Unlocking the Potential of Level Two Options Trading

Options trading has emerged as a lucrative investment strategy for savvy investors seeking to generate substantial returns. Amidst the complexity of options trading, Level Two options offer a higher level of sophistication and potential profitability for experienced traders. This guide delves into the intricacies of Level Two options trading, providing an in-depth understanding and actionable advice for investors seeking to maximize their returns.

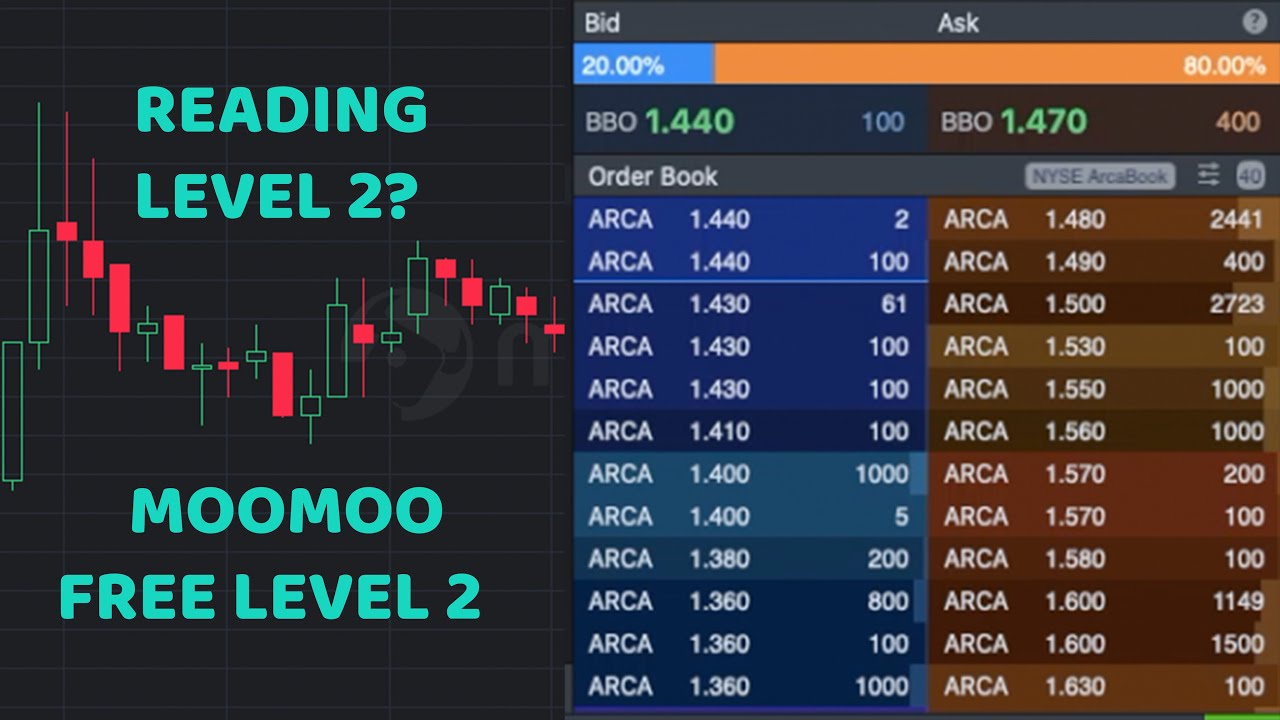

Image: hakukumo.blogspot.com

What is Level Two Options Trading?

Level Two options trading refers to the practice of accessing and utilizing real-time market data beyond the basic Level One data available to all market participants. Level Two options traders gain access to a wealth of advanced information, including:

- Real-time bid and ask prices

- Order book depth

- Historical volume and volatility data

Leveraging this comprehensive data allows Level Two options traders to make more informed trading decisions and capitalize on market inefficiencies, significantly enhancing their potential returns.

Advantages and Disadvantages of Level Two Options Trading

Advantages:

- Enhanced trade execution

- Access to market depth and sentiment

- Increased trading opportunities

Disadvantages:

- Higher subscription fees

- Technical proficiency required

- Potential for information overload

Strategies for Level Two Options Trading Success

Mastering Level Two options trading requires a combination of skills, experience, and a strategic approach. Here are some proven strategies to guide you:

Image: fintrakk.com

Trend Following

Analyze historical price patterns and market depth to identify trends and trade in line with market momentum. Focus on options with strong volume and low volatility, indicating a higher probability of trend continuation.

Range Trading

Identify price boundaries within which an asset has traded over a period of time. Buy options at the lower end of the range and sell at the upper end, profiting from price fluctuations within the range.

Market Making

Becoming a market maker involves quoting both buy and sell prices for specific options. This strategy requires a high level of market understanding and risk management expertise.

Expert Tips for Successful Level Two Options Trading

Utilize Order Book Depth: Analyze the distribution of orders at different price levels to gauge market sentiment and identify potential trading opportunities.

Monitor Historical Volatility: Historical volatility provides insights into the past price fluctuations of an asset. Consider options with volatility that matches your investment horizon and risk tolerance.

Control Risk: Level Two options trading carries substantial risk. Manage your risk by limiting trade sizes, using stop-loss orders, and diversifying your portfolio.

Frequently Asked Questions on Level Two Options Trading

Q: How do I gain access to Level Two options data?

A: Contact your brokerage firm or subscribe to a data provider specializing in Level Two options data feeds.

Q: What are the costs associated with Level Two options trading?

A: Data subscription fees vary depending on the provider and the level of data access. Some brokerages may also charge additional commissions or fees.

Q: Is Level Two options trading suitable for all investors?

A: Level Two options trading requires a high level of skill and experience. It is not recommended for beginner or risk-averse investors.

Level Two Options Trading

Image: quotesgram.com

Conclusion

Level Two options trading offers seasoned investors the opportunity to unlock advanced trading strategies and reap significant returns. By leveraging real-time market data, traders can make more informed decisions, identify profitable opportunities, and manage risk effectively. However, it is imperative to recognize that Level Two options trading is not a risk-free endeavor.

Are you ready to delve into the exciting world of Level Two options trading? Embrace the challenge, master the intricacies, and unlock your potential for success.