Investing in the world of options can be a rollercoaster ride, where every twist and turn is dictated by the whims of the market. Amidst this chaotic landscape, intrinsic value serves as a beacon of stability. But what exactly is intrinsic value, and how does it manifest in options trading portfolios? This in-depth exploration will unravel its significance, shedding light on its profound impact.

Image: urisofod.web.fc2.com

Unmasking Intrinsic Value: The True Worth Beneath the Surface

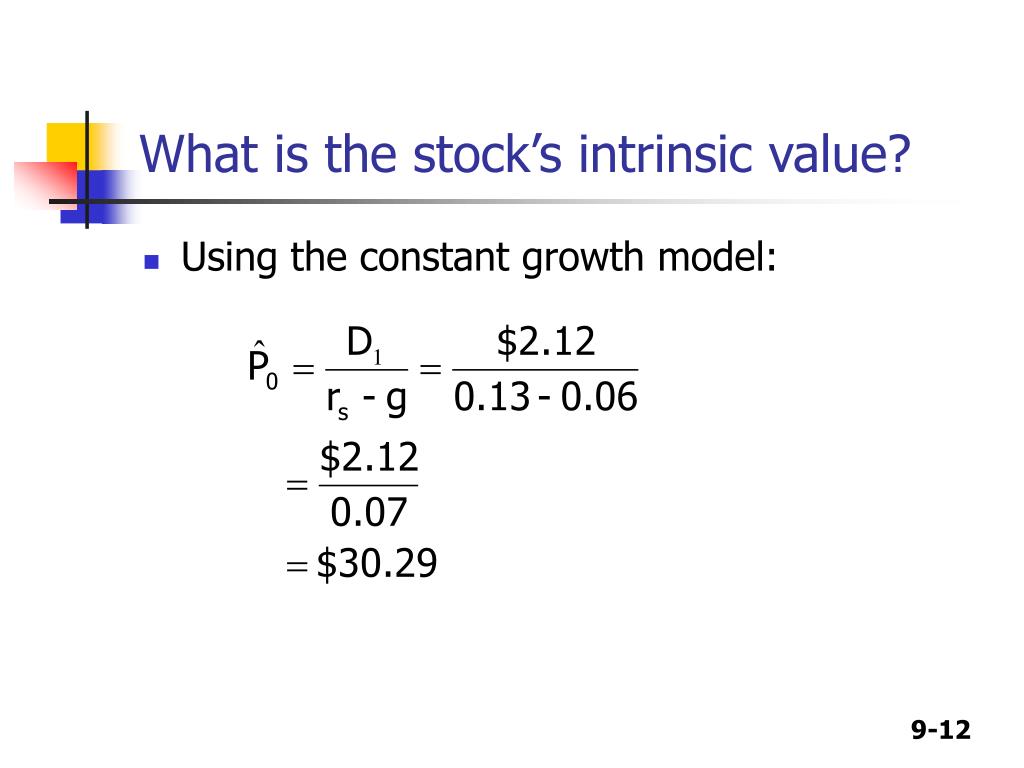

In the realm of options, intrinsic value is a measure of the asset’s inherent worth, exclusive of speculative or time-based components. It represents the actual value that can be realized by exercising the option contract at that moment. Consider it the “heart” of an option, indicating the tangible underlying asset’s value.

Unveiling Intrinsic Value in Options Trading Portfolios

The presence of intrinsic value in options trading portfolios is a testament to the unique nature of these instruments. Unlike stocks, which represent ownership in a company, options confer the right, but not the obligation, to buy or sell the underlying asset at a predefined price. This flexibility allows traders to craft portfolios that reflect their risk tolerance and profit objectives.

Intrinsic value plays a crucial role in shaping the strategies employed by traders. In the case of call options, where the buyer has the right to purchase, the intrinsic value represents the difference between the current market price of the underlying asset and the strike price of the option. A positive intrinsic value indicates that the current market price exceeds the strike price, potentially leading to profit upon execution.

Conversely, in put options, where the buyer possesses the right to sell, intrinsic value is the differential between the strike price and the current market price of the underlying asset. A positive intrinsic value signals that the current market price is below the strike price, offering a potential profit upon execution.

The Dance of Supply and Demand: Intrinsic Value as a Guiding Light

In options trading, the interplay between supply and demand has a profound impact on intrinsic value. When demand for an option rises, typically driven by favorable market conditions or positive news about the underlying asset, its intrinsic value increases. Conversely, declining demand leads to a decrease in intrinsic value.

Traders can leverage intrinsic value to gauge market sentiment and identify potential trading opportunities. By considering the factors influencing supply and demand, they can make informed decisions about entering or exiting positions.

Image: blog.dhan.co

Practical Applications: Harnessing Intrinsic Value for Optimal Portfolio Performance

Grasping the nuances of intrinsic value empowers traders to develop sophisticated strategies that maximize portfolio returns. For instance, intrinsic value can serve as a tool to identify undervalued or overvalued options, enabling traders to buy low and sell high.

Moreover, intrinsic value plays a crucial role in spread strategies, where traders simultaneously sell and buy options with different strike prices or expiration dates. Understanding intrinsic value facilitates the calculation of potential profit and loss scenarios, allowing traders to craft balanced and profitable portfolios.

Cautionary Note: The Elusive Nature of Intrinsic Value

While intrinsic value provides valuable insights into the worth of options and underlying assets, it is essential to recognize its dynamic nature. Intrinsic value can fluctuate rapidly in response to changes in the underlying asset’s price, market volatility, and time to expiration.

This volatility highlights the need for constant monitoring and risk management. Traders should not solely rely on intrinsic value but incorporate other indicators, such as market trends, technical analysis, and economic data, to make informed trading decisions.

How Is Intrinsic Value Displayed In Options Trading Portfolios

:max_bytes(150000):strip_icc()/TipsforAnsweringSeries7OptionsQuestions2_2-f144f0e4668f4f408f2bc0cad3ac328a.png)

Image: www.investopedia.com

Conclusion: Empowering Traders with Intrinsic Value’s Wisdom

Intrinsic value stands as a cornerstone in the realm of options trading portfolios. By unraveling its significance and providing practical applications, this exploration empowers traders to make informed decisions, navigate market complexities, and create a tailored trading strategy that aligns with their goals. Understanding intrinsic value is a key to unlocking the true potential of options trading, ensuring greater success and confidence in navigating the ever-changing financial landscape.