Introduction

In the realm of investing, options trading has emerged as a strategic tool for investors seeking amplified gains. However, maximizing the potential of this endeavor hinges on a crucial facet: selecting the optimal stock. Navigating this intricate decision-making process requires a comprehensive understanding of the factors that shape an ideal candidate. This in-depth guide will illuminate the key parameters to consider when embarking on your stock selection journey for options trading.

Image: www.vectorvest.com

Delving into the Criteria

The selection of the optimal stock for options trading entails evaluating a multitude of variables. Among these, the following hold paramount importance:

-

High Volume: Opt for stocks with substantial trading volume, ensuring ample liquidity for seamless entry and exit from positions. Volume provides insights into market interest and liquidity, reducing the risk of slippage and adverse price movements.

-

Stable Volatility: Seek stocks exhibiting stable historical volatility, as excessive volatility can amplify risks and erode profits. Consistent price movements provide a more predictable environment for option strategies, enabling informed decision-making.

-

Trending Market: Identify stocks with defined market trends, ideally bullish uptrends. Trending markets offer favorable conditions for options trading, increasing the likelihood of profitable trades.

-

Earnings Reports: Keep an eye on companies scheduled to release quarterly earnings reports. Anticipated earnings releases can lead to significant price fluctuations, creating potential opportunities for well-timed options trades.

-

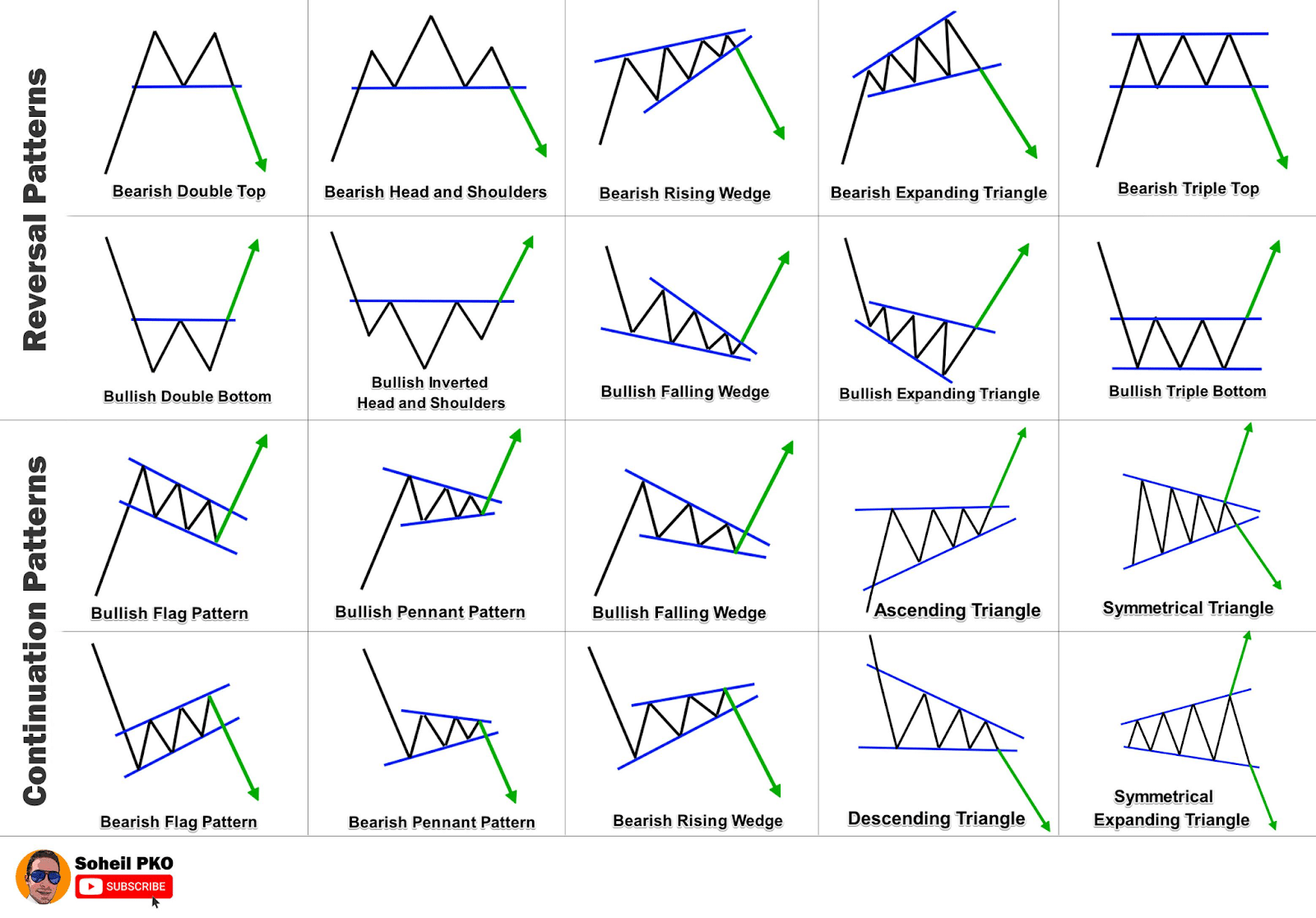

Technical Analysis: Leverage technical analysis tools such as moving averages, support and resistance levels, and trend indicators. These techniques can provide insights into market sentiment and price patterns, improving trade decision-making.

-

Implied Volatility: Consider implied volatility, which reflects market expectations of future price fluctuations. Elevated implied volatility presents opportunities for higher option premiums, but it also magnifies risks.

Heeding Expert Advice

Seasoned experts in the field of options trading recommend adhering to specific guidelines when selecting stocks:

-

Define Your Risk Tolerance: First, establish your risk tolerance and tailor your stock selection accordingly. Risk-averse investors may favor stocks with lower volatility, while more aggressive traders can consider higher-volatility stocks.

-

Diversify Your Portfolio: Spread your capital across multiple stocks to mitigate risks. Diversification is a prudent strategy to minimize potential losses from any single stock’s underperformance.

-

Monitor Market Conditions: Stay attuned to prevailing market conditions and adjust your stock selection strategies accordingly. Bullish markets favor uptrending stocks, while bearish markets call for more conservative choices.

Image: cryptogenerated.com

How To Pick The Best Stock Gor Trading Options

Image: darkwebsiteson.com

Conclusion

Selecting the ideal stock for options trading is a multifaceted endeavor that requires meticulous consideration of various factors. By thoroughly analyzing volume, volatility, market trends, earnings reports, technical analysis, and implied volatility, you can increase your chances of making informed and potentially profitable choices. Remember to heed the advice of experts, define your risk tolerance, and diversify your portfolio to mitigate risks and enhance your success in options trading.