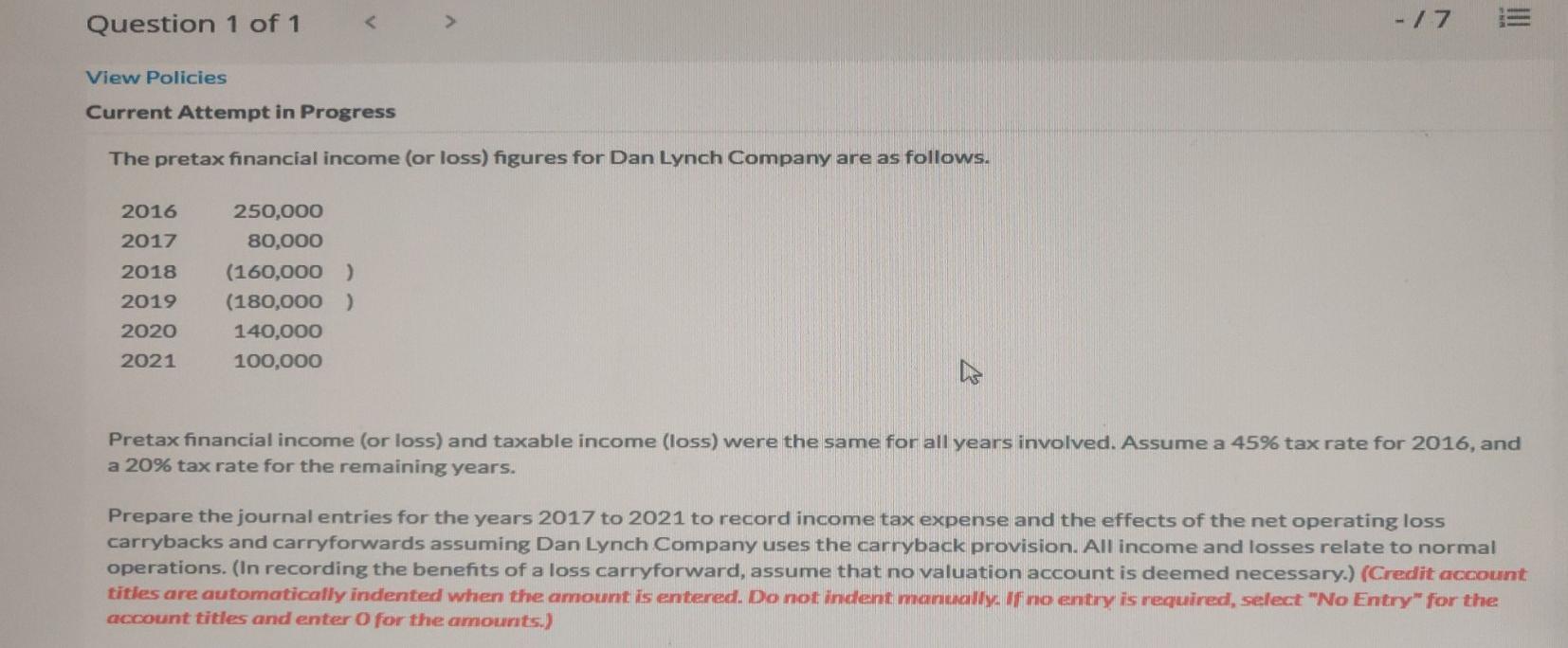

Navigating the realm of options trading can be both thrilling and lucrative, but it’s essential to be fully aware of the tax implications that come along with it. Understanding how losses in options trading are handled by the tax authorities is crucial for managing your financial responsibilities efficiently.

Image: www.chegg.com

In this comprehensive guide, we will delve into the intricacies of options trading loss taxation, providing a clear understanding of the relevant regulations and offering expert advice to help you minimize your tax burden.

