In the fast-paced world of options trading, understanding the market’s subtle nuances is crucial for success. Leading indicators can serve as a beacon of guidance, providing vital insights into the upcoming market directions. Just as a seasoned sailor relies on the wind’s movements, options traders can leverage leading indicators to navigate the ever-changing market landscape.

Image: einvoice.fpt.com.vn

Grasping Leading Indicators: A Path to Market Foresight

Leading indicators are forward-looking metrics that offer a glimpse into the future course of an asset’s price or the broader market’s trajectory. They serve as early signals of emerging market trends, enabling traders to anticipate and strategize ahead of the curve.

Unlike lagging indicators, which merely reflect past events, leading indicators capture the early stages of market movement. By harnessing the power of leading indicators, traders can gain an edge over those who solely rely on historical data.

Types of Leading Indicators: A Diverse Toolkit

The world of leading indicators encompasses a wide array of metrics, each serving a unique purpose. Examples include:

- Economic Indicators: These measure economic activity and health, such as GDP growth, consumer confidence, and unemployment rates.

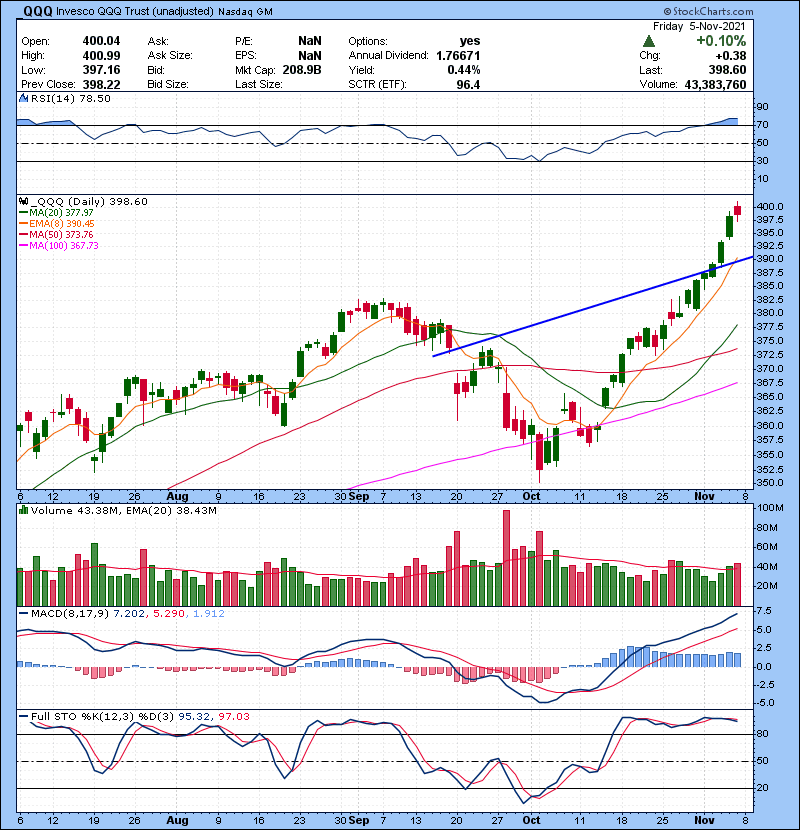

- Technical Indicators: These analyze price and volume data to identify potential reversals, trends, and momentum indicators.

- Sentiment Indicators: These gauge market sentiment through surveys, social media analysis, and option market positioning.

Utilizing Leading Indicators: A Step-by-Step Guide

Incorporating leading indicators into options trading strategies requires a disciplined approach:

Identify Relevant Indicators:

Begin by choosing leading indicators that align with your trading approach and risk tolerance. Consider the asset or market segment you’re trading, your timeframe, and your trading strategy.

Monitor Consistently:

Regularly track the indicators to capture subtle shifts in market sentiment and momentum. Utilize dashboards or automated tools to streamline the monitoring process.

Interpret Cues Carefully:

Leading indicators should not be viewed in isolation but rather in conjunction with other market signals. Combine technical analysis, fundamental data, and market news to gain a comprehensive understanding.

Image: indicatorchart.com

Expert Advice for Enhanced Trading

Stay Ahead of the Curve:

Leading indicators provide a proactive approach in identifying market turns. With their use, you can proactively adjust your trading strategies to align with impending market shifts.

Manage Risk Effectively:

By anticipating market trends, you can mitigate risk by hedging positions or adjusting risk parameters in advance. Leading indicators help traders prepare for potential volatility and adverse market conditions.

Leading Indicators In Options Trading

Image: bullsonwallstreet.com

Frequently Asked Questions

Q: Are leading indicators always accurate?

No, leading indicators can signal false readings, so it’s crucial to use them in conjunction with other market signals and have valid data.

Q: What is the role of technical indicators in options trading?

Technical indicators assess price and volume to identify trend changes and potential trading opportunities. They are valuable for identifying oversold or overbought conditions.

Q: How can I stay updated on the latest leading indicators and market trends?

Follow reputable financial publications and blogs, join online trading groups, and attend industry events to stay abreast of new indicators and market developments.