Have you ever wished you could capitalize on the upswings and downswings of the stock market with greater flexibility and potential for profit? Option trading, with its unique combination of risk and reward, can offer just that. But navigating the complex world of options can feel overwhelming, especially when deciding which stocks to target. Worry not, as this guide will demystify the process, revealing the secrets of identifying the best stocks for option trading and empowering you to make informed decisions.

Image: club.ino.com

Option trading essentially involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a predetermined price within a specific timeframe. These contracts, called options, come in two flavors: calls and puts. Call options grant the right to buy, while put options grant the right to sell. The magic of option trading lies in its leverage – the potential to amplify gains (or losses) compared to directly buying or selling the underlying stock. However, this leverage also amplifies risk.

Understanding the Ideal Option Trading Stock

The quest for the perfect option trading stock starts with understanding the characteristics that make a stock favorable for this strategy. The following factors form a roadmap for your search:

1. Volatility

Volatility is the lifeblood of option trading. Options derive their value from the expectation of price fluctuations in the underlying asset. Stocks exhibiting high volatility, meaning their prices swing significantly in both directions, present lucrative opportunities for option traders. Imagine a stock soaring or plummeting. Options on that stock would experience a corresponding surge in value, offering traders the chance to capitalize on those price movements.

2. Liquidity

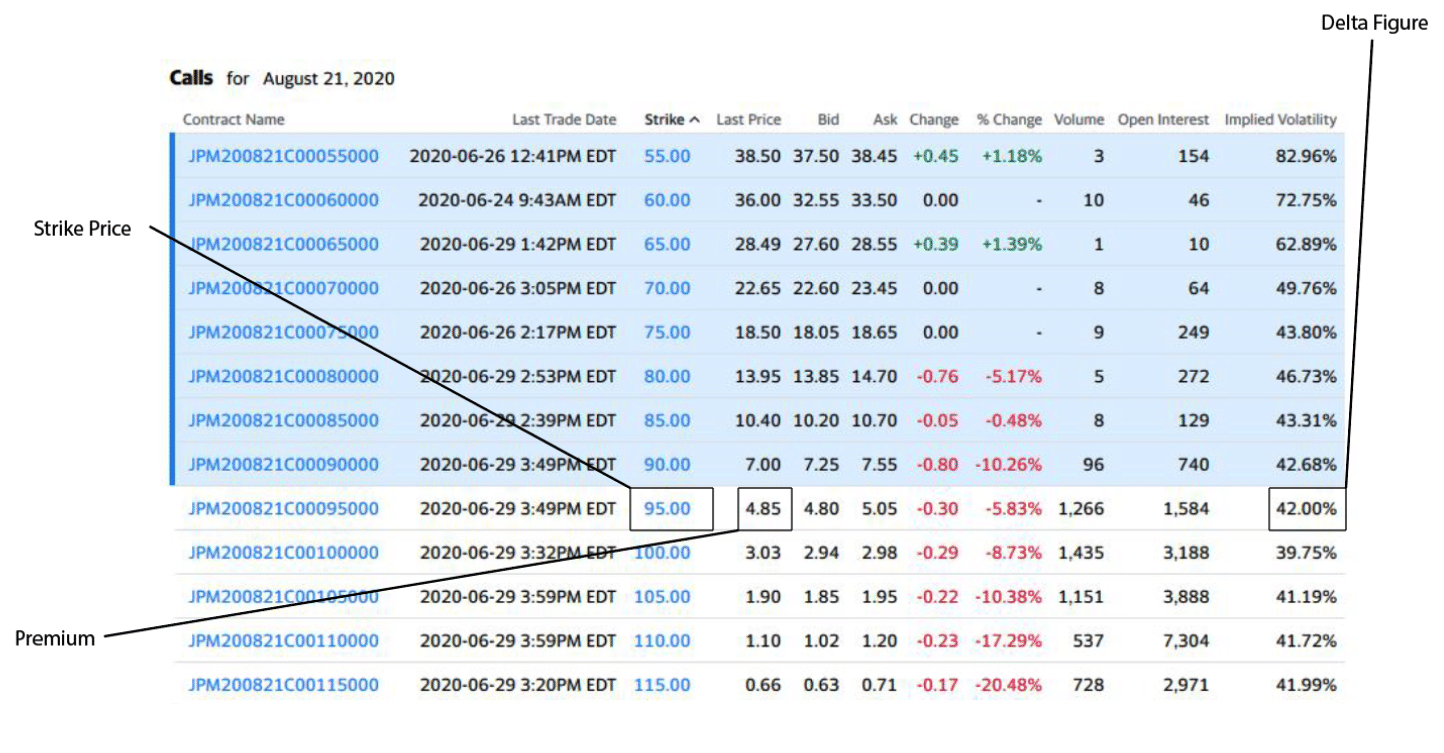

While volatility is the fuel, liquidity is the engine that drives option trading. Liquidity refers to the ease with which an option contract can be bought or sold in the market. Highly liquid options have ample buyers and sellers, ensuring you can enter and exit trades seamlessly. This also translates to smaller price spreads, resulting in more favorable trading costs.

