Introduction

Option trading has emerged as a popular investment strategy, and with its growing popularity comes the question of tax implications. Traders often wonder, “If you lose on option trading, is it tax deductible?” The answer to this question is not straightforward and requires a thorough understanding of complex tax codes. In this article, we will delve into the intricacies of option trading taxation, clarifying when losses can be deducted and providing valuable insights for traders seeking to optimize their tax strategies.

Image: www.chegg.com

The Importance of Understanding Option Trading Taxation

Option trading taxation plays a crucial role in shaping investment decisions. Traders who comprehend the tax implications can make informed choices that maximize their profits and minimize their tax liability. By grasping the rules surrounding option trading deductions, traders can avoid costly mistakes and ensure compliance with tax regulations.

Defining Option Trading and Loss Realization

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specified time frame. Option trading involves buying and selling these contracts, and a loss is realized when the contract expires worthless or is sold for less than its purchase price.

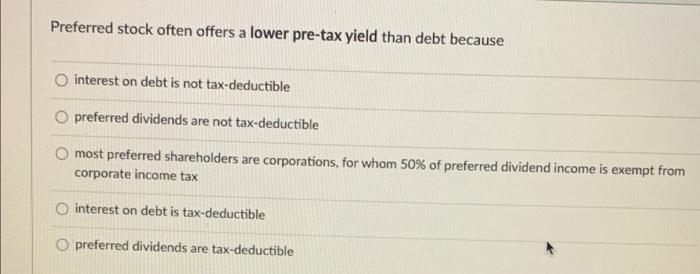

Is Option Trading Loss Deductible?

The tax deductibility of option trading losses depends on the taxpayer’s classification as either a trader or an investor.

Trader Classification: Traders who actively trade options as their primary business or source of income can deduct losses as ordinary business expenses. The Internal Revenue Service (IRS) views traders as engaged in a profit-seeking enterprise, and their trading activities are considered a trade or business. Traders can offset option trading losses against other income, such as wages or profits from other trades.

Investor Classification: Investors who trade options non-professionally are subject to different tax treatment. Option trading losses are classified as capital losses and are deductible against capital gains. However, capital losses can only be deducted up to the amount of capital gains realized in the same tax year. If capital losses exceed capital gains, they can be carried forward to subsequent tax years.

Image: www.studocu.com

The Importance of Documentation and Recordkeeping

Accurate recordkeeping is essential for option traders. Traders should meticulously track their trades, including the purchase and sale price of each contract, the expiration date, and any gains or losses realized. This documentation will be crucial for substantiating deductions when filing tax returns.

Tax Implications of Option Premiums

Option premiums, the amount paid for the right to buy or sell the underlying asset, are treated differently from the underlying asset itself. When an option expires worthless, the premium paid is considered a non-deductible expense, even for traders. However, if the option is exercised or sold for a gain, the premium is added to the cost basis of the underlying asset and reduces the amount of taxable gain.

If You Lose On Option Trading Is It Tax Deductible

Image: www.youtube.com

Conclusion

Understanding the tax implications of option trading losses is essential for maximizing returns and minimizing tax liability. Traders must determine their classification, either as a trader or investor, to correctly deduct losses. Accurate recordkeeping and a deep understanding of the tax code are invaluable tools for traders seeking to navigate the complexities of option trading taxation. By adhering to these principles, traders can optimize their tax strategies and make informed investment decisions.