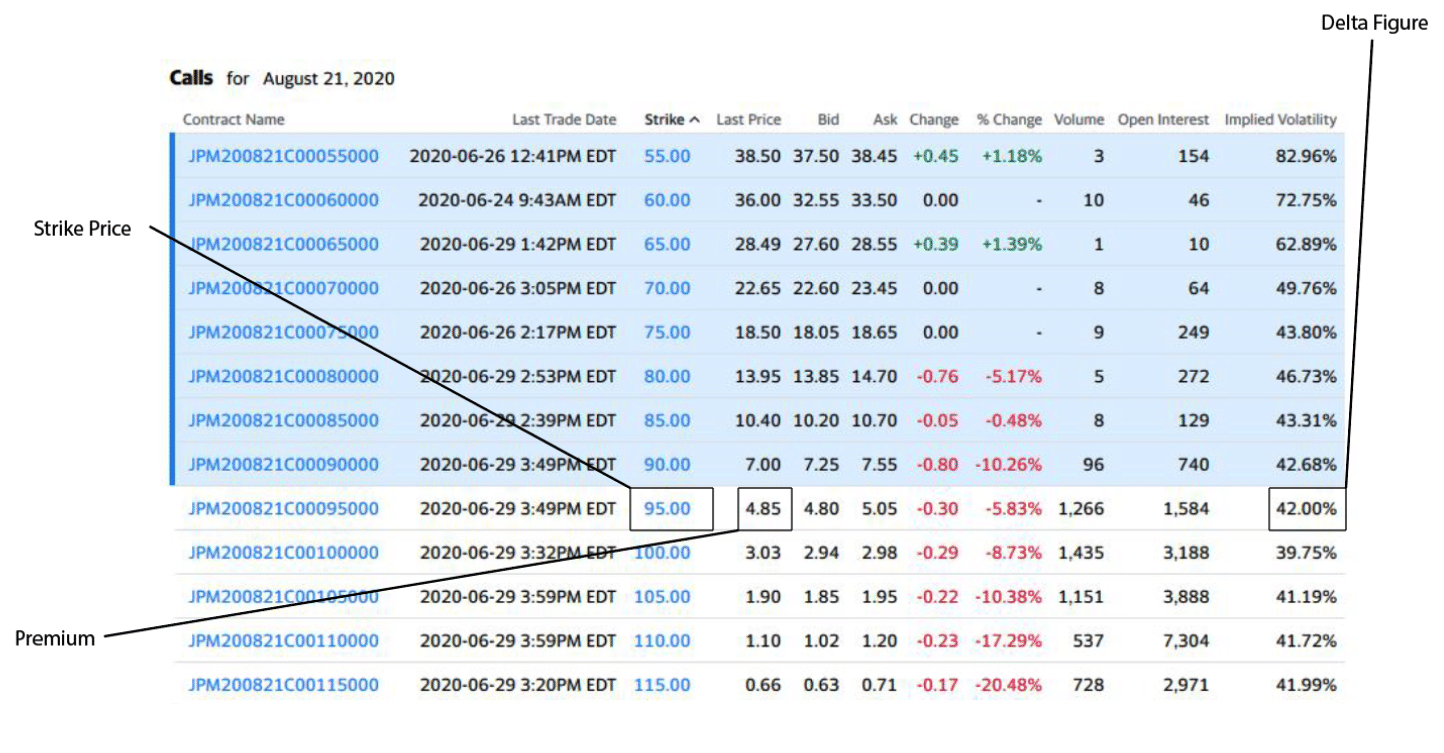

Call options confer the right to buy the underlying asset at a specified price, known as the strike price, on or before the contract’s expiration date. In essence, call options are used when investors anticipate the value of the underlying asset to increase, allowing them to capitalize on potential price appreciation. Conversely, put options grant the holder the right to sell the underlying asset at the strike price. Put options are typically employed when investors anticipate a decline in the underlying asset’s value, enabling them to mitigate potential losses.

Image: tradesmartu.com

List Of Stocks Trading In Options

Image: club.ino.com

Practical Applications of Options Trading

Options trading offers a diverse array of applications, catering to a wide range of investment objectives. Hedging, income generation, and speculation are among the most common applications of this versatile financial instrument.

Hedging: Options can serve as a valuable tool for hedging against potential losses. Investors can purchase put options on an underlying asset that they own to protect themselves against a possible decline in its price. Similarly, call options can be used to hedge against potential losses on an asset that an investor has committed to selling at a future date.

Income Generation: Options trading also presents opportunities for generating income through premium payments. By selling options contracts, investors can receive a premium payment from the buyer of the contract. While the premium payment represents upfront income, it also entails the obligation to complete the transaction if the option is exercised by the buyer.

Speculation: For investors seeking to capitalize on market volatility, options trading can provide a platform for speculation. By taking calculated positions in call or put options, investors can potentially profit from correctly predicting the direction of an underlying asset’s price movement.