Navigating the Complexities of Insider Trading in the Financial Arena

Insider trading, the illicit practice of profiting from non-public information, has cast a dark shadow over the integrity of financial markets. While its consequences are significant, the complexity of insider trading in option markets warrants a closer examination. This article delves into the mechanics, implications, and regulatory measures surrounding insider trading in option markets, shedding light on a pervasive issue that undermines fair play and erodes investor confidence.

Image: www.dreamstime.com

Defining Insider Trading in Option Markets

Insider trading encompasses any unauthorized trading activity based on material, non-public information obtained through privileged access. In the context of option markets, this information could involve upcoming mergers, financial results, or regulatory changes that can influence the value of underlying assets. Perpetrators exploit this knowledge to anticipate market movements and profit handsomely.

Understanding Option Markets

Options, financial instruments that grant the right but not the obligation to buy or sell an underlying asset at a predetermined price, play a crucial role in insider trading. They offer leverage, enabling traders to amplify their profits from price swings. However, this also increases the potential for abuse, as insiders can use their knowledge to time option trades perfectly.

Real-World Implications: Cases and Consequences

History is rife with notorious cases of insider trading in option markets. The scandal that rocked the pharmaceutical giant Merck in 2001 serves as a glaring example. Employees traded on inside information regarding the company’s plan to acquire Medco Health Solutions, reaping immense profits. The fallout led to severe fines, jail sentences, and reputational damage for Merck.

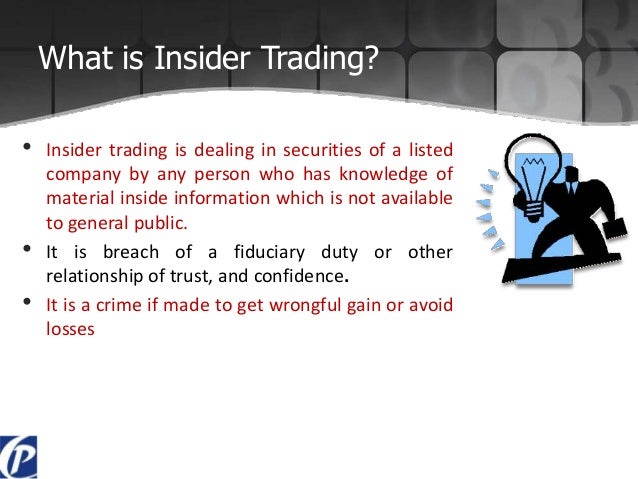

Image: www.slideshare.net

Regulatory Landscape: Combatting Insider Trading

Recognizing the gravity of insider trading, regulatory bodies have enacted strict measures to combat this malpractice. The Securities and Exchange Commission (SEC) enforces stringent rules against insider trading, actively investigating and prosecuting violators. Additionally, companies implement compliance programs, training employees on ethical trading practices and monitoring potential insider activity.

Technological Advancements: Aiding Detection

Technological advancements have played a pivotal role in combating insider trading in option markets. Sophisticated surveillance systems, data mining techniques, and predictive modeling algorithms can detect suspicious trading patterns and identify potential perpetrators. These tools empower regulators and investigators to scrutinize large volumes of data, uncover hidden relationships, and apprehend offenders.

Impact on Market Integrity and Investor Confidence

Insider trading poses a grave threat to the integrity of financial markets. It distorts price discovery, undermines fair competition, and erodes investor confidence. When investors perceive markets as being rigged, they lose trust and may be deterred from participating, which can hinder economic growth and financial stability.

Insider Trading In Option Markets

Image: www.5paisa.com

Conclusion: Striking a Balance

Insider trading in option markets is a complex and pervasive issue that undermines the integrity of financial markets. While regulations and enforcement play a crucial role in combating this practice, ethical conduct and compliance remain paramount. By fostering a culture of transparency and accountability, we can create a fairer and more equitable financial landscape, ensuring that all investors have a level playing field.