Navigating the Enigmatic World of Options Trading with Kohl’s

The realm of options trading beckons with its potential for substantial returns, yet it remains shrouded in a veil of complexity for many investors. Kohl’s, the renowned department store chain, offers an intriguing gateway into this captivating world. In this exhaustive treatise, we embark on a journey to unravel the mysteries of Kohl’s options trading, empowering you with the knowledge to harness its potential.

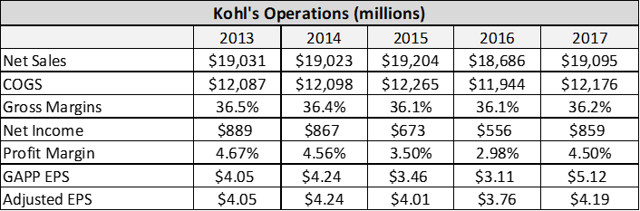

Image: seekingalpha.com

Demystifying Kohl’s Options Trading: A Historical and Conceptual Overview

Options trading, a spin-off of the broader derivatives market, has its origins in the 18th century. As an innovative financial instrument, options provide investors with a dual-edged sword: the opportunity to potentially multiply gains while simultaneously leveraging risk management strategies.

Kohl’s, a prominent player in the retail sector, has its roots in the heartland of America, tracing its inception back to 1927. Over the years, it has transformed into a retail behemoth, catering to millions of customers nationwide. Its foray into options trading empowers investors with the ability to speculate on the future price movements of its stock.

Unveiling the Secrets of Kohl’s Options Trading: A Comprehensive Guide

To master the art of Kohl’s options trading, we delve into its intricate mechanics, armed with simplified concepts and real-world applications. Understanding these fundamental building blocks will lay the groundwork for navigating this dynamic market with confidence.

Option Types: Calls vs. Puts

Options come in two primary flavors: calls and puts. Calls grant the buyer the right, but not the obligation, to purchase the underlying asset (Kohl’s stock in this case) at a predetermined price (strike price) on or before a specific date (expiration date). Puts, on the other hand, confer the right to sell the underlying asset at the strike price on or before the expiration date.

Image: analysisofkohlscorporation.weebly.com

The Anatomy of an Option Contract

Options contracts are characterized by a constellation of attributes that determine their value and functionality:

- Strike Price: The predetermined price at which the underlying asset can be bought (for calls) or sold (for puts).

- Expiration Date: The date on or before which the option can be exercised.

- Option Premium: The price paid to acquire the option.

- Underlying Asset: In Kohl’s options trading, this is the stock of Kohl’s Corporation (KSS).

Real-World Applications: Unveiling the Power of Options Trading

Armed with this newfound understanding, we explore the multifaceted applications of options trading, highlighting their versatility and potential profitability:

- Speculation: Options provide a platform for investors to capitalize on anticipated price movements. By correctly predicting whether the stock price will rise (for calls) or fall (for puts), traders can reap substantial returns.

- Hedging: Options serve as a defensive tool, allowing investors to mitigate potential losses in their stock portfolio. By strategically pairing options with stocks, traders can create a safety net against adverse price fluctuations.

- Income Generation: Selling covered calls, a strategy that involves selling call options while owning the underlying stock, provides a potential avenue for generating income.

The Evolving Landscape of Kohl’s Options Trading: A Glimpse into the Future

The world of options trading is in constant flux, driven by technological advancements and evolving market dynamics. In recent years, Kohl’s options trading has witnessed several notable trends that continue to shape its future:

- Increased Retail Participation: The advent of online trading platforms has democratized access to options trading, attracting a growing number of retail investors.

- Artificial Intelligence and Machine Learning: Sophisticated algorithms and AI-powered tools are transforming the way options are analyzed and traded, enhancing accuracy and efficiency.

- New Options Strategies: Creative and innovative options strategies continue to emerge, expanding the toolkit available to traders seeking diversified approaches.

Kohls Options Trading

Image: www.cnbc.com

Conclusion: Embracing Kohl’s Options Trading with Strategic Insight

Kohl’s options trading, with its multifaceted applications and dynamic nature, presents a compelling opportunity for investors seeking financial growth and risk management. By embracing a comprehensive understanding of its intricacies and honing strategic trading acumen, individuals can harness the power of Kohl’s options trading to navigate market fluctuations and achieve their financial goals.