Tax Treatment of Options Trading Losses

As per the Internal Revenue Service (IRS), losses incurred through options trading are classified as follows:

- Ordinary losses: These losses stem from options traded for hedging purposes or as part of a strategy to generate ordinary income.

- Capital losses: Losses emanating from options traded for capital appreciation are deemed capital losses.

Ordinary Losses

Ordinary losses in options trading are fully deductible against ordinary income, up to the extent of your overall trading income. If your trading losses exceed your income, you can deduct up to $3,000 against other types of income, such as wages or investment earnings. Losses above this threshold can be carried forward to subsequent tax years.

Capital Losses

Capital losses can be offset against capital gains. If your capital losses surpass your capital gains, you can deduct up to $3,000 against other sources of income. Any remaining loss can be carried forward and deducted in future tax years.

Image: www.chegg.com

Tips and Advice for Minimizing Tax Burden

- Keep meticulous records: Maintain detailed records of all your options trading transactions, including the dates, strike prices, premiums, and expiration dates. This documentation will be invaluable during tax filing.

- Utilize tax-advantaged accounts: Consider trading options through a tax-advantaged account, such as an Individual Retirement Account (IRA) or 401(k). Losses incurred in these accounts are not subject to tax until you withdraw funds.

- Offset capital gains: If you have realized capital gains from other investments, use your options trading losses to offset them, thereby reducing your overall tax liability.

- Consult a tax professional: The complexities of options trading taxation can be overwhelming. Seeking guidance from a qualified tax professional is highly recommended, as they can provide personalized advice tailored to your specific situation.

Remember, tax regulations are subject to change. Stay informed about any updates by regularly consulting the IRS website or working with a tax professional who specializes in investment taxation.

Frequently Asked Questions

- Q: Can I deduct losses from options trading against my salary?

A: Yes, ordinary losses can be deducted against your salary, up to the extent of your trading income. However, capital losses can only be offset against capital gains.

- Q: How do I report options trading losses on my tax return?

A: You should report ordinary losses on Schedule C of Form 1040, while capital losses should be reported on Schedule D of Form 1040.

- Q: Can I carry forward losses indefinitely?

A: No, capital losses can only be carried forward for five years. However, ordinary losses can be carried forward indefinitely.

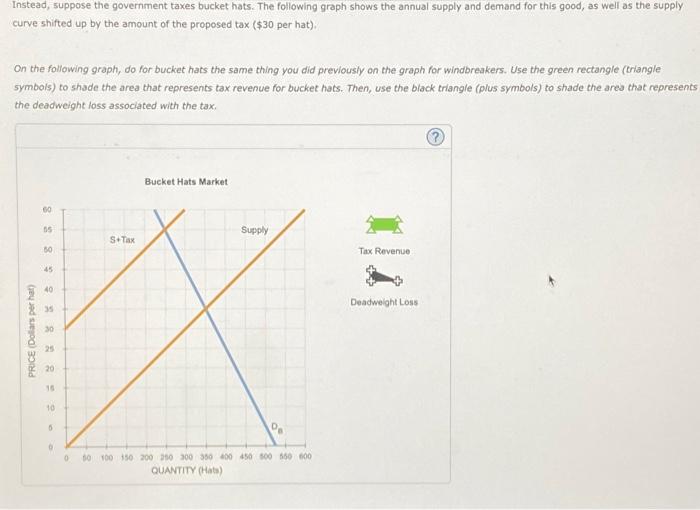

Loss In Options Trading Income Tax

Image: www.chegg.com

Conclusion

Understanding the tax implications of loss in options trading is essential for managing your financial responsibilities effectively. By utilizing the strategies outlined in this guide and staying abreast of tax regulations, you can minimize your tax burden and maximize your profits.

If you’re interested in delving deeper into the intricacies of options trading taxation, we encourage you to consult with a qualified tax professional who specializes in investment taxation. They can provide personalized guidance and tailored advice to help you make informed decisions.