Introduction

Option trading is a powerful tool that can be used to enhance your trading strategy and potentially generate significant profits. However, it’s essential to understand that option trading involves risks and requires a certain amount of capital to get started. In this article, we’ll delve into the capital required for option trading, exploring the factors that determine your capital needs and providing strategies to manage your risk.

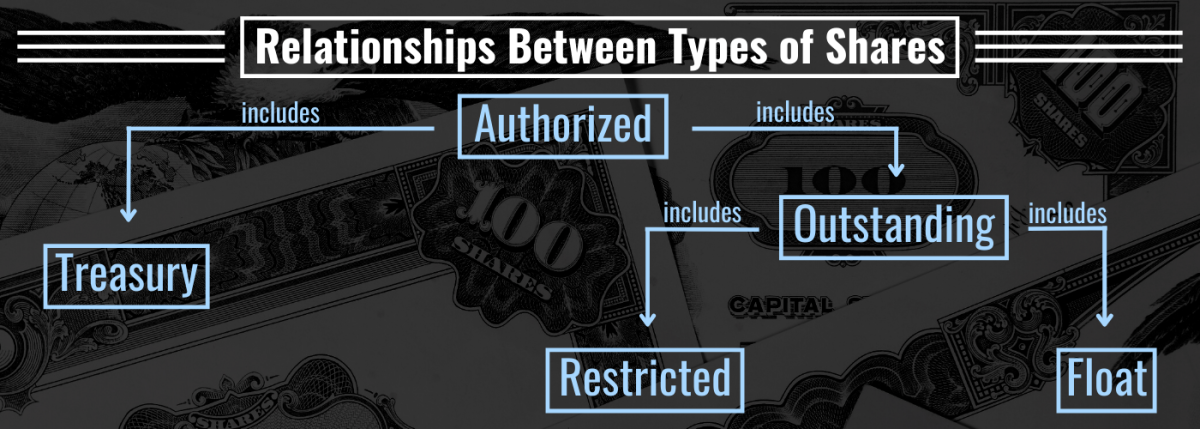

Image: www.thestreet.com

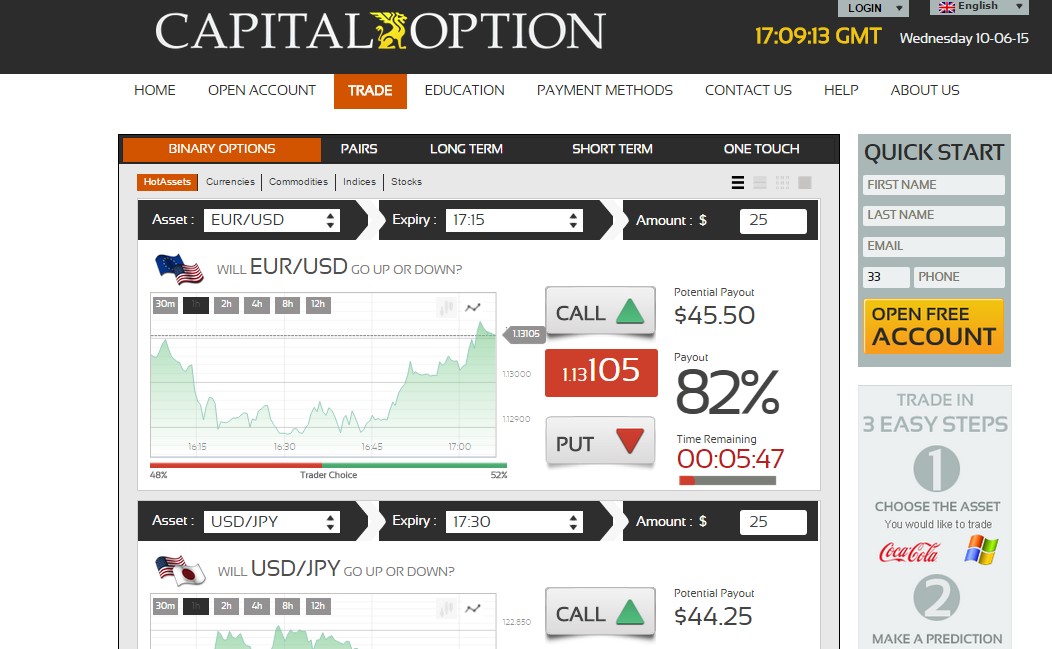

Option trading involves the buying and selling of options contracts, which are derivative instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a particular date. Depending on the type of option you choose (call or put) and the underlying asset (stock, ETF, commodity, etc.), the capital requirements may vary.

Factors Determining Capital Needs

Several factors play a crucial role in determining the capital you need for option trading:

- Option Type: Call options require you to hold sufficient capital to cover the potential purchase price of the underlying asset, while put options necessitate capital to cover potential liabilities in case the asset’s value declines.

- Option Premium: The premium you pay for an option contract is an upfront investment that reduces your available capital for trading. Higher premium options require more capital.

- Risk Tolerance: Your risk tolerance influences the amount of capital you should allocate to option trading. Higher risk tolerance allows for more aggressive trading strategies and potentially greater returns, but it also exposes you to more significant losses.

- Trading Strategy: The type of option trading strategy you employ (scalping, day trading, swing trading, etc.) impacts your capital needs. Some strategies, such as selling premium, may reduce capital requirements.

- Account Type: Margin accounts provide access to leverage, allowing you to trade with more capital than you have in your account. However, margin trading magnifies potential gains and losses, increasing capital requirements.

Calculating Capital Needs

To estimate the capital you need for a specific option trade, you can use the following formula:

Capital Required = Option Premium + Commission + Minimum Margin Requirement

The option premium is the amount you pay to purchase the option contract. The commission is the fee charged by your brokerage firm for executing the trade. The minimum margin requirement varies depending on the type of option and your account type.

Strategies for Managing Risk

Managing risk is paramount in option trading, and proper capital management is crucial. Here are some strategies to help you mitigate risks:

- Establish a Maximum Loss Limit: Determine the maximum amount you’re willing to lose on any single trade and stick to it.

- Diversify Your Portfolio: Trade options on various underlying assets to reduce the impact of losses on any particular asset.

- Trade Smaller Positions: Start with smaller position sizes to minimize potential losses and gain experience.

- Use Protective Strategies: Employ hedging techniques such as spreads and protective collars to limit downside risk.

- Set Realistic Expectations: Don’t expect to make excessive profits quickly. Option trading requires patience and discipline.

Image: binarydiaries.com

Capital Required For Option Trading

Conclusion

Capital requirements for option trading depend on various factors, including the option type, premium, risk tolerance, trading strategy, and account type. By carefully assessing these factors and implementing proper risk management strategies, you can determine the appropriate capital you need to get started with option trading. Remember, option trading involves both potential profits and risks, so it’s crucial to approach it with a well-informed and disciplined approach.