An Introduction to Options Trading on Robinhood

Options trading can be a lucrative way to speculate on the future price of an asset. However, it can also be a complex and risky endeavor. If you’re new to options trading, it’s important to do your research and understand the risks involved. Robinhood is a popular platform for options trading, and it offers a number of features that make it a good choice for beginners. In this article, we’ll provide a comprehensive overview of how options trading works on Robinhood.

Image: www.youtube.com

What is Options Trading?

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date. The buyer of an option pays a premium to the seller of the option in exchange for this right. There are two main types of options: calls and puts. A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset.

How Do Options Work on Robinhood?

On Robinhood, you can trade options on a variety of underlying assets, including stocks, ETFs, and indices. To trade options on Robinhood, you’ll need to have a Robinhood account and you’ll need to be approved for options trading. Once you’re approved, you can start trading options by selecting the underlying asset you want to trade and then choosing the type of option you want to buy or sell.

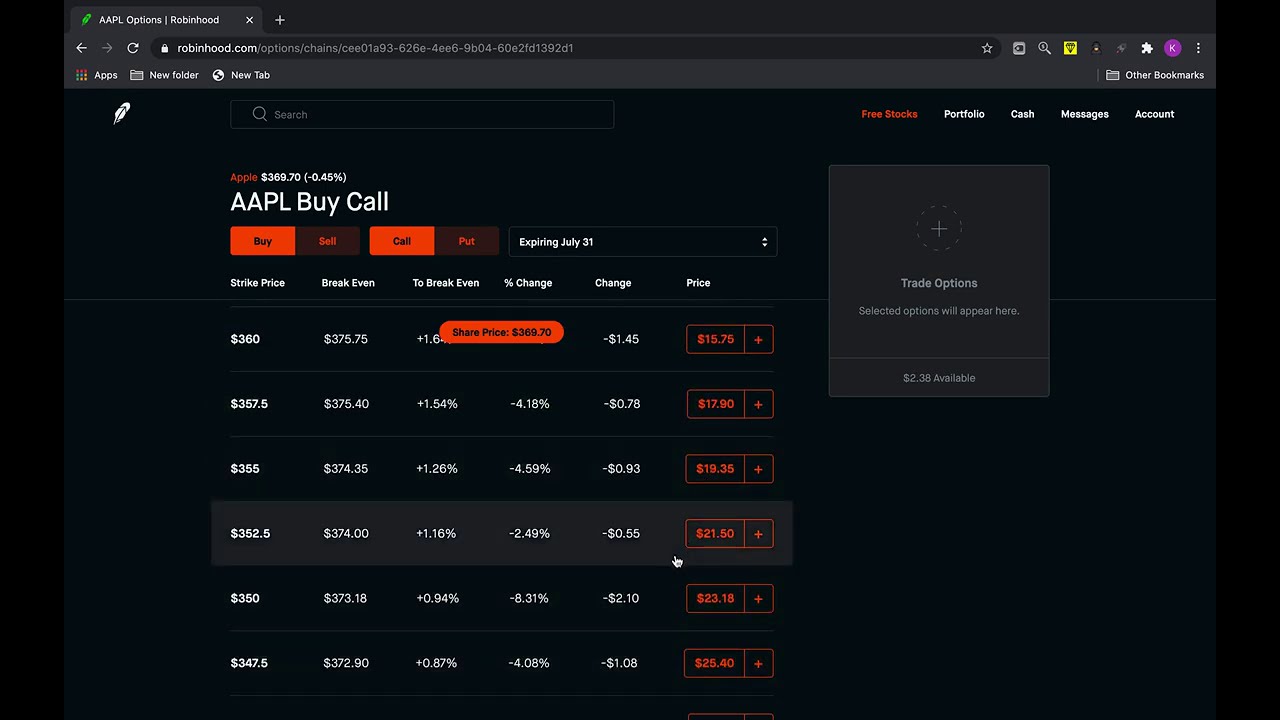

There are a number of factors that you’ll need to consider when trading options, including the strike price, the expiration date, and the premium. The strike price is the price at which you can buy or sell the underlying asset. The expiration date is the date on which the option expires. And the premium is the price that you pay to the seller of the option.

Tips for Trading Options on Robinhood

If you’re new to options trading, it’s important to do your research and understand the risks involved. Here are a few tips to help you get started:

- Start with a small amount of money. Options trading can be a risky endeavor, so it’s important to start with a small amount of money that you can afford to lose.

- Choose the right options. There are a number of factors to consider when choosing options, including the strike price, the expiration date, and the premium. It’s important to do your research and understand the risks involved before you choose an option.

- Manage your risk. Once you’ve chosen an option, it’s important to manage your risk. This means setting limits on how much you’re willing to lose and monitoring your positions regularly.

Image: www.youtube.com

How Does Options Trading Work Robinhood

Image: www.youtube.com

Conclusion

Options trading can be a lucrative way to speculate on the future price of an asset. However, it can also be a complex and risky endeavor. If you’re new to options trading, it’s important to do your research and understand the risks involved. Robinhood is a popular platform for options trading, and it offers a number of features that make it a good choice for beginners. By using alternative categories, you can enhance your brand and posting as a not just informative but also interesting piece of content. This will help you to attract a wider audience. You can also use affiliate links to promote products and services that are related to your topic. The introduction of alternative categories and affiliate links into your content will give your post a better chance of being found by indexing technology.