Introduction

Navigating the world of options trading can be a daunting endeavor, especially for those seeking advanced strategies. Level 4 options trading on E*Trade presents a higher level of complexity and risk, granting traders access to sophisticated options strategies that can amplify potential gains. Embark on a detailed exploration of Level 4 options trading, uncovering its nuances, benefits, and potential pitfalls.

Image: www.makeupera.com

Before venturing into Level 4 options trading, it’s imperative to establish a solid foundation in basic options concepts. Once a comprehensive understanding is achieved, traders can delve into the intricacies of Level 4 options trading, empowering themselves with a strategic advantage in the financial markets.

Understanding Level 4 Options Trading on E*Trade

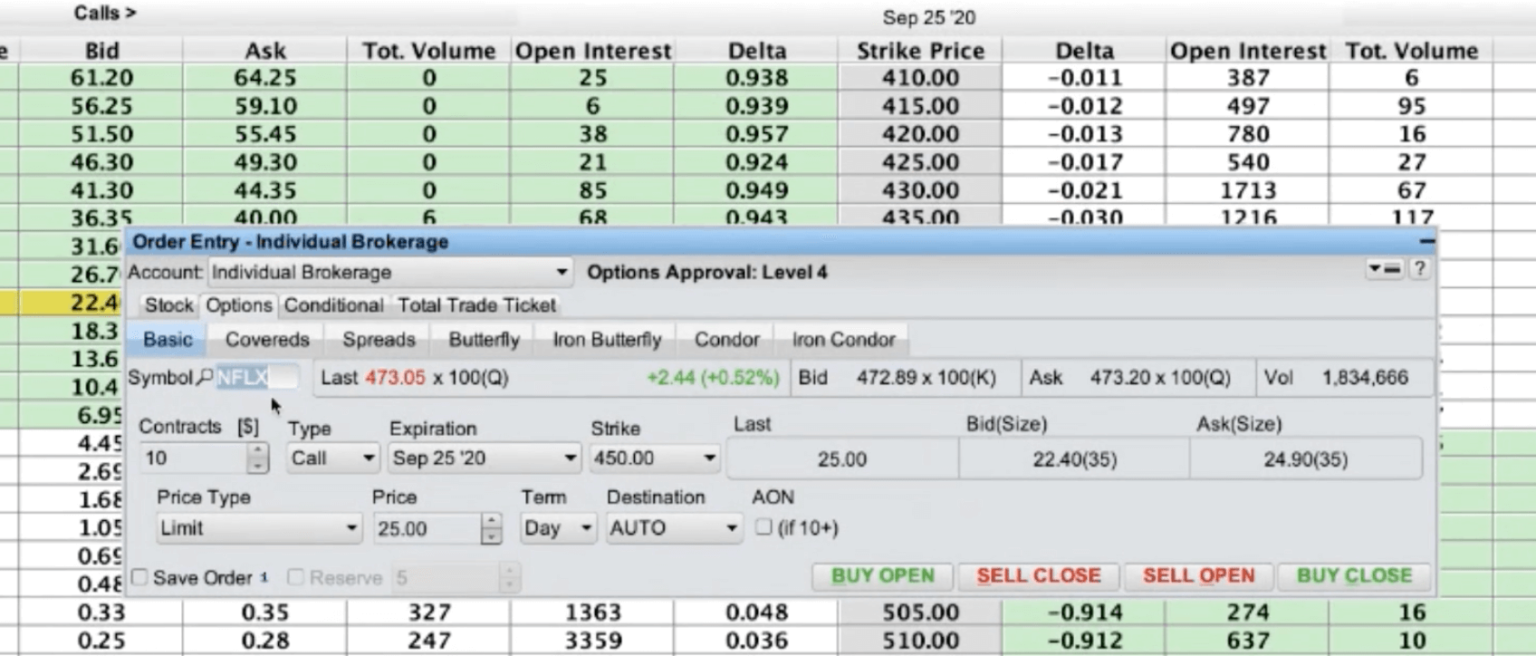

E*Trade’s Level 4 options trading authorization elevates traders to a higher echelon, empowering them with access to advanced options strategies that were previously unavailable. This exclusive privilege unlocks the potential for enhanced returns, but it also demands a heightened level of risk management and a thorough understanding of complex options concepts.

To qualify for Level 4 options trading on E*Trade, traders must meet specific criteria, including experience with options trading, passing a comprehensive exam, and maintaining a suitable account balance. By fulfilling these requirements, traders demonstrate their proficiency and commitment to responsible options trading.

Benefits and Risks of Level 4 Options Trading

Level 4 options trading presents a unique blend of benefits and risks that traders must carefully consider. Among its advantages are the potential for amplified returns, enhanced trading flexibility, and the ability to implement sophisticated strategies. However, it’s crucial to acknowledge the elevated risks associated with these advanced options strategies, including the potential for significant losses.

Traders contemplating Level 4 options trading must possess a deep understanding of risk management techniques. Sound risk management practices, such as position sizing, stop-loss orders, and hedging strategies, are essential for mitigating potential losses. By adopting a disciplined risk management approach, traders can navigate the inherent risks of Level 4 options trading.

Tips and Expert Advice for Level 4 Options Traders

To maximize their success in Level 4 options trading, traders can benefit from incorporating proven tips and expert advice into their trading strategies. One crucial tip is to focus on mastering a few well-defined strategies rather than attempting to execute a broad range of complex strategies.

Additionally, maintaining a meticulous trading journal is highly recommended. By diligently tracking trades, traders can identify patterns, evaluate performance, and refine their strategies over time. Furthermore, leveraging educational resources, such as webinars, seminars, and books, can significantly contribute to traders’ knowledge and understanding of advanced options trading concepts.

Image: mimevagebasoh.web.fc2.com

Frequently Asked Questions (FAQs) about Level 4 Options Trading

- What are the key differences between Level 4 and lower levels of options trading? Level 4 options trading grants access to a wider spectrum of complex options strategies, such as spreads, straddles, and butterflies, which are not available at lower levels.

- What is the minimum account balance required for Level 4 options trading on E*Trade? The minimum account balance requirement for Level 4 options trading on E*Trade may vary depending on the account type and trading experience. It is recommended to contact E*Trade directly for the most up-to-date information.

- What are some common mistakes made by Level 4 options traders? Common mistakes include overleveraging, failing to manage risk effectively, and not fully understanding the complexities of the strategies they are employing.

Level 4 Options Trading Etrade

Image: thebrownreport.com

Conclusion

Level 4 options trading on E*Trade presents a gateway to advanced trading strategies, unlocking the potential for increased returns. However, this elevated level of trading also demands a profound understanding of risk management and a commitment to continuous learning. By mastering a few well-defined strategies, maintaining a trading journal, and leveraging educational resources, traders can navigate the complexities of Level 4 options trading while maximizing their chances of success.

Are you interested in learning more about Level 4 options trading or other advanced options trading strategies? Share your questions or insights in the comments section below.