Navigating the Tax Implications of Loss Recognition

Have you pondered the consequences of trading options, specifically whether they can trigger a dreaded wash sale? Step into our virtual guide as we delve into this intricate topic, arming you with a lucid understanding of the intricacies involved. Read on to unravel the mysteries of wash sales, enabling you to steer clear of potential tax pitfalls.

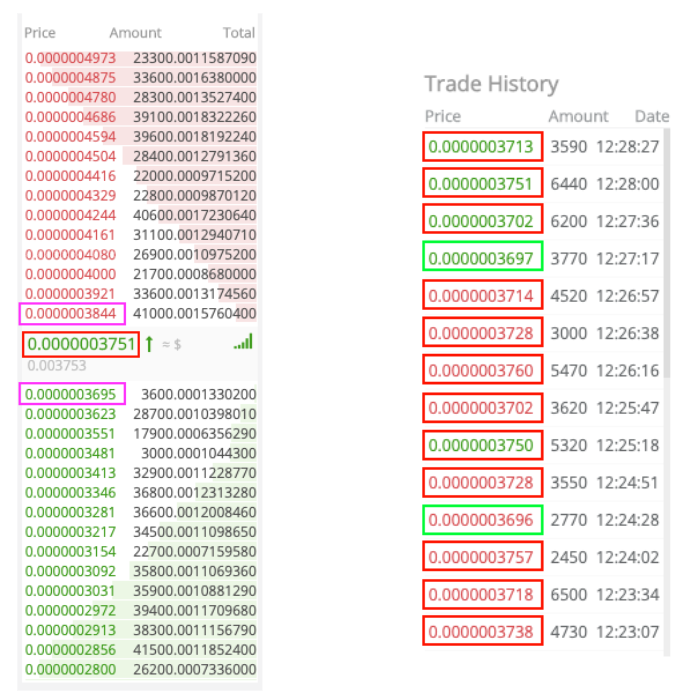

Image: coinacademy.fr

Understanding Wash Sales

When we delve into the realm of taxation, a wash sale describes a situation where an investor sells a security at a loss and, within a specific time frame, reacquires the same or a substantially identical security. This well-defined period extends for 30 days before and after the date of the sale.

Upon encountering a wash sale, the Internal Revenue Service (IRS) disallows the recognition of the loss for tax purposes. In essence, the tax agency deems the loss to be unrealized until you dispose of the replacement shares. This prudent measure prevents investors from engaging in “tax-loss harvesting” strategies.

Applicability to Options Trading

Now, let us scrutinize whether trading options can indeed trigger a wash sale. The answer to this intricate question hinges upon whether the options being traded are considered “substantially identical.” The IRS guidelines provide clarity on this matter, defining substantially identical options as those with the same underlying security, strike price, and expiration date.

In scenarios where an investor engages in the sale of an option at a loss and, within the 61-day wash sale window, purchases an option with identical terms, a wash sale is deemed to have occurred. Consequently, the loss incurred on the initial sale will be disallowed for tax purposes. It is essential to note that these principles extend to both call and put options.

Consequences and Considerations

Disallowed losses due to wash sales can have ripple effects on your tax situation. The disallowed loss cannot be used to offset capital gains or reduce your taxable income. Moreover, the cost basis of the replacement shares is adjusted to reflect the disallowed loss, which may result in a higher capital gain or a smaller capital loss upon eventual sale.

In light of these potential ramifications, it is prudent to exercise caution when trading options within the 61-day wash sale window. Careful consideration should be given to the tax implications before engaging in any transactions that may trigger a wash sale.

Image: www.magikist.com

Expert Tips and Avoiding Wash Sales

Seasoned traders and tax professionals offer valuable insights to help you navigate the complexities of wash sales. To avoid inadvertently triggering a wash sale, consider these expert recommendations:

- Monitor Your Trading Activity: Track your option trades meticulously, paying close attention to sale dates and the 61-day wash sale window.

- Plan Your Trades Strategically: Avoid purchasing substantially identical options within the 61-day wash sale window following a sale at a loss.

- Choose Different Strike Prices or Expiration Dates: Opt for options with varying strike prices or expiration dates to avoid acquiring substantially identical options.

- Exercise Caution with Spreads: Be mindful when dealing with option spreads, as they may involve multiple legs and increase the likelihood of triggering a wash sale.

- Consult with a Tax Professional: Seek guidance from a qualified tax professional for tailored advice based on your specific circumstances.

Frequently Asked Questions

- Q: What is the time period for a wash sale?

A: A wash sale occurs when you sell a security at a loss and reacquire the same or substantially identical security within 61 days. - Q: Can closing an option position trigger a wash sale?

A: Closing an option position by exercising or selling it can also be subject to wash sale rules. - Q: How do wash sales impact my taxes?

A: Wash sales disallow the recognition of the loss for tax purposes, potentially leading to higher capital gains or smaller capital losses in the future. - Q: Can wash sales apply to options on different underlying securities?

A: No, wash sale rules only apply to options with the same underlying security, strike price, and expiration date. - Q: What should I do if I accidentally trigger a wash sale?

A: Consult with a tax professional to explore potential strategies to mitigate the negative tax consequences.

Can Trading Options Trigger Wash Sale

Image: coinrule.com

Conclusion

Navigating the intricacies of wash sales is crucial for traders to optimize their tax positions. By understanding the interplay between options trading and wash sale rules, you can avoid the potential pitfalls and make informed decisions. Remember to monitor your trading activity, plan strategically, and consult with a tax professional when needed. As you enhance your knowledge and adhere to the guidelines outlined, you will be better equipped to maximize your returns while minimizing tax implications.

We hope this in-depth exploration has provided clarity on the topic. If you have any further questions or wish to delve deeper into the complexities of wash sales, please do not hesitate to reach out. We are always eager to assist fellow traders on their journeys toward financial success.