Image: www.samco.in

3. Implied Volatility

Implied volatility, often represented as a percentage, reflects the market’s collective perception of a stock’s future price fluctuations. This is different from actual historical volatility. When implied volatility is high, it usually signals that the market expects significant price movements in the near future. Option traders capitalize on this by buying options, hoping the price movement aligns with their prediction. Conversely, when implied volatility is low, traders might consider selling options, betting that the price swings will be less dramatic.

4. Strong Underlying Business

While volatility and liquidity are important, remember the foundation of option trading is the underlying stock. It’s crucial to choose stocks with strong fundamentals:

- Solid financial performance: Seek companies with stable revenue, consistent earnings, and a healthy balance sheet.

- Proven track record: Look for companies with a history of consistent growth and profitability.

- Positive industry outlook: Consider the overall growth potential and future prospects of the industry in which the company operates.

Navigating the Landscape: Best Practices for Stock Selection

Armed with the understanding of desirable characteristics, let’s delve into the practical steps for finding those coveted option trading stocks.

1. Market Research: The Foundation of Success

- Stay informed: Regularly check financial news sources, market analysis websites, and investor forums for insights into market trends and emerging opportunities.

- Analyze industry sectors: Investigate sectors known for their volatility, such as technology, healthcare, and energy.

- Track market indicators: Pay attention to economic indicators like inflation, interest rate changes, and employment data, as these influence market sentiment and impact stock prices.

2. Utilizing Screeners: Shortcuts to Efficient Discovery

Numerous online tools and stock screeners can help you narrow down promising candidates.

- Set your criteria: These screeners let you define specific search parameters, like volatility levels, trading volume, and financial metrics, to identify stocks matching your criteria.

- Utilize multiple screeners: Experiment with different platforms to access a broader range of stocks and refine your search results.

3. Fundamental Analysis: Deep Dive into Company Performance

- Review financial statements: Explore companies’ balance sheets, income statements, and cash flow statements for insights into their financial health and growth trajectory.

- Evaluate management team: Analyze the experience and expertise of the company’s management. This insight provides a glimpse into their potential to navigate market challenges and drive long-term value.

- Assess competitive landscape: Understand the company’s position within its industry and assess its competitive advantages.

4. Technical Analysis: Chart Patterns and Market Trends

Technical analysis involves studying price charts and historical data to identify patterns and trends that could suggest future price movements.

- Learn chart patterns: Familiarize yourself with common charting patterns, like head and shoulders, double tops, and triangles, which can signal potential reversals or breakouts.

- Understand technical indicators: Employ indicators like moving averages, relative strength index (RSI), and MACD to gauge momentum, overbought/oversold conditions, and potential trend changes.

Examples of High-Volatility Stocks

While past performance doesn’t guarantee future results, we can examine recent trends to identify stocks known for their volatility. These examples should serve as starting points for your own research, not as investment recommendations.

- Technology: Companies like Tesla, Apple, and Nvidia often exhibit high levels of volatility due to their rapidly evolving industry and dependence on investor sentiment.

- Biotechnology: Biotech firms, such as Moderna and Gilead Sciences, are subject to significant price swings driven by clinical trial results, regulatory approvals, and market trends.

- Meme Stocks: Stocks like AMC Entertainment and GameStop have gained notoriety for their wild price movements, driven by social media hype and retail investor enthusiasm.

Key Strategies for Success in Option Trading

Remember, option trading is a complex endeavor. Success requires thorough research, a disciplined approach, and a deep understanding of risk management principles.

- Manage your risk: Options trading involves leverage, which amplifies both potential gains and losses. Never invest more than you can afford to lose.

- Set profit targets and stop-loss orders: Define clear exit strategies for your trades before entering them, minimizing potential losses and maximizing potential profits.

- Stay updated: Continuously monitor market news, financial data, and your investment positions. Trading conditions can change rapidly, requiring flexibility and adaptability.

- Start small: It’s crucial to gain experience and build confidence gradually, beginning with smaller trades and expanding as your understanding grows.

Option Trading Best Stock

Conclusion: Embrace the Power of Option Trading

Option trading isn’t just about making money; it’s about wielding financial tools to navigate the market’s complexities. By focusing on volatility, liquidity, fundamentals, and market research, you can identify the best stocks for option trading. Remember, this journey involves continuous learning, meticulous planning, and a sensible approach to risk management. As you refine your strategies and embrace the power of knowledge, option trading can unlock a world of opportunities and empower you to make informed decisions in the financial markets.