Introduction: Unlocking the Labyrinth of Pharmaceutical Investment

In the ever-evolving world of financial markets, the allure of options trading beckons investors seeking both risk mitigation and potential gains. Gilead Sciences, a pharmaceutical powerhouse, stands as a beacon in this arena, offering options that grant traders the right to buy or sell its underlying stock at a specified price on a designated future date. Understanding the dynamics of Gilead options trading empowers investors to navigate this complex realm, potentially enhancing portfolio performance and mitigating risk.

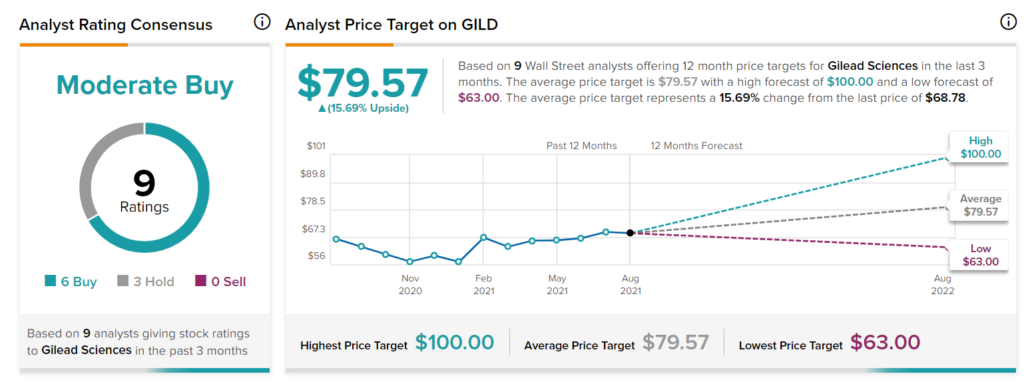

Image: www.tipranks.com

1. Demystifying Gilead Options: A Tale of Two Choices

Gilead options, like options contracts in general, grant the holder the option, but not the obligation, to exercise the right to buy (call option) or sell (put option) a specified number (100 per contract) of Gilead Sciences shares at a predetermined price (strike price) on or before a predetermined date (expiration date). This flexibility allows traders to tailor their strategies to match their investment objectives, whether it’s capturing potential upside or protecting against potential downside.

2. Call Options: Embracing the Potential for Growth

Call options provide the holder with the right to buy Gilead Sciences shares at the strike price on or before the expiration date. Typically purchased when bullish sentiment prevails, call options offer the potential for substantial gains if the underlying stock price rises above the strike price. However, losses can also be significant if the stock price falls below the strike price.

3. Put Options: A Defensive Stance Amid Uncertainty

Put options, on the other hand, confer the right to sell Gilead Sciences shares at the strike price on or before the expiration date. Often employed as a hedging strategy during bearish market conditions, put options offer protection against potential stock price declines. However, if the stock price rises above the strike price, put options may result in losses.

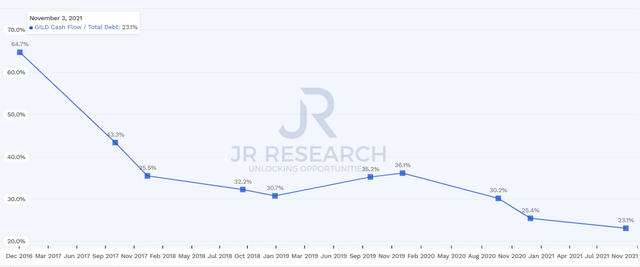

Image: www.infofinanceblog.com

4. Factors Influencing Gilead Options Pricing

Multiple factors intertwine to determine the pricing of Gilead options, including the underlying stock price, strike price, time to expiration, and volatility. Understanding these variables is crucial for informed decision-making. Volatility, in particular, plays a significant role, as higher volatility generally translates into higher option premiums due to the increased uncertainty.

5. Breaking Down Time Value: The Essence of Time’s Impact

Time value constitutes a crucial component of option pricing, representing the value attributed to the remaining time until the expiration date. As the expiration date approaches, time value gradually erodes, ultimately expiring worthless at maturity. This concept underscores the importance of timing when it comes to options trading.

6. The Mechanics of Gilead Options Trading: A Step-by-Step Guide

Engaging in Gilead options trading involves several key steps:

a) Selection: Choosing the appropriate option type (call or put) based on market outlook.

b) Strike Price: Determining the desired strike price, considering factors such as risk tolerance and profit potential.

c) Expiration Date: Opting for an expiration date that aligns with investment objectives and market conditions.

d) Execution: Transacting the option purchase or sale on the chosen trading platform.

e) Monitoring: Tracking the performance of the underlying stock and adjusting positions if necessary.

7. Strategies for Maximizing Gilead Options Trading

A myriad of trading strategies can be employed to enhance the potential profitability of Gilead options trading:

a) Covered Calls: Utilizing call options while simultaneously owning the underlying stock.

b) Protective Puts: Using put options to hedge against potential downside risk in existing stock positions.

c) Straddle: A combination strategy involving both call and put options with the same strike price and expiration date.

8. Risks Associated with Gilead Options Trading: Navigating Potential Headwinds

Understanding the risks associated with Gilead options trading is paramount for informed decision-making:

a) Unlimited Losses: Call options expose investors to unlimited losses, while put options carry limited downside risk.

b) Time Decay: The gradual erosion of time value can diminish option value, especially for short-term trades.

c) Volatility Risk: Incorrectly assessing volatility can lead to significant losses, as higher volatility can lead to larger price swings.

9. Additional Considerations for Prudent Trading

Prudent trading practices are essential for success in Gilead options trading:

a) Broker Selection: Choosing a reputable broker with competitive fees and robust trading platforms.

b) Education: Embarking on a continuous learning journey to enhance knowledge and refine trading skills.

c) Risk Management: Establishing clear risk parameters and adhering to strict discipline.

Gilead Options Trading

Image: seekingalpha.com

Conclusion: Empowered Decision-Making in Gilead Options Trading

Mastering the intricacies of Gilead options trading can empower investors to participate in the vibrant pharmaceutical industry. By understanding the core concepts, evaluating risk, and embracing prudent trading practices, investors can potentially leverage options trading to enhance returns and mitigate risks in their portfolios. Remember, knowledge and informed decision-making are the cornerstones of successful options trading, unlocking the gateway to potential financial success in the ever-evolving realm of financial markets.